- Reaction score

- 620

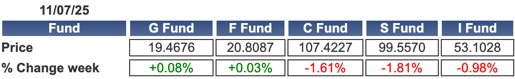

Week 1: Nov 3 - Nov 7

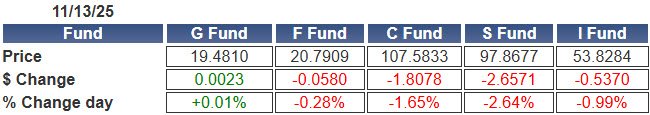

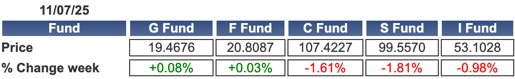

October’s volatility has spilled into November. The first week of the month ended with losses across all three stock funds, extending the uncertainty investors faced through much of the fall.

How did AutoTracker Members Reacted

Despite the weak start, activity among AutoTracker members remained steady.

Among non-premium participants, 38 members submitted Interfund Transfers (IFTs) during the first week of November—split almost evenly between those adding to stocks and those pulling back.

12 members of the 38 members increased their stock exposure by 30 percentage points or more -the buyers.

14 members of the 38 decreased their stock exposure by 30 percentage points or more - the sellers.

The remaining 12 members used their first IFTs to swap which stock they held without changing their G-fund holding much or at all.

These numbers balance each other without revealing a community wide trend.

Fund-Level Shifts

The most notable allocation change came in the I-fund, which saw an average decrease of 6.5 percentage points among these 38 members. Much of that capital appears to have rotated into the C-fund, which gained an average 4.2 points. It’s a subtle rotation toward domestic equities after weeks of global market instability.

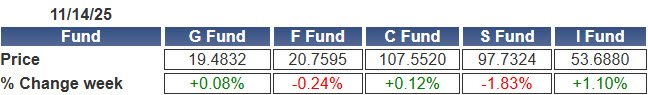

Weekly Performance

As far a performance, only three members outperformed the G-fund this week, including myself. Each had increased stock exposure on Thursday as prices slipped, a move that at first looked premature when markets fell again Friday morning. But a late-day rebound rewarded those early buyers, particularly the two members holding 100% S-fund, who ended the week up more than 1%.

Looking Ahead

Next week will reveal whether the buyers or the sellers were on the right side of this market.

For now, November begins as October ended—volatile, uncertain, and filled with opportunity for those watching closely.

Stay in the know

Get the Last Look Report delivered to your email each trading day—30 minutes before the IFT deadline—with real-time AutoTracker insights and morning market analysis.

Get 5 Free Reports

October’s volatility has spilled into November. The first week of the month ended with losses across all three stock funds, extending the uncertainty investors faced through much of the fall.

How did AutoTracker Members Reacted

Despite the weak start, activity among AutoTracker members remained steady.

Among non-premium participants, 38 members submitted Interfund Transfers (IFTs) during the first week of November—split almost evenly between those adding to stocks and those pulling back.

12 members of the 38 members increased their stock exposure by 30 percentage points or more -the buyers.

14 members of the 38 decreased their stock exposure by 30 percentage points or more - the sellers.

The remaining 12 members used their first IFTs to swap which stock they held without changing their G-fund holding much or at all.

These numbers balance each other without revealing a community wide trend.

Fund-Level Shifts

The most notable allocation change came in the I-fund, which saw an average decrease of 6.5 percentage points among these 38 members. Much of that capital appears to have rotated into the C-fund, which gained an average 4.2 points. It’s a subtle rotation toward domestic equities after weeks of global market instability.

Weekly Performance

As far a performance, only three members outperformed the G-fund this week, including myself. Each had increased stock exposure on Thursday as prices slipped, a move that at first looked premature when markets fell again Friday morning. But a late-day rebound rewarded those early buyers, particularly the two members holding 100% S-fund, who ended the week up more than 1%.

Looking Ahead

Next week will reveal whether the buyers or the sellers were on the right side of this market.

For now, November begins as October ended—volatile, uncertain, and filled with opportunity for those watching closely.

Stay in the know

Get the Last Look Report delivered to your email each trading day—30 minutes before the IFT deadline—with real-time AutoTracker insights and morning market analysis.

Get 5 Free Reports