nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

May 3, 2012, 11:52 a.m. EDT

Crude oil slides 2%, extending losses

Natural gas adds to gains after inventories data, up 5.1%

By Claudia Assis and Virginia Harrison, MarketWatch

SAN FRANCISCO (MarketWatch) — Crude-oil futures fell Thursday, joining a broader drop across commodity markets, with natural-gas futures bucking the trend and adding to gains after a weekly inventories report.

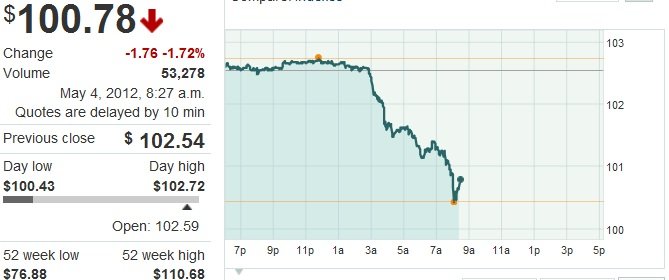

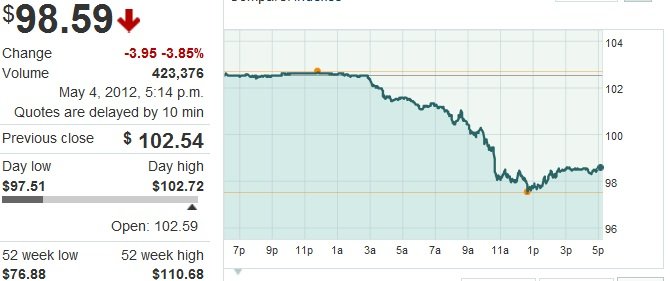

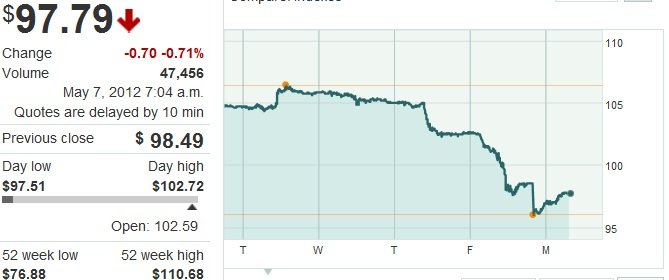

Crude for June delivery lost $2.18, or 2.1%, to $103.04 a barrel on the New York Mercantile Exchange. A close in the red would be oil’s second in a row.

Better-than-expected weekly jobless numbers in the U.S. helped oil pare losses earlier, “but there is still a good amount of tentativeness ahead of tomorrow given yesterday’s poor ADP report,” wrote Matt Smith, an analyst with Summit Energy, in a note to clients. Crude oil slides 2%, extending losses - Futures Movers - MarketWatch

Crude oil slides 2%, extending losses

Natural gas adds to gains after inventories data, up 5.1%

By Claudia Assis and Virginia Harrison, MarketWatch

SAN FRANCISCO (MarketWatch) — Crude-oil futures fell Thursday, joining a broader drop across commodity markets, with natural-gas futures bucking the trend and adding to gains after a weekly inventories report.

Crude for June delivery lost $2.18, or 2.1%, to $103.04 a barrel on the New York Mercantile Exchange. A close in the red would be oil’s second in a row.

Better-than-expected weekly jobless numbers in the U.S. helped oil pare losses earlier, “but there is still a good amount of tentativeness ahead of tomorrow given yesterday’s poor ADP report,” wrote Matt Smith, an analyst with Summit Energy, in a note to clients. Crude oil slides 2%, extending losses - Futures Movers - MarketWatch