It didn't start out very well for stocks in the early going today, but by 1100 EST an intraday reversal in the dollar helped stocks also reverse course and eventually end the day not far off its highs.

On the economic front, there was a bigger decline in initial jobless claims this morning, which was not expected, while continuing claims hit a one-year low.

Across the pond and as expected, the EU officially announced that financial assistance would be made available to Greece. No specifics have been given so this saga will continue to play out.

Yesterday I said I was going into stocks, but that I may have been doing so too early, as the Seven Sentinels had yet to give a buy signal. But they were improving and looked as though they could give a buy signal any day as long as the action was favorable.

Today it was favorable, so it appears I nailed it.

Here's the charts:

Both NAMO and NYMO are well within buy territory and have some room to move higher.

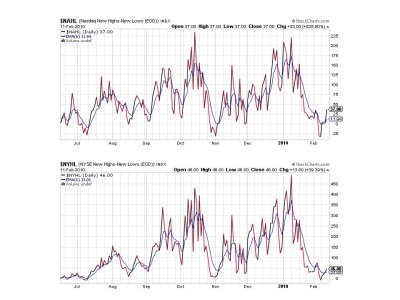

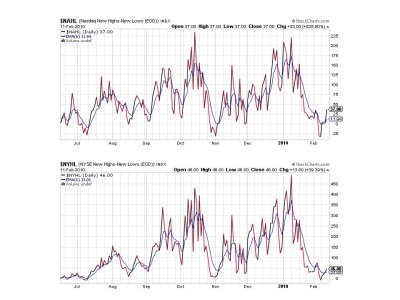

NAHL and NYHL are both on buys too.

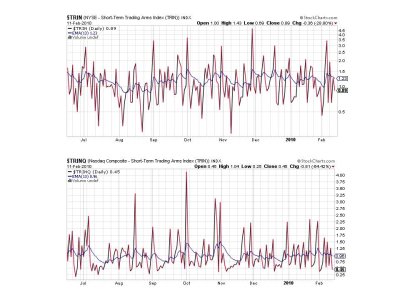

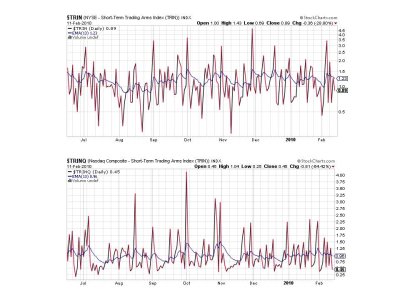

TRIN and TRINQ flashing buys.

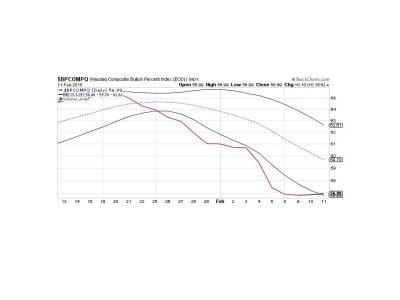

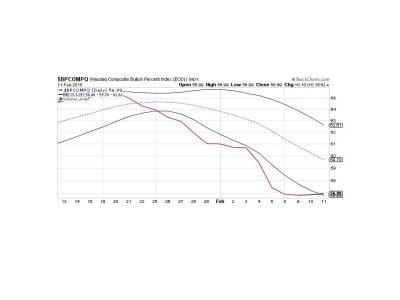

BPCOMPQ crossed the lower bollinger band triggering a buy signal here as well. I'd like to see this signal show some upward movement, but that should come soon if we have in fact turned the corner.

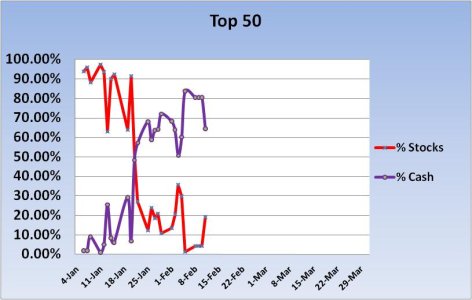

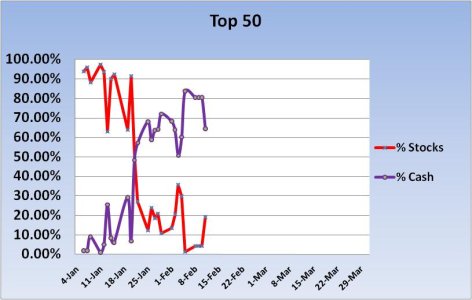

Here is how our Top 50 were positioned for today's action. The Top 15 have not changed all week.

So the Seven Sentinels have all flipped to buy signals concurrently, which changes the system from a sell condition to a buy condition. The system appears to have more upside potential in the coming days/weeks too, but be prepared for chop and volatility. It does not appear we will be seeing the "V" shaped tops and bottoms we saw last year. At least not many of them. That's a good thing as it gives the Sentinels a chance to provide some advance warning without getting me whipsawed.

That's it for today. Sure am glad to be back home. It was darn cold and windy up in Virginia, but at least I didn't get much snow in the Norfolk area. See you tomorrow.

On the economic front, there was a bigger decline in initial jobless claims this morning, which was not expected, while continuing claims hit a one-year low.

Across the pond and as expected, the EU officially announced that financial assistance would be made available to Greece. No specifics have been given so this saga will continue to play out.

Yesterday I said I was going into stocks, but that I may have been doing so too early, as the Seven Sentinels had yet to give a buy signal. But they were improving and looked as though they could give a buy signal any day as long as the action was favorable.

Today it was favorable, so it appears I nailed it.

Here's the charts:

Both NAMO and NYMO are well within buy territory and have some room to move higher.

NAHL and NYHL are both on buys too.

TRIN and TRINQ flashing buys.

BPCOMPQ crossed the lower bollinger band triggering a buy signal here as well. I'd like to see this signal show some upward movement, but that should come soon if we have in fact turned the corner.

Here is how our Top 50 were positioned for today's action. The Top 15 have not changed all week.

So the Seven Sentinels have all flipped to buy signals concurrently, which changes the system from a sell condition to a buy condition. The system appears to have more upside potential in the coming days/weeks too, but be prepared for chop and volatility. It does not appear we will be seeing the "V" shaped tops and bottoms we saw last year. At least not many of them. That's a good thing as it gives the Sentinels a chance to provide some advance warning without getting me whipsawed.

That's it for today. Sure am glad to be back home. It was darn cold and windy up in Virginia, but at least I didn't get much snow in the Norfolk area. See you tomorrow.