nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

[h=1]Oil Reverses Course, Ends Higher On Weak Dollar[/h]by Reuters

|

Catherine Ngai

|

Monday, October 06, 2014

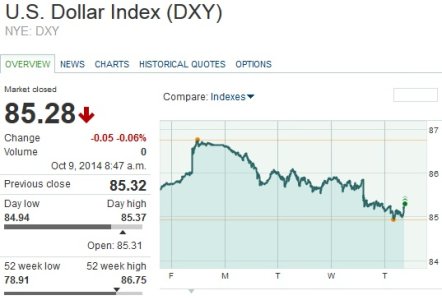

NEW YORK, Oct 6 (Reuters) - Crude oil futures reversed course on Monday after a massive sell-off last week and ended higher on a slump in the U.S. dollar. The dollar pushed into negative territory on track for its biggest one-day drop since January, after climbing to a more than four-year peak on Friday. An increase in the index makes oil most costly for buyers using other currencies. Crude's price rise came as talk of an extended outage at the 300,000-barrel per day Irving, St. John refinery in Canada, pushed front-month New York gasoline prices 1.5 percent higher. "There seemed to be a little nervous buying in the products, which led to short covering and turned us around (in crude)," said Phil Flynn, an analyst at Price Futures Group in Chicago. "It was the perfect connection where the market was a bit oversold, and St. John gave us a reason to buy." Brent for November ended 48 cents higher at $92.79 a barrel, after hitting a low of $91.25 a barrel intraday. The benchmark had hit $91.48 a barrel on Friday, its lowest since June 2012. U.S. November crude settled 60 cents higher at $90.34 a barrel, and New York gasoline was up 1.5 percent. Despite the uptick, analysts said that oversupplied markets coupled with lackluster demand continued to weigh on the crude markets. - See more at:

RIGZONE - Oil Reverses Course, Ends Higher On Weak Dollar

|

Catherine Ngai

|

Monday, October 06, 2014

NEW YORK, Oct 6 (Reuters) - Crude oil futures reversed course on Monday after a massive sell-off last week and ended higher on a slump in the U.S. dollar. The dollar pushed into negative territory on track for its biggest one-day drop since January, after climbing to a more than four-year peak on Friday. An increase in the index makes oil most costly for buyers using other currencies. Crude's price rise came as talk of an extended outage at the 300,000-barrel per day Irving, St. John refinery in Canada, pushed front-month New York gasoline prices 1.5 percent higher. "There seemed to be a little nervous buying in the products, which led to short covering and turned us around (in crude)," said Phil Flynn, an analyst at Price Futures Group in Chicago. "It was the perfect connection where the market was a bit oversold, and St. John gave us a reason to buy." Brent for November ended 48 cents higher at $92.79 a barrel, after hitting a low of $91.25 a barrel intraday. The benchmark had hit $91.48 a barrel on Friday, its lowest since June 2012. U.S. November crude settled 60 cents higher at $90.34 a barrel, and New York gasoline was up 1.5 percent. Despite the uptick, analysts said that oversupplied markets coupled with lackluster demand continued to weigh on the crude markets. - See more at:

RIGZONE - Oil Reverses Course, Ends Higher On Weak Dollar