We are closing in on the end of the quarter and stocks managed to post a moderate gain today. Of course, it's Monday. No economic data releases of import were released today and there's not much on tap for tomorrow either. However, Thursday we have initial and continuing claims along with ISM while Friday will see non-farm payrolls and the unemployment rate released, so we do have some potential for market moving activity. And those come in the new quarter. It could be interesting. Today's charts:

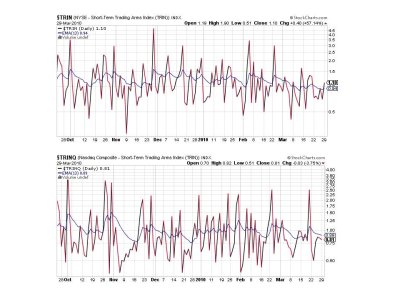

Still on a sell, but it sure hasn't been dramatic like many other drops below the zero line.

Flashing sells here too.

TRIN flipped to a sell, TRINQ remains on a buy.

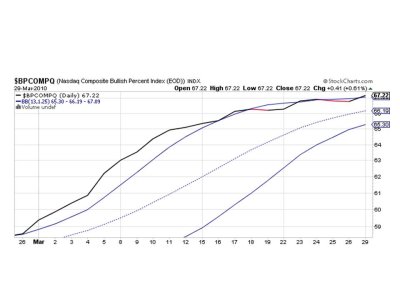

BPCOMPQ managed to pop back up above the upper bollinger band, flipping it to a buy.

So the system remains on a sell with 5 of 7 signals in sell territory. The market has really managed to hold its ground so far, and really hasn't given up much ground at all since that last sell signal. I am expecting more weakness this week, but I'm turning neutral from my previous bearish leaning.

Don't forget, Thursday will give us new IFTs to work with. If I'm not mistaken, I believe the market is closed for Good Friday this week. But we'll have those data releases nonetheless. See you tomorrow.

Still on a sell, but it sure hasn't been dramatic like many other drops below the zero line.

Flashing sells here too.

TRIN flipped to a sell, TRINQ remains on a buy.

BPCOMPQ managed to pop back up above the upper bollinger band, flipping it to a buy.

So the system remains on a sell with 5 of 7 signals in sell territory. The market has really managed to hold its ground so far, and really hasn't given up much ground at all since that last sell signal. I am expecting more weakness this week, but I'm turning neutral from my previous bearish leaning.

Don't forget, Thursday will give us new IFTs to work with. If I'm not mistaken, I believe the market is closed for Good Friday this week. But we'll have those data releases nonetheless. See you tomorrow.