Not bearish

Price matters and nothing else

(Jason rants)

Price matters and nothing else

(Jason rants)

It's important to use filters when you trade the markets. Ignore the news, ignore the moving averages, ignore the oscillators, and focus on the most important thing that matters...PRICE

News comes is waves just like plane crashes come in threes. Right now we're going through a bad news cycle and we are being manipulated by the CNBCers, Bloggers & the LAGGING Federal government's obscured statistics.

Moving averages are lagging indicators, sometimes they work and other times they don't. I've done perhaps thousands of scans over multiple time frames and have never found a moving average from 2-200 that consistently beats the market for all points of time. In fact, I've actually found that in the short term, inverse moving average crossovers can work better. That's right, you might get better results when the 10MA moves under the 20MA. Hard to believe but true.

Don't even get me started on oscillators, they too lag and whats worse is they can diverge by going down, while prices rise and they can do this for months at a time. You never know how high or low and for how long they will go, and by the time you follow them, the smart-faster money already took the better entry point and left you holding the leftovers.

Ok, I'm done ranting now, let's move to the charts...

The quarterly chart shows us the long-term truth with the price action. Looking at the Green March 2009 Channel, we've already tested the bottom trend-line at 1010, and as long as 1010 holds, the channel remains intact. The current median price is about 1215 and I wouldn't be the least bit surprised it we close there in late September.

So I just told you if we stay above 1010 we are still long-term bullish. Now let's look at that same time-frame on the weekly charts with our Fibonacci levels drawn in. Mr. Fibonacci is telling us that anything above the 38.2% retracement at 1009 is still bullish. So basically our quarterly March channel is supporting our weekly Fibonacci levels.

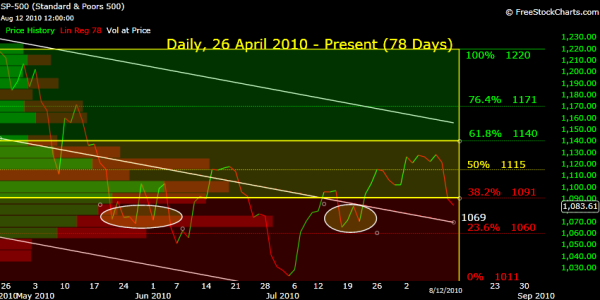

The daily chart shows the 78-day April channel and I believe this is giving us some key levels in the intermediate-term. I've removed the candlesticks and used only closing prices, to make it easier to identify the importance of 1069. Median price is 1069. Within this channel, the longest volume at price bar resides at 1069-1076. I've circled some key closes and they reside from 1065-1071. Based on closing prices I don't believe we have establish a lower low, therefore the uptrend (although damaged) is not officially broken on this chart as long as we remain above these key levels.

Here is the hourly July channel and it's been violated. I've left it where is instead of redrawing it partially due to the Fibonacci levels here. Although choppy, we are still in bullish territory trading within the key 38.2% Fibonacci level at 1084. I don't like making predictions, but if I were, I'd estimate we have a good chance at climbing up but under the bottom trend-line, I say this partially because we still have a gap that needs to be filled, and sometimes when channels get violated, prices like to crawl along the bottom of the previous channel.

In summary, watch the 1069-1076 level, the more it holds, the better the chance we can resume the uptrend. Despite what looks like some drastic downside price action, I see it as nothing more then too many traders deciding to take profits at the same time.

Take care and trade safe...Jason