-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

Buster

TSP Talk Royalty

- Reaction score

- 109

Also the current admin has now endorsed same sex marriages to sweetin his voter base numbers..That is a problem, the current Administration won't touch that with a 10' pole. It seems that for some reason they like the price of oil high?

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Also the current admin has now endorsed same sex marriages to sweetin his voter base numbers..

Might as well, he has nothing else to run on...

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

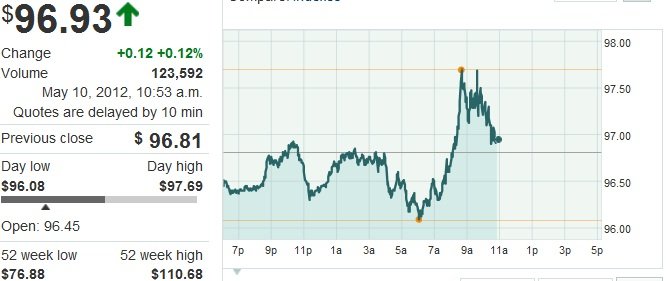

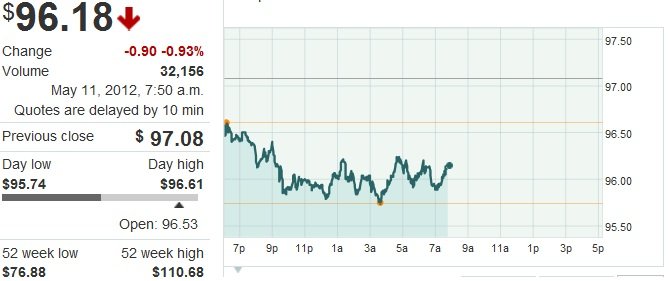

Oil price continues to fall.

$96.04 -$1.04 -1.07%

May 11, 2012, 9:11 a.m.

Crude Oil - Electronic (NYMEX) Jun 2012, CLM2 Future Quote - (NMN) CLM2, Crude Oil - Electronic (NYMEX) Jun 2012 Future Price

$96.04 -$1.04 -1.07%

May 11, 2012, 9:11 a.m.

Crude Oil - Electronic (NYMEX) Jun 2012, CLM2 Future Quote - (NMN) CLM2, Crude Oil - Electronic (NYMEX) Jun 2012 Future Price

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Notice that lower prices for Producers will lower consumer prices, this is what we need, don't even say DEFLATION!

U.S. producer prices drop 0.2% in April

By Steve Goldstein, MarketWatch

WASHINGTON (MarketWatch) — A drop in gasoline prices dragged producer prices down in April by the most in six months, according to data released by the government on Friday.

U.S. producer prices drop 0.2% in April - Economic Report - MarketWatch

U.S. producer prices drop 0.2% in April

By Steve Goldstein, MarketWatch

WASHINGTON (MarketWatch) — A drop in gasoline prices dragged producer prices down in April by the most in six months, according to data released by the government on Friday.

U.S. producer prices drop 0.2% in April - Economic Report - MarketWatch

Buster

TSP Talk Royalty

- Reaction score

- 109

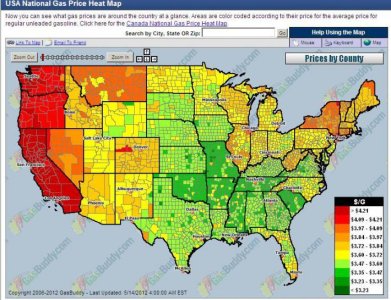

I don't want to see anyone AGAIN saying it's because of CUSHING OK is why our prices are cheap, because that is total BullSh!t and you don't know what the hell you're talking about!...Today, gas rose again to $3.40...Regular 10% moonshine down 2 cents today to $3.28 a gallon in Boiled Peanut GA.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

You know how the Market thinks ahead, the pipeline to the GOM has raised the price of gas because it will release the excess in Cushing.JMHOI don't want to see anyone AGAIN saying it's because of CUSHING OK is why our prices are cheap, because that is total BullSh!t and you don't know what the hell you're talking about!...Today, gas rose again to $3.40...

Last edited:

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

The highest and lowest price around here is $3.55 and $3.25, it depends where you buy GAS! If you take the average that's $3.40 a gallon.I don't want to see anyone AGAIN saying it's because of CUSHING OK is why our prices are cheap, because that is total BullSh!t and you don't know what the hell you're talking about!...Today, gas rose again to $3.40...

I use: http://www.gasbuddy.com/

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Crude Falls 1% As Bearish News Piles Up

by Dow Jones Newswires

|

Ben Lefebvre

|

Friday, May 11, 2012

by Dow Jones Newswires

|

Ben Lefebvre

|

Friday, May 11, 2012

RIGZONE - Crude Falls 1% As Bearish News Piles UpCrude-oil futures settled lower on a spate of negative news Friday, including word of ample crude supply, discouraging signs for economic growth and revelations of a $2 billon trading loss at J.P. Morgan Chase & Co.

Late Thursday, J.P. Morgan disclosed the loss on an illiquid hedge position--and handed ammunition to reformers who want tighter regulation of financial markets. Such regulation could limit the level of risk allowed in futures markets, such as crude oil.

"J.P. Morgan could definitely be the straw that brings more regulation," said Andy Lebow, analyst at Jefferies & Co.

