Even I was surprised by that gap up to start the trading day. I was actually expecting selling pressure at the start and then, maybe, a reversal to positive territory by the close. I had thought the real buying pressure would come next week. And it still should.

It was a wild day, and that by itself didn't surprise me given the sentiment picture. More on that in a minute. I think dollar strength and the big whack gold took shocked a lot of traders too. For about an hour after the opening bell I thought today might end the way it began, but there was a lot at play after the jobs numbers were released. This is good news, and it may help the market for a little while, but if the bears begin to back off on their shorts and go long we could be in trouble. I have a hard time seeing that happening any time soon, but I'll let the charts guide me.

On the sentiment front. Yesterday I pointed out that our survey was overly bullish (bearish) for the next week. But this is a weekly picture and it only tells us how we feel entering the week. It doesn't change as the market plays out regardless of the action or news. The other sentiment I talked about was Trader Talk's "Daily" sentiment survey. It is more volatile. The other difference is that those folks are hard core day traders (most of them anyway) and do this for a living. I consider them smart money for the most part. Today, they were over 60% short at the beginning of trade and that's bullish on stocks. Anything over 50% is a fade, and they got whacked right out the gate.

But our bullishness for next week also means to expect some selling even if we do rally some more. The volatility will probably continue. We didn't close high enough to convince many bears that the rally will continue. Some traders are looking for the S&P to close over 1117 before they go long. We aren't there yet, but we did tag that number today.

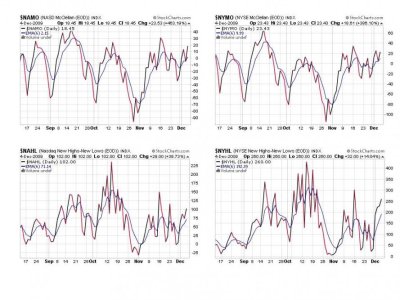

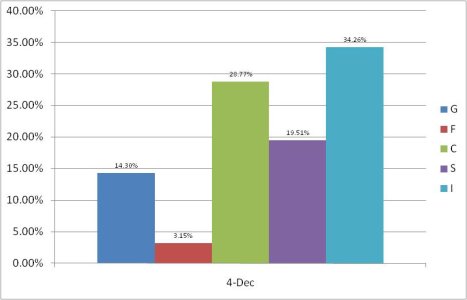

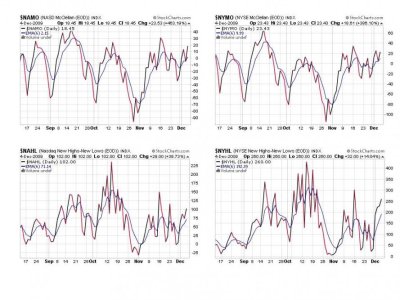

To the charts:

Four for four. All on a buy.

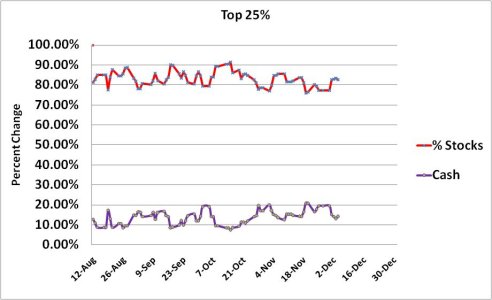

Three for three, all on a buy.

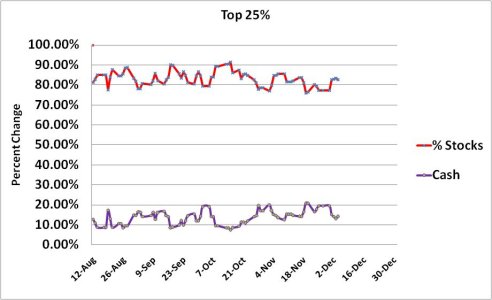

Our Top 25% remain solidly bullish too. At least at the start of today's trading.

So all seven signals remain on a buy. But expect volatility to continue. VIX is back down towards its lows too. It's going to be very hard for the bears to do much damage this month given the pathetic attempts in previous months. And we're heading into a very positive seasonal bias. As long as I have that SSBS, I'm holding my position.

It was a wild day, and that by itself didn't surprise me given the sentiment picture. More on that in a minute. I think dollar strength and the big whack gold took shocked a lot of traders too. For about an hour after the opening bell I thought today might end the way it began, but there was a lot at play after the jobs numbers were released. This is good news, and it may help the market for a little while, but if the bears begin to back off on their shorts and go long we could be in trouble. I have a hard time seeing that happening any time soon, but I'll let the charts guide me.

On the sentiment front. Yesterday I pointed out that our survey was overly bullish (bearish) for the next week. But this is a weekly picture and it only tells us how we feel entering the week. It doesn't change as the market plays out regardless of the action or news. The other sentiment I talked about was Trader Talk's "Daily" sentiment survey. It is more volatile. The other difference is that those folks are hard core day traders (most of them anyway) and do this for a living. I consider them smart money for the most part. Today, they were over 60% short at the beginning of trade and that's bullish on stocks. Anything over 50% is a fade, and they got whacked right out the gate.

But our bullishness for next week also means to expect some selling even if we do rally some more. The volatility will probably continue. We didn't close high enough to convince many bears that the rally will continue. Some traders are looking for the S&P to close over 1117 before they go long. We aren't there yet, but we did tag that number today.

To the charts:

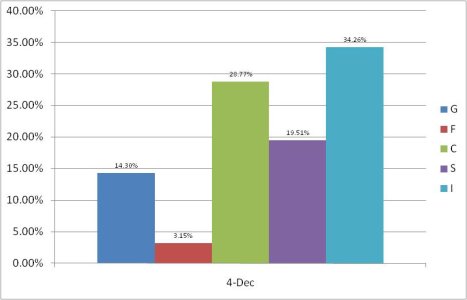

Four for four. All on a buy.

Three for three, all on a buy.

Our Top 25% remain solidly bullish too. At least at the start of today's trading.

So all seven signals remain on a buy. But expect volatility to continue. VIX is back down towards its lows too. It's going to be very hard for the bears to do much damage this month given the pathetic attempts in previous months. And we're heading into a very positive seasonal bias. As long as I have that SSBS, I'm holding my position.