Choppy trade dominated the action today in another low volume session. The dollar finished finished flat and the 50 dma provided support for the broader market.

But this was Monday, and Monday's have been green for months with few exceptions. It was not the kind of action one would expect to start the week after the string of positive closes that ended the previous week's performance. But it wasn't down by much, so no damage was done.

Here's today's charts:

We may be seeing a short term reversal as indicated by the decining trendline in NAMO and NYMO, but there's nothing to suggest a deep sell-off here, especially when taking the rest of the indicators into consideration.

NAHL and NYHL continue to look bullish, inching a bit higher in spite of the red close.

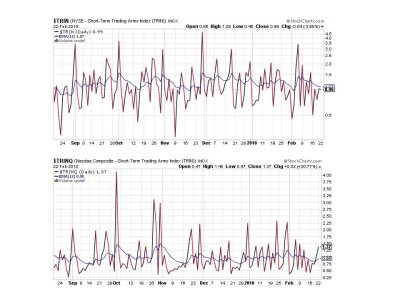

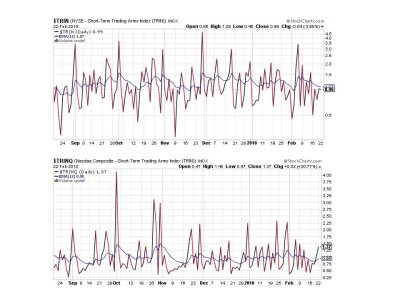

TRIN and TRINQ remain close to their 13 day EMAs, although TRINQ has flipped to a sell. No worries here though.

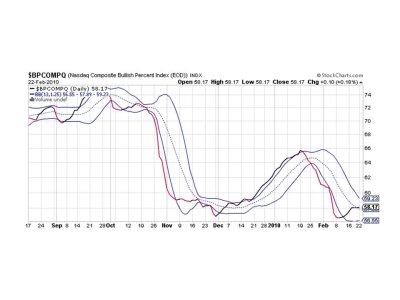

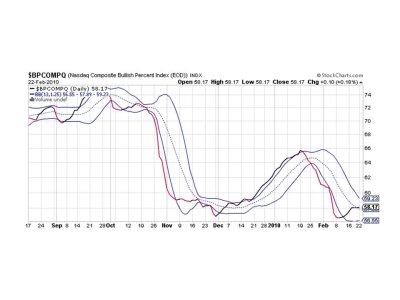

BPCOMPQ actually moved up just a tad and is remaining within the middle of the bollinger band for now.

So 6 of 7 Sentinels remain on a buy, but a short term pullback looks likely. Keep in mind that the system is on a buy, so don't look for a deep reversal. I don't think we'll see anything lower than 1089 on the S&P and I'd be surprised if it gets that low. It's more likely we'll chop lower and consolidate recent gains, but if bearish levels don't taper off we may continue higher instead. But then again the system is on a solid buy, so don't be surprised if that's what happens. See you tomorrow.

But this was Monday, and Monday's have been green for months with few exceptions. It was not the kind of action one would expect to start the week after the string of positive closes that ended the previous week's performance. But it wasn't down by much, so no damage was done.

Here's today's charts:

We may be seeing a short term reversal as indicated by the decining trendline in NAMO and NYMO, but there's nothing to suggest a deep sell-off here, especially when taking the rest of the indicators into consideration.

NAHL and NYHL continue to look bullish, inching a bit higher in spite of the red close.

TRIN and TRINQ remain close to their 13 day EMAs, although TRINQ has flipped to a sell. No worries here though.

BPCOMPQ actually moved up just a tad and is remaining within the middle of the bollinger band for now.

So 6 of 7 Sentinels remain on a buy, but a short term pullback looks likely. Keep in mind that the system is on a buy, so don't look for a deep reversal. I don't think we'll see anything lower than 1089 on the S&P and I'd be surprised if it gets that low. It's more likely we'll chop lower and consolidate recent gains, but if bearish levels don't taper off we may continue higher instead. But then again the system is on a solid buy, so don't be surprised if that's what happens. See you tomorrow.