Now that we know we can successfully produce gas from U.S. shale gas plays, the question remains: What do we do with all this supply?

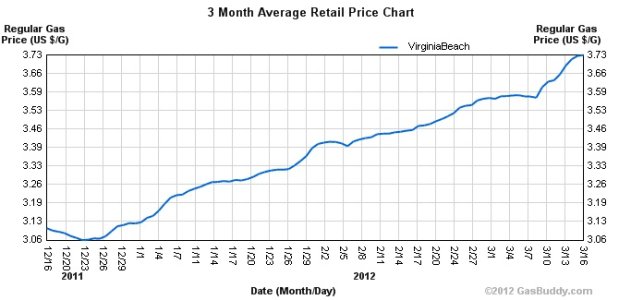

Price differentials between the low U.S. natural gas prices versus diesel, gasoline and propane are providing incentives for fuel-switching in other demand areas aside from the electric power and industrial sectors, and the abundance of U.S. natural gas has prompted some oil and gas companies to find new ways to use gas.

The U.S. trucking sector offers the greatest opportunity for gas to substitute transportation fuels. Prior to the economic downturn, approximately 65 billion gallons a year were consumed by diesel vehicles; two thirds of the vehicle segment is comprised of large semi tractor trailers, said David Schultz, vice president of fuels at Pivotal LNG, a subsidiary of Atlanta-based AGL Resources. Through Pivotal, AGL is positioning itself using its existing gas liquefaction capacity to capture the growing market opportunities for switching to gas from other fuel options.