Monday began with a modest gap down, rallied modestly higher until 1000 and then plunged lower for an hour to the days lows. It looked like it could be a tough day for the bulls, but after the lows were put in the market clawed back to the flat line and finished mixed overall. The Naz, Dow, and S&P all finished a bit higher, but the broader market (Wilshire 4500) was moderately lower.

Still, after last week's strong gains and this being OPEX week, it was not a bad start to begin the week. All eyes are on earnings now, and although they don't really start getting released in earnest until next week, there are a few that will be reporting this week. Alcoa (AA) is the first and released its results after the closing bell.

They reported earnings of 13 cents a share, inline with expectations. But unlike some recent quarterly reports that were on the negative side, this time they set a positive tone. Revenue came in at $5.2 billion, up 22% from a year-ago and more than the $4.97 billion analysts expected.

Additionally, Alcoa upwardly revised from 10% to 12% its global aluminum demand forecast.

So after hours futures for Alcoa are up 3.22%. Now the question is how will the market react?

Futures are up modestly so far. A positive sign?

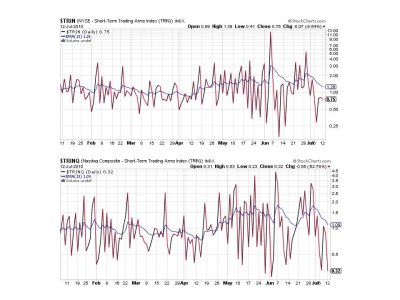

The Seven Sentinels didn't change much to speak of today. All signals remain on a buy. Here's the charts with no commentary necessary:

So we remain on a buy and today's early selling pressure and subsequent reversal may be a sign that higher prices are coming.

Still, after last week's strong gains and this being OPEX week, it was not a bad start to begin the week. All eyes are on earnings now, and although they don't really start getting released in earnest until next week, there are a few that will be reporting this week. Alcoa (AA) is the first and released its results after the closing bell.

They reported earnings of 13 cents a share, inline with expectations. But unlike some recent quarterly reports that were on the negative side, this time they set a positive tone. Revenue came in at $5.2 billion, up 22% from a year-ago and more than the $4.97 billion analysts expected.

Additionally, Alcoa upwardly revised from 10% to 12% its global aluminum demand forecast.

So after hours futures for Alcoa are up 3.22%. Now the question is how will the market react?

Futures are up modestly so far. A positive sign?

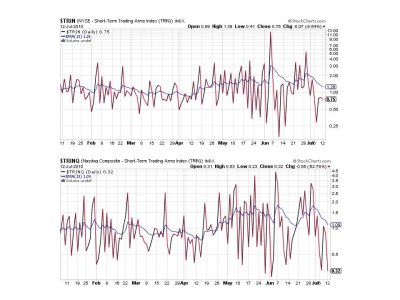

The Seven Sentinels didn't change much to speak of today. All signals remain on a buy. Here's the charts with no commentary necessary:

So we remain on a buy and today's early selling pressure and subsequent reversal may be a sign that higher prices are coming.