nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

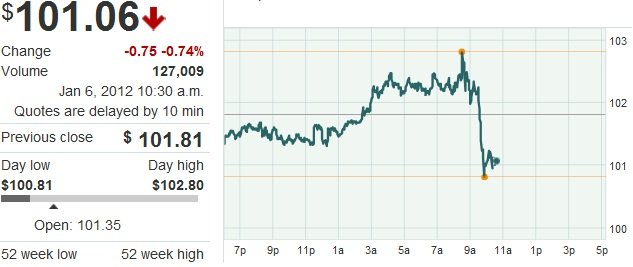

Crude Oil Falls From Near Eight-Month High on European Economic Concerns

By Grant Smith - Jan 4, 2012 6:54 AM ET

http://www.bloomberg.com/news/2012-...emand-iran-tension-amid-shrinking-supply.html

By Grant Smith - Jan 4, 2012 6:54 AM ET

http://www.bloomberg.com/news/2012-...emand-iran-tension-amid-shrinking-supply.html