MrJohnRoss

Market Veteran

- Reaction score

- 58

Looking at the S&P 500:

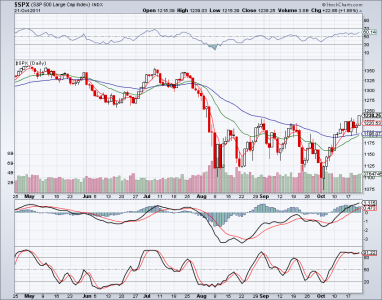

On Monday, we had the Stochastics and PPO crossover, and heading higher. We also have price movement break above the 50 day EMA. That was enough to trigger a buy signal, although I waited until Wednesday to make my IFT's due to the weak breakthrough on Monday. Note the positive divergence of the PPO (middle indicator), and price action. These are all positive signs.

This is my 6th trade for the year.

We are right at the resistance level ceiling of 1224, but if we can clear that next week, things will improve technically.

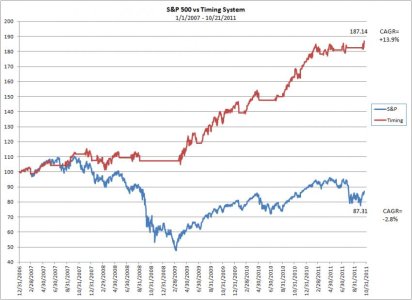

Time will tell if this is the beginning of an "end of year rally" or not. Honestly, I have no idea why the Stock Market wants to move higher here. With all the financial problems in the world, I'm amazed that we haven't seen a bloodbath (yet). I expect it will come soon enough.

To your success!

On Monday, we had the Stochastics and PPO crossover, and heading higher. We also have price movement break above the 50 day EMA. That was enough to trigger a buy signal, although I waited until Wednesday to make my IFT's due to the weak breakthrough on Monday. Note the positive divergence of the PPO (middle indicator), and price action. These are all positive signs.

This is my 6th trade for the year.

We are right at the resistance level ceiling of 1224, but if we can clear that next week, things will improve technically.

Time will tell if this is the beginning of an "end of year rally" or not. Honestly, I have no idea why the Stock Market wants to move higher here. With all the financial problems in the world, I'm amazed that we haven't seen a bloodbath (yet). I expect it will come soon enough.

To your success!