I'm not surprised by the rally, but once again the market overdoes it in a big way. This time to the upside. And now we're very overbought in the short term.

So what was the excuse for the rally this time?

Well, the August ISM Manufacturing Index posted a 56.3, which was well above the expected 52.9. And apparently the market ignored the August ADP Employment Change report, which showed that private payrolls fell by 10,000 last month, instead of an an expected increase of 13,000.

We still have the non-farms payroll data coming at the end of the week, and that's always good for some volatile action.

Still, more than 98% of the companies in the S&P 500 staged gains. But it should be noted that the S&P has still not closed above its 50-day moving average.

Seasonality favors stocks at the moment, so we could see more gains in the days ahead. But I suspect the bulk of the gains just passed by.

The Seven Sentinels managed to all flip to buys, but NYMO did not hit its 28 day trading high. In fact, it's quite a ways away from it. July 26 was 28 trading days ago and that's when NYMO hit the mid-90s at its peak. Today's action left NYMO sitting at 6.81. Here's the charts:

Yes, we've improved and both signals are now flashing buys.

NAHL and NYHL also improved in dramatic fashion.

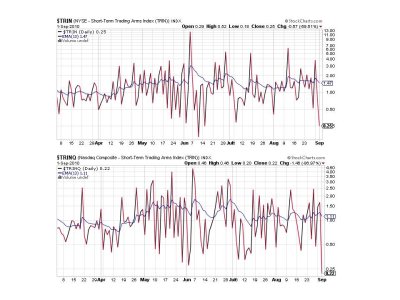

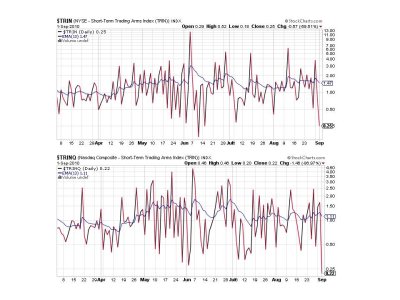

TRIN and TRINQ, while on buys, are showing extremely overbought conditions in the short term. I will be very surprised is we don't retrace at least half these gains by the end of the week.

BPCOMPQ managed to move a bit higher today and did cross the lower bollinger band, which triggers a buy signal.

So as I mentioned above, all signals are flashing buys, but the system remains on a sell as NYMO has not hit a new 28 day trading high. Remember that this particular caveat is designed to avoid whipsaws in highly volatile action. I remain 100% G.

So what was the excuse for the rally this time?

Well, the August ISM Manufacturing Index posted a 56.3, which was well above the expected 52.9. And apparently the market ignored the August ADP Employment Change report, which showed that private payrolls fell by 10,000 last month, instead of an an expected increase of 13,000.

We still have the non-farms payroll data coming at the end of the week, and that's always good for some volatile action.

Still, more than 98% of the companies in the S&P 500 staged gains. But it should be noted that the S&P has still not closed above its 50-day moving average.

Seasonality favors stocks at the moment, so we could see more gains in the days ahead. But I suspect the bulk of the gains just passed by.

The Seven Sentinels managed to all flip to buys, but NYMO did not hit its 28 day trading high. In fact, it's quite a ways away from it. July 26 was 28 trading days ago and that's when NYMO hit the mid-90s at its peak. Today's action left NYMO sitting at 6.81. Here's the charts:

Yes, we've improved and both signals are now flashing buys.

NAHL and NYHL also improved in dramatic fashion.

TRIN and TRINQ, while on buys, are showing extremely overbought conditions in the short term. I will be very surprised is we don't retrace at least half these gains by the end of the week.

BPCOMPQ managed to move a bit higher today and did cross the lower bollinger band, which triggers a buy signal.

So as I mentioned above, all signals are flashing buys, but the system remains on a sell as NYMO has not hit a new 28 day trading high. Remember that this particular caveat is designed to avoid whipsaws in highly volatile action. I remain 100% G.