Well, the closing days of the quarter aren't seeing much late minute window dressing being applied. Maybe everyone came to the party early this time around. Still, I suspect the party may be just getting started from a longer term perspective, but I'm interested is seeing what next week brings during the first full week of October trading. We have enough time for the big money to take prices lower again before the elections. I'd be surprised if that doesn't happen, but with sentiment as bearish as it is we may not get a deep sell-off.

There was no economic data released today, but tomorrow we'll get the third reading for the second quarter GDP. We'll also get the initial and continuing claims number as well as the Chicago PMI. So the market does have an opportunity to be volatile tomorrow. That said, I'm expecting the market to gap, but I'm not sure which way.

The dollar continued its downward trajectory and hit a new eight month-low, finishing down about 0.3% against a basket of competing currencies.

Here's the charts:

NAMO and NYMO remain on buys.

NAHL and NYHL also remain on buys.

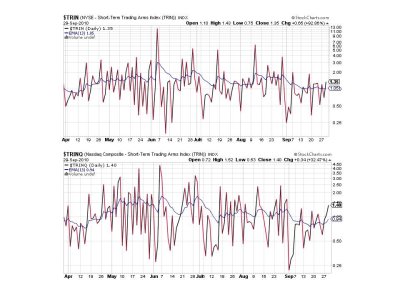

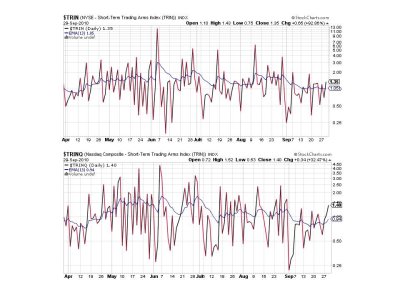

TRIN and TRINQ are flashing sells, but they also suggest a chance for higher prices in spite of their sell position.

BPCOMPQ continues to walk up the ladder and remains on a buy.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy.

At the moment, sentiment may be the main reason this market is marching higher, consolidation notwithstanding. A weaker dollar certainly doesn't hurt either. But as I said early on, I'm very interested on how we trade next week in the first full week of the new month. If we're going to get some weakness, I'd think it would be sooner rather than later as we run up to election time. It's also possible we simply grind higher.

There was no economic data released today, but tomorrow we'll get the third reading for the second quarter GDP. We'll also get the initial and continuing claims number as well as the Chicago PMI. So the market does have an opportunity to be volatile tomorrow. That said, I'm expecting the market to gap, but I'm not sure which way.

The dollar continued its downward trajectory and hit a new eight month-low, finishing down about 0.3% against a basket of competing currencies.

Here's the charts:

NAMO and NYMO remain on buys.

NAHL and NYHL also remain on buys.

TRIN and TRINQ are flashing sells, but they also suggest a chance for higher prices in spite of their sell position.

BPCOMPQ continues to walk up the ladder and remains on a buy.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy.

At the moment, sentiment may be the main reason this market is marching higher, consolidation notwithstanding. A weaker dollar certainly doesn't hurt either. But as I said early on, I'm very interested on how we trade next week in the first full week of the new month. If we're going to get some weakness, I'd think it would be sooner rather than later as we run up to election time. It's also possible we simply grind higher.