-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

How's that Socialism working out for you Maduro?

Sliding oil prices leave socialist Venezuela on brink of financial collapse

President Nicolas Maduro under international pressure for jailing opposition figures.

The ongoing plunge in global oil prices is pushing Venezuela toward economic collapse just as President Nicolas Maduro — the hand-picked successor to the late socialist Hugo Chavez — faces mounting international criticism for jailing opposition figures after months of street protests.

Where Chavez once drew praise from the world’s leftist elite for using the high price of crude oil during the 2000s to underwrite a socialist revolution, a growing number of analysts in Washington say Mr. Maduro is clinging to power in a country on the edge of becoming a failed state.

Venezuela still boasts some of the world’s largest known crude reserves, but it has continued for too long spending more on government programs than it has collected in oil revenue, analysts say. The average price of oil has dropped from more than $100 a barrel to less than $60 during recent weeks, only adding to Venezuela’s woes.

Simply put, the “current situation in Venezuela is unsustainable if the price continues to fall,” said Michael Shifter, president of the Inter-American Dialogue, a policy research group in Washington. “You can debate what a failed state is and what it looks like, but Venezuela can’t continue like this.”[more]

Sliding oil prices leave socialist Venezuela on brink of financial collapse

President Nicolas Maduro under international pressure for jailing opposition figures.

By Guy Taylor - The Washington Times - Tuesday, December 23, 2014

The ongoing plunge in global oil prices is pushing Venezuela toward economic collapse just as President Nicolas Maduro — the hand-picked successor to the late socialist Hugo Chavez — faces mounting international criticism for jailing opposition figures after months of street protests.

Where Chavez once drew praise from the world’s leftist elite for using the high price of crude oil during the 2000s to underwrite a socialist revolution, a growing number of analysts in Washington say Mr. Maduro is clinging to power in a country on the edge of becoming a failed state.

Venezuela still boasts some of the world’s largest known crude reserves, but it has continued for too long spending more on government programs than it has collected in oil revenue, analysts say. The average price of oil has dropped from more than $100 a barrel to less than $60 during recent weeks, only adding to Venezuela’s woes.

Simply put, the “current situation in Venezuela is unsustainable if the price continues to fall,” said Michael Shifter, president of the Inter-American Dialogue, a policy research group in Washington. “You can debate what a failed state is and what it looks like, but Venezuela can’t continue like this.”[more]

James48843

TSP Talk Royalty

- Reaction score

- 956

I wish I had a 500 Gallon tank in my backyard!

Think big.

20 000 Gallon Collapsible Fuel Tank Bladder in Aluminum Container | eBay

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

I don't think I have the disposable funds to fill up that tank! And there are local regulations covering storage of flammable liquids on residential property. DUH

PessOptimist

Market Veteran

- Reaction score

- 67

That brought back some memories of a bunch of Airmen digging holes for similar devices. These were black and I didn't care about the capacity, just knew they were big.

E10 $1.95-1.99 here today.

E10 $1.95-1.99 here today.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

[h=1]Oil rises further above $60 as Libyan output slumps[/h]

LONDON (Reuters) - Oil rose further above $60 (39 pounds) a barrel on Friday as unrest in Libya cut supplies, offsetting a growing supply glut in top consumer the United States and weak imports by Japan.

Fighting in Libya has cut output there to 352,000 barrels a day, a state oil company spokesman said on Thursday, or about half November's average. This countered the U.S. Department of Energy's (DOE) report showing a big stockbuild.

"Libya is a supportive factor," said Olivier Jakob, analyst at Petromatrix in Zug, Switzerland. "The fighting in Libya is starting to be more and more about a battle for the oil resources and this will not end well."

http://finance.yahoo.com/news/brent-holds-above-60-heads-035121103.html

LONDON (Reuters) - Oil rose further above $60 (39 pounds) a barrel on Friday as unrest in Libya cut supplies, offsetting a growing supply glut in top consumer the United States and weak imports by Japan.

Fighting in Libya has cut output there to 352,000 barrels a day, a state oil company spokesman said on Thursday, or about half November's average. This countered the U.S. Department of Energy's (DOE) report showing a big stockbuild.

