I'd been wondering if the sell signal currently in force by the Seven Sentinels might end up bearing no fruit, and after today that could very well be the case. Let's start with today's market data.

The ISM Manufacturing Index came in at 59.6, the highest reading in five years, and may the reason for today's bullish underpinnings.

Construction spending for February dropped more than expected -1.3% while initial jobless claims were close to estimates at 439,000.

The market started out strong this morning before giving way to selling pressure in the afternoon as traders who didn't want to hold long over the 3-day weekend exited their positions. But just like yesterday the market did another reversal in the final hour of trading, only this time it rallied instead of selling down giving the indicies a strong finish. The dollar fell another 0.5% today, which really helped the I fund post an impressive gain.

But another test awaits. Tomorrow's Nonfarm Payrolls will be the main event and given how strong the market has been it could prove to be a sell-the-news event on Monday as the equity market is closed tomorrow. If the market manages to advance on Monday we could see a Seven Sentinels buy signal. Here's the charts:

NAMO remains on a sell, but is close to flipping to a buy. NYMO did flip to a buy today.

Both NAHL and NYHL flipped to buys today.

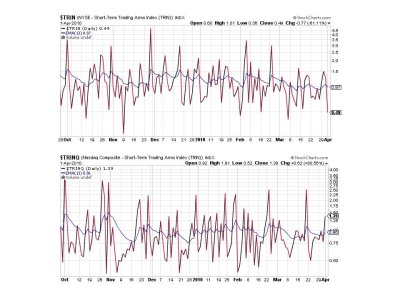

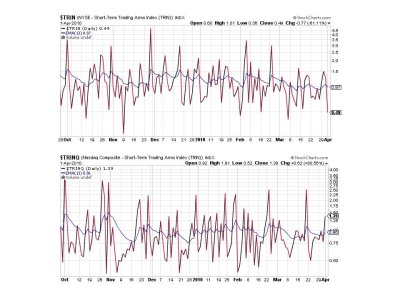

TRIN flipped to a buy, while TRINQ is flashing a sell.

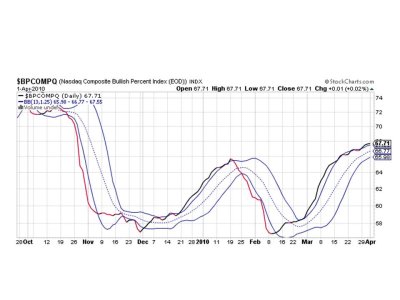

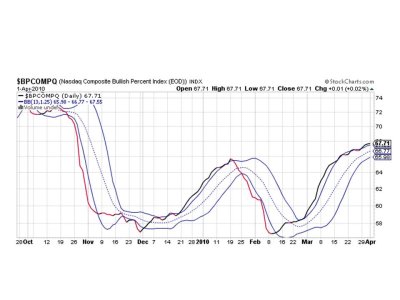

BPCOMPQ remains on a buy, but trading in sideways fashion, skirting the upper bollinger band.

So we now have 5 of 7 signals on a buy and could now flip the system to a buy with some follow-through buying pressure on Monday. Unless Monday sees a sell-the-news event.

Since the last Seven Sentinels sell signal the market has only managed modest gains. Downside has been extremely limited. For the moment though, the system remains on a sell until the market proves it can dish out additional gains. We'll have to wait until Monday to see how it goes.

I'll post Top 15 and Top 50 charts later this week. See you then.

The ISM Manufacturing Index came in at 59.6, the highest reading in five years, and may the reason for today's bullish underpinnings.

Construction spending for February dropped more than expected -1.3% while initial jobless claims were close to estimates at 439,000.

The market started out strong this morning before giving way to selling pressure in the afternoon as traders who didn't want to hold long over the 3-day weekend exited their positions. But just like yesterday the market did another reversal in the final hour of trading, only this time it rallied instead of selling down giving the indicies a strong finish. The dollar fell another 0.5% today, which really helped the I fund post an impressive gain.

But another test awaits. Tomorrow's Nonfarm Payrolls will be the main event and given how strong the market has been it could prove to be a sell-the-news event on Monday as the equity market is closed tomorrow. If the market manages to advance on Monday we could see a Seven Sentinels buy signal. Here's the charts:

NAMO remains on a sell, but is close to flipping to a buy. NYMO did flip to a buy today.

Both NAHL and NYHL flipped to buys today.

TRIN flipped to a buy, while TRINQ is flashing a sell.

BPCOMPQ remains on a buy, but trading in sideways fashion, skirting the upper bollinger band.

So we now have 5 of 7 signals on a buy and could now flip the system to a buy with some follow-through buying pressure on Monday. Unless Monday sees a sell-the-news event.

Since the last Seven Sentinels sell signal the market has only managed modest gains. Downside has been extremely limited. For the moment though, the system remains on a sell until the market proves it can dish out additional gains. We'll have to wait until Monday to see how it goes.

I'll post Top 15 and Top 50 charts later this week. See you then.