It was pointed out to me yesterday that NYMO had not actually hit its 28 day trading average. And after looking at it again this morning, I had to agree. But right now we're within a whisker of hitting it, and yesterday's action had game-changer written all over it. And that's why I think it's a waiting game. If there is no rally tomorrow, the sell signal will in fact be confirmed. But as you folks are already aware, we are not in a position to "turn on a dime" the way this market is. I myself have no reservations about moving to G.

If you didn't already know, we had an initial jobless claims report released this morning that showed 484,000 filing claims, which is much larger than the 465,000 claims that had been expected.

Continuing claims dropped again, but for the same reasons as before. It's due to the expiration of jobless benefits of the unemployed.

And so the S&P 500 dropped for a third day in a row. It was a volatile session that actually worked off some of the oversold condition due to the intra-day rallies. It also saw the S&P drop below its 50-day moving average for the first time in about three weeks.

I know some folks are a bit perplexed by the sudden turn of the dollar the past few days, as it gained another 0.4% in a fourth straight advance. Of course this is bad news for the I fund.

Here's the charts:

NAMO and NYMO continue to ebb lower.

NAHL and NYHL remain on sells.

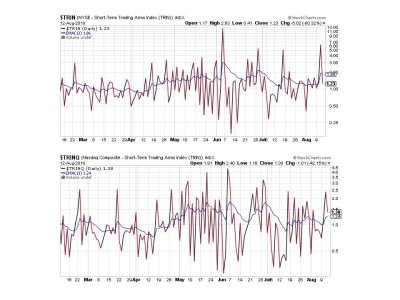

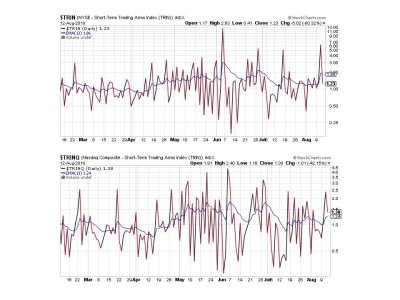

Here's where we can see that the oversold condition was largely alleviated today. TRIN flipped back to buy, but TRINQ remains on a sell.

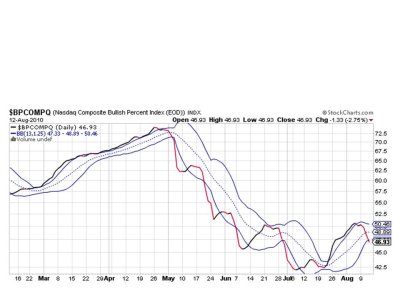

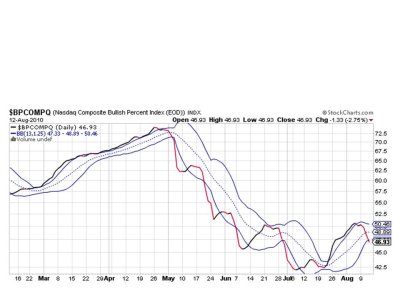

BPCOMPQ has now penetrated the lower bollinger band and remains on sell.

So we have 6 of 7 signals that remain in a sell condition.

It is certainly frustrating to see gains evaporate so quickly in this market. And our opportunities to get reinvested usually mean from several percent higher off the bottom too. I am currently working on compiling the buy/sell signals going back through 2007 to see what I can learn. I can tell you right now that in 2008 the SS side-stepped the vast majority of the losses in that year, which was huge, but it hasn't been able to react fast enough to side-step the corrections in what had been a bull market.

So I am now 100% G fund and simply waiting the market out.

If you didn't already know, we had an initial jobless claims report released this morning that showed 484,000 filing claims, which is much larger than the 465,000 claims that had been expected.

Continuing claims dropped again, but for the same reasons as before. It's due to the expiration of jobless benefits of the unemployed.

And so the S&P 500 dropped for a third day in a row. It was a volatile session that actually worked off some of the oversold condition due to the intra-day rallies. It also saw the S&P drop below its 50-day moving average for the first time in about three weeks.

I know some folks are a bit perplexed by the sudden turn of the dollar the past few days, as it gained another 0.4% in a fourth straight advance. Of course this is bad news for the I fund.

Here's the charts:

NAMO and NYMO continue to ebb lower.

NAHL and NYHL remain on sells.

Here's where we can see that the oversold condition was largely alleviated today. TRIN flipped back to buy, but TRINQ remains on a sell.

BPCOMPQ has now penetrated the lower bollinger band and remains on sell.

So we have 6 of 7 signals that remain in a sell condition.

It is certainly frustrating to see gains evaporate so quickly in this market. And our opportunities to get reinvested usually mean from several percent higher off the bottom too. I am currently working on compiling the buy/sell signals going back through 2007 to see what I can learn. I can tell you right now that in 2008 the SS side-stepped the vast majority of the losses in that year, which was huge, but it hasn't been able to react fast enough to side-step the corrections in what had been a bull market.

So I am now 100% G fund and simply waiting the market out.