An end-of-day barrage of selling sent light, sweet crude prices to $96.13 a barrel--down 1%, or 95 cents, on the June contract on the New York Mercantile Exchange. The decline was the seventh out of the last eight sessions.

June Brent crude futures fell 47 cents a barrel, or 0.4%, to $112.26 on the Intercontinental Exchange.

J.P. Morgan's loss was only the latest in a stream of news weighing on market sentiment.

"The bearish fundamentals are just piling up this week," said PFG Best analyst Phil Flynn. "A lot of the reasons we were buying oil before are going away."

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Oil Traders Fear New Regulations Will Lead To Higher Costs

by Dow Jones Newswires

|

Sarah Kent

|

Friday, May 11, 2012

by Dow Jones Newswires

|

Sarah Kent

|

Friday, May 11, 2012

RIGZONE - Oil Traders Fear New Regulations Will Lead To Higher CostsLONDON - The oil market is bracing itself for a wave of change as contentious regulations begin to come into effect this year, just as soaring oil prices shine a spotlight on the issue of market oversight.

High gasoline prices in the U.S. and Europe-the two regions seeking to undertake serious regulatory overhauls-have added weight to the push for tougher market supervision, which began in 2008 when prices spiked to record highs just as the financial crisis hit.

Proposed regulatory changes, some of which have already been passed into law, include restrictions on the size of investors' commodity holdings, tougher rules on transparency and insider trading and a push for more products not traded on exchanges to go through central clearing houses. These identify the obligations both sides of a trade have to a contract and also take on the credit risk.

However, market participants have raised concerns that restrictions on the size of holdings might discourage financial players from participating in the market, while more stringent regulatory obligations and a push to clear the majority of products could increase prices. The overall result, they say, may be less market liquidity and increased volatility-exactly the reverse of what was intended.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

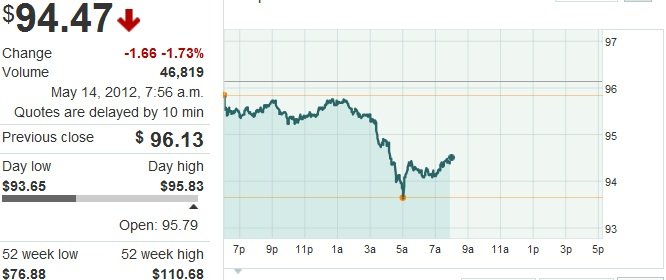

May 14, 2012, 5:52 a.m. EDT

Crude sinks amid Saudie comments, Europe woes

By Michael Kitchen and Kim Hjelmgaard, MarketWatch

LONDON (MarketWatch)—Pressure on crude-oil futures was intensifying on Monday, driven by comments from Saudi Arabia’s oil minister and escalating political crisis in Greece.

Crude sinks amid Saudi comments Europe woes - Futures Movers - MarketWatch

Crude sinks amid Saudie comments, Europe woes

By Michael Kitchen and Kim Hjelmgaard, MarketWatch

LONDON (MarketWatch)—Pressure on crude-oil futures was intensifying on Monday, driven by comments from Saudi Arabia’s oil minister and escalating political crisis in Greece.

Crude sinks amid Saudi comments Europe woes - Futures Movers - MarketWatch

James48843

TSP Talk Royalty

- Reaction score

- 943

I don't want to see anyone AGAIN saying it's because of CUSHING OK is why our prices are cheap, because that is total BullSh!t and you don't know what the hell you're talking about!...Today, gas rose again to $3.40...

Let's see Buster- according to the Gasbuddy map, Oklahoma has some of the lowest prices in the country, along with Missouri and Arkansas, which also is near the Cushing Oil Patch backup.

So...if it's not the oil backup at Cushing that causes your prices to be significantly less than most of the rest of the nation, what else would you attribute it to?

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

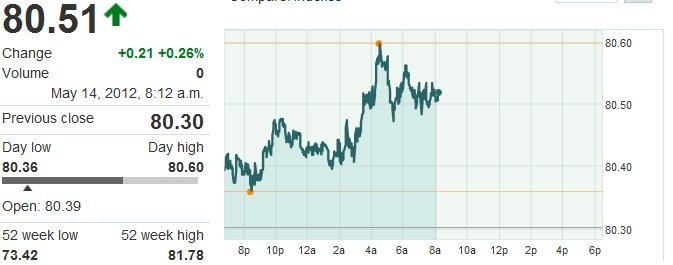

Dollar UP, need I say more?

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

U.S. Dollar Index (DXY), DXY Index Quote - (NYE) DXY, U.S. Dollar Index (DXY) Index Price

Minnow

TSP Pro

- Reaction score

- 80

Some math:

Spot price of Unleaded Gasoline on the CME as of last Friday (haven't look to see if we have rolled over to next month's contract yet, sorry): $3.00/gal

Total tax(including federal):

Oklahoma's gasoline tax: $0.354/gal

Florida's gasoline tax: $0.534

California's gasoline tax: $0.690

Georgia's gasoline tax: $0.478

Michigan's gasoline tax: $0.613

Math wins! Math wins! Math wins!

Spot price of Unleaded Gasoline on the CME as of last Friday (haven't look to see if we have rolled over to next month's contract yet, sorry): $3.00/gal

Total tax(including federal):

Oklahoma's gasoline tax: $0.354/gal

Florida's gasoline tax: $0.534

California's gasoline tax: $0.690

Georgia's gasoline tax: $0.478

Michigan's gasoline tax: $0.613

Math wins! Math wins! Math wins!