-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Supply Risks Push Crude Back Toward $60

Bloomberg) -- Oil jumped back above $58 a barrel and was set for the longest run of gains in more than a year as U.S. sanctions on Russia’s largest producer and conflict in Libya shifted the focus to supply threats from virus-driven demand concerns.

The U.S. sanctioned a unit of Russia’s Rosneft PJSC for maintaining ties with Venezuela’s president and its state-run oil company, threatening to crimp the nation’s ability to export crude. In Libya, fighters loyal to eastern military commander Khalifa Haftar shelled Tripoli’s port, forcing a halt to shipping and leading to the suspension of cease-fire talks.

Oil is extending its longest rally since January 2019 after surging last week on optimism that the worst economic impacts of the deadly coronavirus had been accounted for. Any disruptions to global supply could go some way to offsetting the demand destruction from the outbreak, just as China and other nations in Asia roll out stimulus packages to cushion the blow.

Rosneft’s sanctioned unit has been “Venezuela’s primary conduit for brokering cargoes, which find their way predominantly to refineries in India and China,” Stephen Innes, Asia Pacific market strategist at AxiCorp, said in a note. “Throttling this Asian supply channel will provide some support for oil prices.” [more]

https://www.rigzone.com/news/wire/supply_risks_push_crude_back_toward_60-19-feb-2020-161134-article/

Bloomberg) -- Oil jumped back above $58 a barrel and was set for the longest run of gains in more than a year as U.S. sanctions on Russia’s largest producer and conflict in Libya shifted the focus to supply threats from virus-driven demand concerns.

The U.S. sanctioned a unit of Russia’s Rosneft PJSC for maintaining ties with Venezuela’s president and its state-run oil company, threatening to crimp the nation’s ability to export crude. In Libya, fighters loyal to eastern military commander Khalifa Haftar shelled Tripoli’s port, forcing a halt to shipping and leading to the suspension of cease-fire talks.

Oil is extending its longest rally since January 2019 after surging last week on optimism that the worst economic impacts of the deadly coronavirus had been accounted for. Any disruptions to global supply could go some way to offsetting the demand destruction from the outbreak, just as China and other nations in Asia roll out stimulus packages to cushion the blow.

Rosneft’s sanctioned unit has been “Venezuela’s primary conduit for brokering cargoes, which find their way predominantly to refineries in India and China,” Stephen Innes, Asia Pacific market strategist at AxiCorp, said in a note. “Throttling this Asian supply channel will provide some support for oil prices.” [more]

https://www.rigzone.com/news/wire/supply_risks_push_crude_back_toward_60-19-feb-2020-161134-article/

PessOptimist

Market Veteran

- Reaction score

- 67

Filled up wife's car for $2.959 today. Same old story, not worth a 10 mile round trip for the $.2 per gal savings.

Christopher

Market Tracker

- Reaction score

- 7

- AutoTracker

My wife texted a pic, 87 Octane hit $1.99 today in Columbus, OH.

Sent from my iPhone using TSP Talk Forums

Sent from my iPhone using TSP Talk Forums

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

The GLUT is GOOD! Remember this?My wife texted a pic, 87 Octane hit $1.99 today in Columbus, OH.

Sent from my iPhone using TSP Talk Forums

Christopher

Market Tracker

- Reaction score

- 7

- AutoTracker

bmneveu

TSP Pro

- Reaction score

- 92

Dow futures down 900+ right now. Corona and oil...

1100 :blink:

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

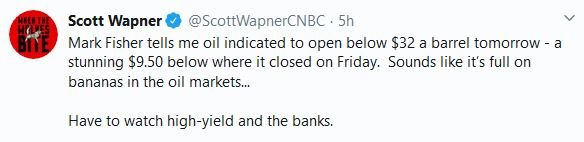

[FONT="][h=1]WTI Crude (Apr'20) (@CL.1:New York Mercantile Exchange)[/h]

+ WATCHLIST

*Data is delayed | USD

[/FONT]

[FONT="][TABLE="class: quote-horizontal regular, width: 725"]

[TR="class: last_time table-row-group"]

[TD]Last | 7:58:25 PM EDT[/TD]

[TD]Volume[/TD]

[/TR]

[TR]

[TD]32.58 -8.7 (-21.08%

https://www.cnbc.com/quotes/?symbol=@CL.1

[/TD]

[/TR]

[/TABLE]

[/FONT]

+ WATCHLIST

*Data is delayed | USD

[/FONT]

[FONT="][TABLE="class: quote-horizontal regular, width: 725"]

[TR="class: last_time table-row-group"]

[TD]Last | 7:58:25 PM EDT[/TD]

[TD]Volume[/TD]

[/TR]

[TR]

[TD]32.58 -8.7 (-21.08%

https://www.cnbc.com/quotes/?symbol=@CL.1

[/TD]

[/TR]

[/TABLE]

[/FONT]

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Oil plummets 30% as OPEC deal failure sparks price war

PUBLISHED SUN, MAR 8 20206:03 PM EDTUPDATED AN HOUR AGO

Oil prices plunged 30% in early trading after OPEC’s failure to strike a deal with its allies regarding production cuts caused Saudi Arabia to slash its prices as it reportedly gets set to ramp up production, leading to fears of an all-out price war.

