This week, the herd once again increased their collective stock exposure (albeit modestly), while the Top 50 dropped their overall exposure by a significant measure.

Here's the charts:

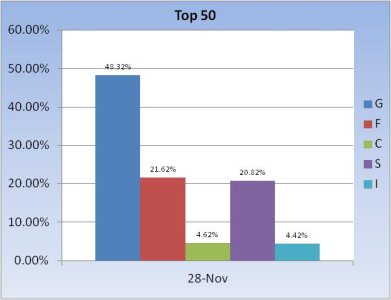

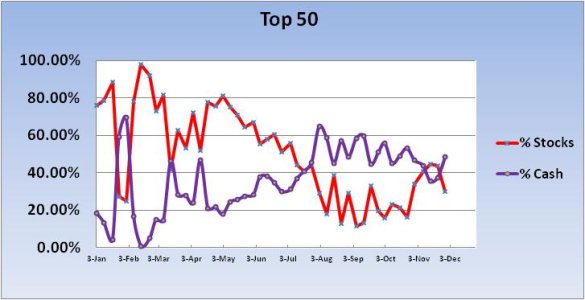

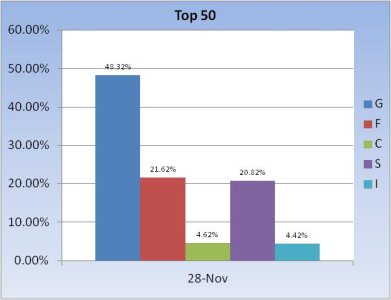

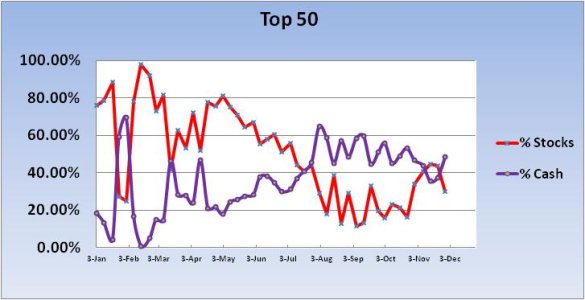

The Top 50 dropped their stock exposure from 43.72% last week to a much more modest 29.86%. I suspect a number of Top 50 folks dropped off the list as some G and F funders rose as a result of the current decline.

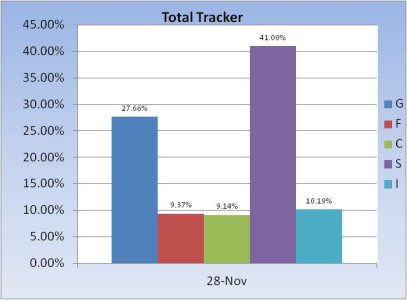

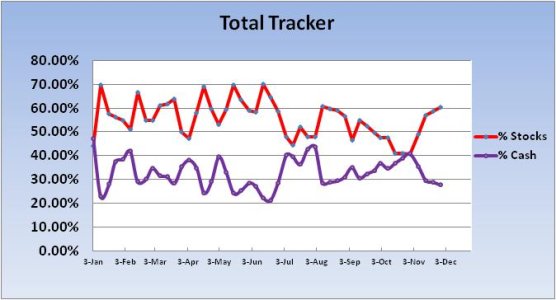

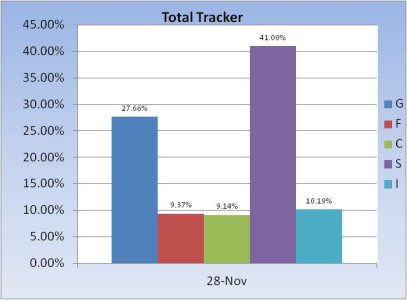

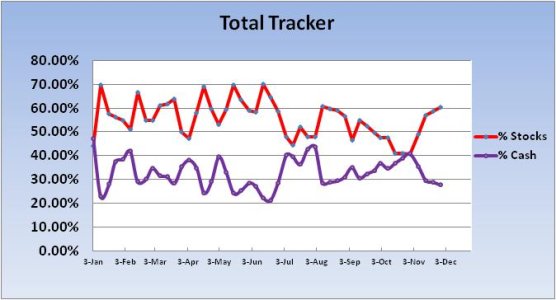

The herd bumped up their stock exposure from 58.44% to 60.33%.

Our sentiment survey is on a hold for this week (sell condition) and the Seven Sentinels also remain in a sell condition.

We are oversold and futures are significantly higher as I type this blog. If we open as futures indicate Sunday evening, I hope it's more than an oversold bounce. Sentiment has gotten bearish is some pockets so we could see a multi-day advance, but that remains to be seen.

Here's the charts:

The Top 50 dropped their stock exposure from 43.72% last week to a much more modest 29.86%. I suspect a number of Top 50 folks dropped off the list as some G and F funders rose as a result of the current decline.

The herd bumped up their stock exposure from 58.44% to 60.33%.

Our sentiment survey is on a hold for this week (sell condition) and the Seven Sentinels also remain in a sell condition.

We are oversold and futures are significantly higher as I type this blog. If we open as futures indicate Sunday evening, I hope it's more than an oversold bounce. Sentiment has gotten bearish is some pockets so we could see a multi-day advance, but that remains to be seen.