nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

[h=1]July Fourth gas prices to be highest since 2008[/h] Published June 29, 2014

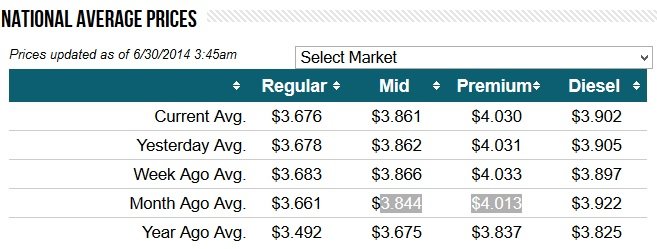

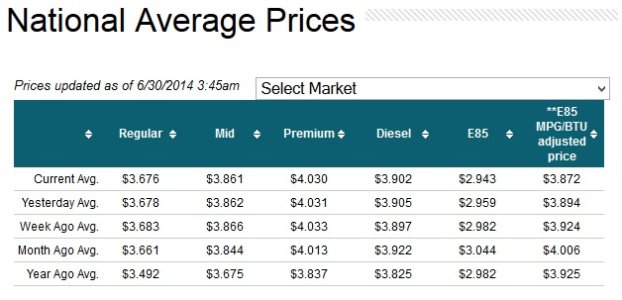

The recent spike in gas prices will make the July 4 holiday weekend the most expensive for drivers since 2008.

According to USA Today, prices will average $3.68 a gallon for regular-grade gas, up 17 cents from last year. That is still below the record price of $4.11 at the pump just after July 4, 2008.[more]

July Fourth gas prices to be highest since 2008 | Fox News

The recent spike in gas prices will make the July 4 holiday weekend the most expensive for drivers since 2008.

According to USA Today, prices will average $3.68 a gallon for regular-grade gas, up 17 cents from last year. That is still below the record price of $4.11 at the pump just after July 4, 2008.[more]

July Fourth gas prices to be highest since 2008 | Fox News