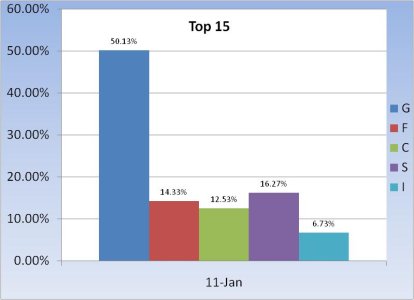

When you compare the Top 50 statistics in this early 2010 market picture with that of the Top 15 one thing certainly stands out. For the most part, the Top 15 aren't buying it. That is they appear to be in capital preservation mode in an increasingly risky market.

But regardless of one's view about this market, one thing should be remembered; It's a marathon, not a sprint. It's the score at the end of the year that counts and the game has only just started.

Here is how our two groups are positioned for Monday's action:

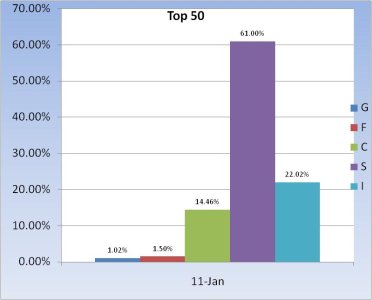

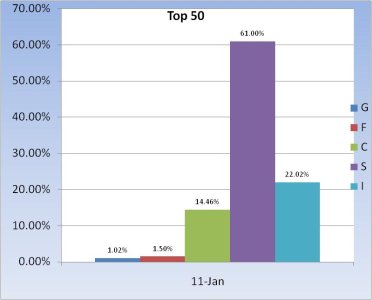

When the first week of the new year is up for 5 consecutive days, one can predict what the Top 50 will look like. And we can see that this group has positioned themselves almost exclusively in stocks.

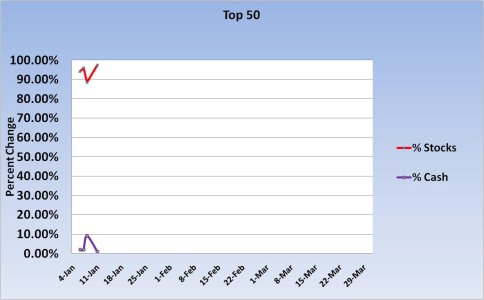

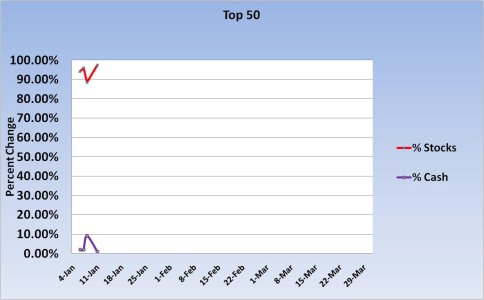

Here's the the weekly view so far. Keep in mind that the bond fund is not reflected in either the stock or cash statistics.

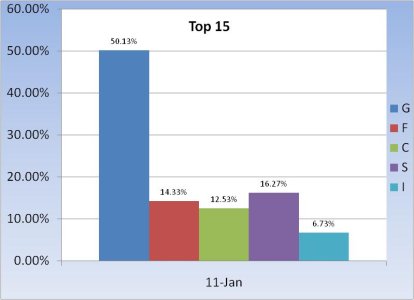

Our Top 15 did make a move for Monday's action. Some bonds were purchased. That was the only change in the chart. I had considered doing the same thing, but chose to stay planted in the G fund.

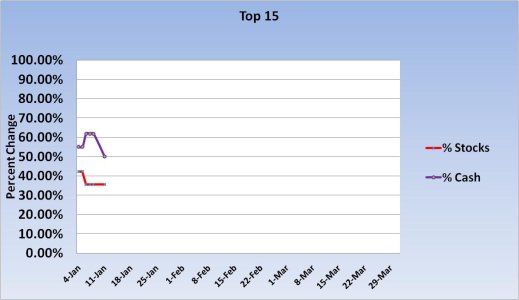

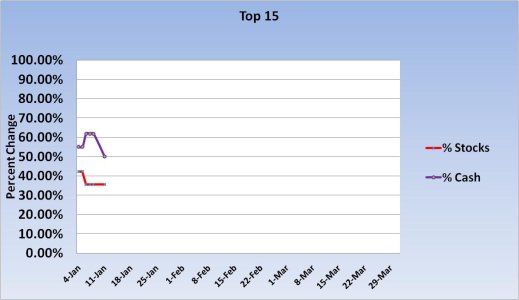

And the weekly view. Again, bonds are not reflected in this chart, so any percentage difference can be attributed to that omission.

While I do not have any historical reference, I can infer that our Top 15 consider stocks to be fairly risky at the moment. I am expecting volatility to pick up this coming week as it is OPEX and the Santa Claus rally timeframe is officially over. Let's see how many more days this market can move higher without taking a break.

But regardless of one's view about this market, one thing should be remembered; It's a marathon, not a sprint. It's the score at the end of the year that counts and the game has only just started.

Here is how our two groups are positioned for Monday's action:

When the first week of the new year is up for 5 consecutive days, one can predict what the Top 50 will look like. And we can see that this group has positioned themselves almost exclusively in stocks.

Here's the the weekly view so far. Keep in mind that the bond fund is not reflected in either the stock or cash statistics.

Our Top 15 did make a move for Monday's action. Some bonds were purchased. That was the only change in the chart. I had considered doing the same thing, but chose to stay planted in the G fund.

And the weekly view. Again, bonds are not reflected in this chart, so any percentage difference can be attributed to that omission.

While I do not have any historical reference, I can infer that our Top 15 consider stocks to be fairly risky at the moment. I am expecting volatility to pick up this coming week as it is OPEX and the Santa Claus rally timeframe is officially over. Let's see how many more days this market can move higher without taking a break.