International benchmark Brent crude futures plummeted 30% to $31.02 per barrel, its lowest level since Feb. 2016. U.S. West Texas Intermediate crude dropped 27% to $30 per barrel, also its lowest level since Feb. 2016.

https://www.cnbc.com/2020/03/08/oil...opec-deal-failure-sparks-price-war-fears.html

PUBLISHED SUN, MAR 8 20206:03 PM EDTUPDATED AN HOUR AGO

Oil prices plunged 30% in early trading after OPEC’s failure to strike a deal with its allies regarding production cuts caused Saudi Arabia to slash its prices as it reportedly gets set to ramp up production, leading to fears of an all-out price war.

International benchmark Brent crude futures plummeted 30% to $31.02 per barrel, its lowest level since Feb. 2016. U.S. West Texas Intermediate crude dropped 27% to $30 per barrel, also its lowest level since Feb. 2016.

https://www.cnbc.com/2020/03/08/oil...opec-deal-failure-sparks-price-war-fears.html

James48843

TSP Talk Royalty

- Reaction score

- 946

COMMENTARY

Putin just sparked an oil price war with Saudi Arabia — and US energy companies may be the victims

PUBLISHED SUN, MAR 8 20206:34 PM EDT

Brian Sullivan

@SULLYCNBC

KEY POINTS

Russia rejected a proposal by OPEC to cut 1.5 million barrels per day of production.

In response, Saudi Arabia not only cut its forward crude price to Chinese customers by as much as $6 or $7 per barrel, but is also reportedly looking to raise its daily crude output by as many as 2 million barrels.

The move by the Saudis is both a market share grab and a loud signal to Moscow that it’s done playing games.

American oil and gas workers and investors are caught in the middle of this epic ego battle.

Vladimir Putin just sparked what could end up being one of the ugliest oil price wars in modern history, and American oil and gas companies may be the victims.

This weekend Saudi Arabia dropped the oil bomb. It not only cut its forward crude price to Chinese customers by as much as $6 or $7 per barrel, but is also reportedly looking to raise its daily crude output by as many as 2 million barrels per day into an already oversupplied global market. Look out below.

More:

https://www.cnbc.com/2020/03/08/put...-war-and-us-companies-may-be-the-victims.html

Sent from my iPhone using TSP Talk Forums

Putin just sparked an oil price war with Saudi Arabia — and US energy companies may be the victims

PUBLISHED SUN, MAR 8 20206:34 PM EDT

Brian Sullivan

@SULLYCNBC

KEY POINTS

Russia rejected a proposal by OPEC to cut 1.5 million barrels per day of production.

In response, Saudi Arabia not only cut its forward crude price to Chinese customers by as much as $6 or $7 per barrel, but is also reportedly looking to raise its daily crude output by as many as 2 million barrels.

The move by the Saudis is both a market share grab and a loud signal to Moscow that it’s done playing games.

American oil and gas workers and investors are caught in the middle of this epic ego battle.

Vladimir Putin just sparked what could end up being one of the ugliest oil price wars in modern history, and American oil and gas companies may be the victims.

This weekend Saudi Arabia dropped the oil bomb. It not only cut its forward crude price to Chinese customers by as much as $6 or $7 per barrel, but is also reportedly looking to raise its daily crude output by as many as 2 million barrels per day into an already oversupplied global market. Look out below.

More:

https://www.cnbc.com/2020/03/08/put...-war-and-us-companies-may-be-the-victims.html

Sent from my iPhone using TSP Talk Forums

- Reaction score

- 860

Oil price war definitely not good for global economy.

Gas here between $1.96 and $2.69. There is a Speedway down the street from us and gas Saturday morning was $2.15 by lunch it was $2.13 and mid-afternoon it was $2.10. I can't remember when I watched the price of gas drop like that in a day. I've seen it jump up double digits in a day but not down.

Gas here between $1.96 and $2.69. There is a Speedway down the street from us and gas Saturday morning was $2.15 by lunch it was $2.13 and mid-afternoon it was $2.10. I can't remember when I watched the price of gas drop like that in a day. I've seen it jump up double digits in a day but not down.

I DO REMEMBER YOUR POST!

I DO REMEMBER YOUR POST!