It was looking good for the bulls early on as news of extended tax cuts sent the market to new two-year highs, but selling pressure was present throughout the day although it didn't take its toll until the final hour trading. At the close, the broader market ended the session mixed overall.

It was that final hour of trading that saw the dollar hit its high of the day and eventually close with a gain of 0.3%. The dollar had been up as much as 0.6%.

There wasn't much on the economic data front, but the October consumer credit data jumped to $3.4 billion, which caught economists off guard as a $2.5 billion decline was expected. September's consumer credit data was revised down to a $1.2 billion increase.

In case you hadn't noticed, treasuries were pummeled today, all day long. At one point I saw AGG had a decline of over 0.9%, but managed to close off that high at 0.78%, which was still a sizable drop.

Let's go to the charts:

NAMO and NYMO remain on a buy, but NYMO has declined two days in a row, and that's the signal I need to see a new 28 day trading high from to confirm last week's Seven Sentinels buy signal. It's a bit troubling to see it backsliding.

Oddly enough, NAHL and NYHL drove much higher today and remain on buys.

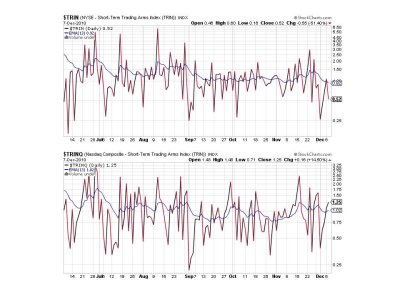

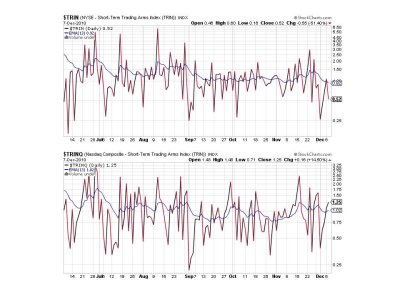

TRIN and TRINQ are mixed, with TRIN flashing a buy and TRINQ flashing a sell.

As of this posting, BPCOMPQ had not been updated at the stockcharts website, so I cannot show that chart, but I'm sure it's still on a buy.

So the sentinels are showing some interesting action as NAMO is moving higher, while NYMO is declining. NAHL and NYHL suggest internals are doing well as they both spiked on today's action, but TRIN and TRINQ are mixed.

I'm not sure what to expect tomorrow, but today's action has me a bit bearish in the very short term and I'm looking for weakness very soon. Perhaps a buying opportunity is at hand, but given the bullish sentiment in several survey's I would not be surprised if a one day decline is not enough to get the bulls to back off. In other words, it remains to be seen if sentiment can move to a more neutral or bearish bias with only a short term drop in price. If we get that weakness and bullish levels stay elevated the bulls could be in for more than some token pain. But that's a big "what if" at the moment. For now we'll just have to see what happens tomorrow and take it from there.

It was that final hour of trading that saw the dollar hit its high of the day and eventually close with a gain of 0.3%. The dollar had been up as much as 0.6%.

There wasn't much on the economic data front, but the October consumer credit data jumped to $3.4 billion, which caught economists off guard as a $2.5 billion decline was expected. September's consumer credit data was revised down to a $1.2 billion increase.

In case you hadn't noticed, treasuries were pummeled today, all day long. At one point I saw AGG had a decline of over 0.9%, but managed to close off that high at 0.78%, which was still a sizable drop.

Let's go to the charts:

NAMO and NYMO remain on a buy, but NYMO has declined two days in a row, and that's the signal I need to see a new 28 day trading high from to confirm last week's Seven Sentinels buy signal. It's a bit troubling to see it backsliding.

Oddly enough, NAHL and NYHL drove much higher today and remain on buys.

TRIN and TRINQ are mixed, with TRIN flashing a buy and TRINQ flashing a sell.

As of this posting, BPCOMPQ had not been updated at the stockcharts website, so I cannot show that chart, but I'm sure it's still on a buy.

So the sentinels are showing some interesting action as NAMO is moving higher, while NYMO is declining. NAHL and NYHL suggest internals are doing well as they both spiked on today's action, but TRIN and TRINQ are mixed.

I'm not sure what to expect tomorrow, but today's action has me a bit bearish in the very short term and I'm looking for weakness very soon. Perhaps a buying opportunity is at hand, but given the bullish sentiment in several survey's I would not be surprised if a one day decline is not enough to get the bulls to back off. In other words, it remains to be seen if sentiment can move to a more neutral or bearish bias with only a short term drop in price. If we get that weakness and bullish levels stay elevated the bulls could be in for more than some token pain. But that's a big "what if" at the moment. For now we'll just have to see what happens tomorrow and take it from there.