The very short term continues to be difficult to predict, which we all know is due to the potentially explosive news that can hit the airwaves at any time. And today was certainly no exception as the market got word before the opening bell that a deal to restore Greece's economy had been drafted. That elevated futures above the positive bias they were already showing.

At the open, the market gapped up and continued to rise for about an hour before it leveled off and slowly retraced gains. That lasted until the early afternoon before a news release by the NY Times reported that officials had moved closer to a deal on the debt ceiling at which point the market reversed to the upside once again. The President's Press Secretary quickly dispelled that report, but the market held those gains nonetheless.

Another batch of better-than-expected earnings reports also came out today, but the market didn't seem to key on that.

Also released this morning was the initial jobless claims which totaled 418,000, which was more than the 411,000 claims that had been expected. One other data point was the Philadelphia Fed Survey, which came in at 3.20 for July. Economists had anticipated a flat reading.

The dollar took a beating as a result of the EU media reports and ended the day with a 0.8% loss.

Yesterday the Seven Sentinels were showing relatively neutral readings, but were biased negatively. They were also still officially in a buy condition, but after an unconfirmed sell signal was triggered on Monday's sell-off, I began to anticipate lower prices leading to an official sell signal. But at the moment the market seems to have other ideas. Today's action dramatically improved those signals, although I continue to be wary of more volatility. One of today's signals also has me thinking twice about entering this market too soon.

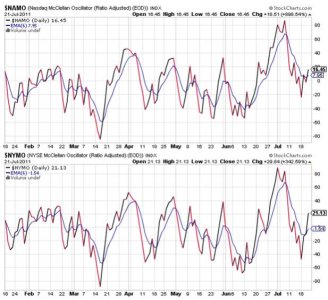

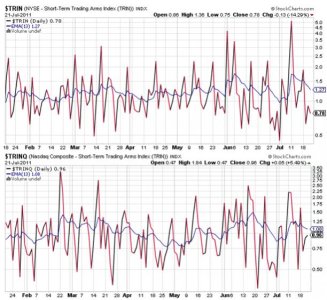

Here's the charts:

NAMO and NYMO bounced nicely on today's action and are back above the neutral line and in buy conditions.

NAHL and NYHL continue to rise and also remain in buy conditions.

TRIN and TRINQ also remain on buys. A plus for the bulls given the health gains today.

Interestingly, BPCOMPQ actually ticked lower a bit and remains on a sell. And that's reason for pause, although I don't want to read too much into it as it often takes a bit more time to turn this signal in the event the market stages a true reversal.

So all but one signal are now flashing buys. But the system remains in a buy condition nonetheless.

Today's strength probably surprised many traders, and admittedly that includes myself, but I am now wondering if the market is simply buying the rumor of successful outcomes for both the EU debt problems and our debt ceiling limit. That would call into question whether it can continue to rally assuming positive outcomes by the end of next week or so. I'm still leaning towards another move down, but I doubt we tag new July lows. And I would think that move would happen soon, but I'm not as sure of that outcome as I was. But I'm also still not buying this market in such a news driven environment, especially given the fact that the S&P is near the upper end of its current channel. I had anticipated waiting as long as the end of July for reentry, and I still that that's a reasonable target time frame. Now if the market would just cooperate. :cheesy: