nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Actually I like a strong Dollar, it's what the economy needs.

So a stronger dollar increases inflation? We need a stronger dollar and interest rates at a sensible level, forcing people to play the markets to finance their retirement isn't the way to go. Lower prices on commodities, gas, food and imports will make things better for all. The transition to normality will not come easy but is the only way to go.But not the market, too much inflation around.

So a stronger dollar increases inflation? We need a stronger dollar and interest rates at a sensible level, forcing people to play the markets to finance their retirement isn't the way to go. Lower prices on commodities, gas, food and imports will make things better for all. The transition to normality will not come easy but is the only way to go.

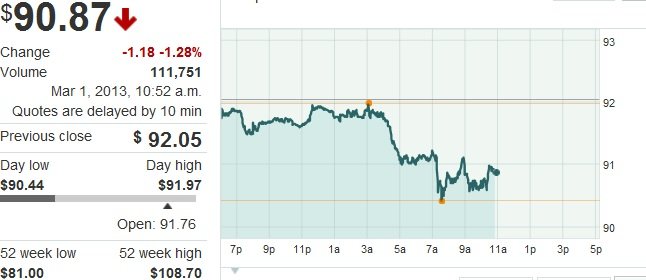

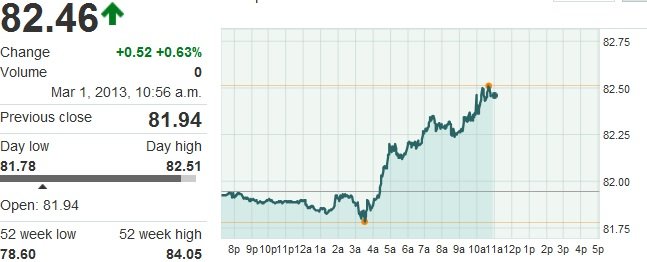

The FED is the reason we have lost buying power, every month 85 billion dollars, they areforcing the dollar down because they want us to be able to compete with overseas and stimulate exports, it's NOT working. I think it's the worst thing we have done.

...commodities, gas, food...

Good thoughts Christopher, they have purposely got us used to gas prices of over $3.50 a gallon on the way to $7 or $8 to align us with European prices, that's the plan and when transportation prices rise the price of all commodities rises with it. Look at the prices of groceries it's there we don't say a thing and they don't report it.I've had to constantly remind myself so that I don't go insane: at it's root, the supply/demand for metals, crude, grains, etc. is indirectly (DIRECTLY, in some cases) controlled by governments/organizations via subsidies and/or production caps - which, of course, manipulates supply, which manipulates price. The market speculation behavior piece seems to simply be traders in the pits watching in real-time and anticipating the effects based on expected (historical) outcomes - and reacting accordingly. That leaves you and me to then react to THEIR reaction to this scenario, because we too have a significant (to us, albeit a quite limited) hand to "play" ourselves as the end-users of these things. Our "free markets" really aren't so free ...

I was thinking the other day: when was the last time I felt SHOCK over paying this much for gasoline, since it first spiked ~5 years ago? We're frogs in a big pot of water, I tell ya. :worried:

A small uptick, don't worry Burntankle will adjust that back down in no time!Um, USD is up... But by no means does that mean it is "strong"... :nuts: