Lackluster, choppy trading was the order of the day, just one day after a powerful upthrust off the July low. At the close, the S&P 500 shed a modest 0.07% to close at 1325.84, while the DOW and Nasdaq fell 0.12% and 0.43% respectively.

Economic data was very light, but earnings reports are in abundance.

Perhaps the most notable company to report today was Apple, which reported a stunningly successful quarter that pushed its stock price to a record closing high of $386.90 per share. But it wasn't enough to offset some of the disappointing reports such as Yahoo!, which fell to a new 2011 low.

The only economic report was June existing home sales, which revealed an annualized sales rate of 4.77 million units. That was under the 4.93 million units economists were looking for.

Neither the European debt crisis nor our debt ceiling talks had much influence over the market today, which is almost certainly the reason for the muted trading activity in today's session.

Let's look at the charts:

NAMO dipped back into a sell condition today, while NYMO managed to ebb a bit higher and trigger a buy. Both are just south of the neutral line and remain very close to their respective 6 day EMA trigger points.

NAHL fell back a bit today, while NYHL climbed a bit higher. Both remain in buy conditions, albeit barely for NAHL.

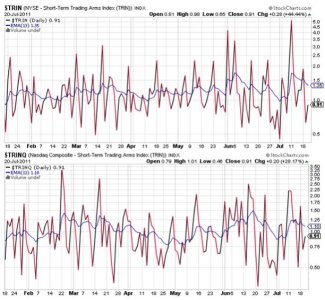

Both TRIN and TRINQ moved higher today, but remained in a buy status. Both also moved closer to a neutral status in the process.

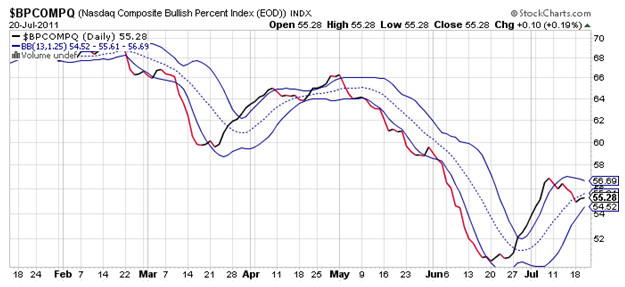

BPCOMPQ ticked sideways and remains in a sell condition. As a reminder, this is an intermediate term trend indicator that continues to suggest lower prices, although not convincingly at the moment.

So the system remains in a buy condition, although it did issue an unconfirmed sell signal earlier in the week.

Beyond the technical analysis, today's signals seem to reflect a market that's showing indecision. That's not surprising given we have no endgame as of yet to the current debt ceiling talks. And that August 2nd deadline is drawing very near. I am seeing more negative media reports regarding this stalemate too. Among them:

Fed Making Contingency Plans for Possible US Default

http://www.cnbc.com/id/43830242

And then there's the EU crisis and this report focusing on a critical meeting tomorrow:

Here's Everything You Need To Know About Tomorrow's Huge EU Meeting

http://www.businessinsider.com/ever...-big-eu-meeting-thursday-2011-7#ixzz1Sgl8LGJ8

So stand by for more volatility in the coming days. I'm still anticipating another shot lower before this market resolves to the upside. And I'll almost certainly be a buyer should that opportunity present itself.