"Libya is a supportive factor," said Olivier Jakob, analyst at Petromatrix in Zug, Switzerland. "The fighting in Libya is starting to be more and more about a battle for the oil resources and this will not end well."

http://finance.yahoo.com/news/brent-holds-above-60-heads-035121103.html

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Here are the reasons oil is plunging toward $50

By William Watts

Published: Dec 30, 2014 9:32 p.m. ET

NEW YORK (MarketWatch) — Oil’s stunning price collapse is undoubtedly one of 2014’s top stories and will remain a major theme for investors in 2015.

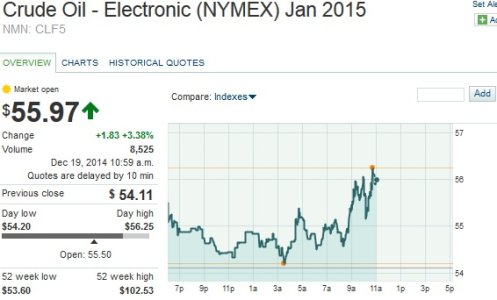

Indeed, Nymex WTI oil futures US:CLF5 have seen their sharpest drop since 2008, plunging around 50% from their 52-week high of $107.26 in June. Brent UK:LCOF5 is down more than 50% from its 52-week high.

Prices were choppy on Tuesday, with Nymex oil futures flitting between gains and losses.

Here’s a look at the factors behind oil’s plunge.

Here are the reasons oil is plunging toward $50 - MarketWatch

By William Watts

Published: Dec 30, 2014 9:32 p.m. ET

NEW YORK (MarketWatch) — Oil’s stunning price collapse is undoubtedly one of 2014’s top stories and will remain a major theme for investors in 2015.

Indeed, Nymex WTI oil futures US:CLF5 have seen their sharpest drop since 2008, plunging around 50% from their 52-week high of $107.26 in June. Brent UK:LCOF5 is down more than 50% from its 52-week high.

Prices were choppy on Tuesday, with Nymex oil futures flitting between gains and losses.

Here’s a look at the factors behind oil’s plunge.

Here are the reasons oil is plunging toward $50 - MarketWatch

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

[h=1]Cramer: Oil will get worse before improving[/h]Video:

http://finance.yahoo.com/news/cramer-oil-analysts-enemy-233152761.html

http://finance.yahoo.com/news/cramer-oil-analysts-enemy-233152761.html

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

[h=1]North Dakota Producers Looking at Crude Falling to $30[/h] By Paul Ausick January 6, 2015 7:45 am EST

Read more: North Dakota Producers Looking at Crude Falling to $30 - Whiting Petroleum Corp (NYSE:WLL) - 24/7 Wall St. North Dakota Producers Looking at Crude Falling to $30 - Whiting Petroleum Corp (NYSE:WLL) - 24/7 Wall St.

Read more: North Dakota Producers Looking at Crude Falling to $30 - Whiting Petroleum Corp (NYSE:WLL) - 24/7 Wall St. North Dakota Producers Looking at Crude Falling to $30 - Whiting Petroleum Corp (NYSE:WLL) - 24/7 Wall St.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

EIA Petroleum Status Report

[TD="class: econo-releaseinfo"] Released On 1/7/2015 10:30:00 AM For wk1/2, 2015 [/TD]

[TD="class: actual_consensus_box_numbers"]-1.8 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] -3.1 M barrels [/TD]

[TD="class: actual_consensus_box_numbers"]3.0 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] 8.1 M barrels [/TD]

[TD="class: actual_consensus_box_numbers"]1.9 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] 11.2 M barrels [/TD]

[/TD]

[/TR]

[/TABLE]

| Economic Calendar - Bloomberg [TABLE="class: actual_consensus_box"] [TR="class: actual_consensus_toprow"] [TD] | Prior | Actual |

| Crude oil inventories (weekly change) | ||

| Gasoline (weekly change) | ||

| Distillates (weekly change) |

[TD="class: econo-releaseinfo"] Released On 1/7/2015 10:30:00 AM For wk1/2, 2015 [/TD]

[TD="class: actual_consensus_box_numbers"]-1.8 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] -3.1 M barrels [/TD]

[TD="class: actual_consensus_box_numbers"]3.0 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] 8.1 M barrels [/TD]

[TD="class: actual_consensus_box_numbers"]1.9 M barrels[/TD]

[TD="class: actual_consensus_box_numbers"] 11.2 M barrels [/TD]

[/TR]

[/TABLE]