How AutoTracker Members Reacted to October’s Volatility

As we head into November, let’s look back at how AutoTracker members navigated October — one of the most volatile months of 2025.

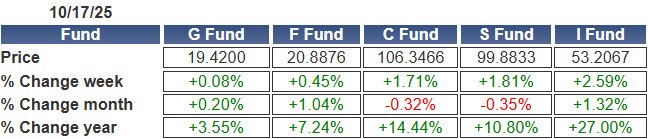

The sell-off in the C and S-fund on October 10th served as an early warning. Many members shifted toward the I-fund the following week, only for the C-fund to rebound and ultimately outperform.

Those sharp market swings made October one of the most active trading months of the year:

- 201 members made at least one Interfund Transfer (IFT).

- 94 members made two moves — including all of the current Top 5 investors of 2025.

- 11 members made a third move, retreating to the G-fund as volatility peaked near month’s end.

Here’s how these

201 active members adjusted their overall exposure:

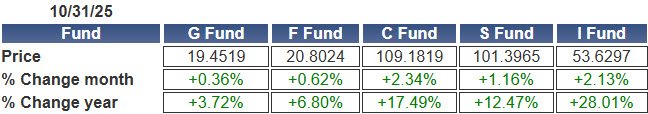

Average Allocation on 9/30/25

G: 45.9% | F: 4.2% | C: 14.3% | S: 25.2% | I: 10.2%

Average Allocation on 10/31/25

G: 26.3% | F: 0.3% | C: 23.4% | S: 28.8% | I: 21.2%

Despite the volatility,

TSP Talk investors increased their overall stock exposure, with the I-fund seeing the largest inflow. By end of the month, allocations were nearly balanced between the G-fund and the three stock funds — with a slight

tilt toward the S-fund, even though it lagged in performance throughout October.

Catch the November trends as they happen with the

Last Look Report.