More choppy trading, but we remain solidly in buy territory for the intermediate term.

The euro continued its advance against the dollar, ending the day with a 0.6% gain.

But it was today's market data that kept the trading mood on the negative side.

Initial jobless claims climbed 12,000 to 472,000, higher than expected. Continuing jobless claims were up 88,000 to 4.57 million, again higher than expected.

The June Philadelphia Fed Index fell to 8.0 from 21.4. This was much lower than the 21.0 that had been forecast.

The May Consumer Price Index (CPI) dropped 0.2% while Core CPI was up 0.1%. Both numbers were pretty much in-line with expectations.

Finally, May leading economic indicators were up 0.4%, just a bit under the anticipated 0.5%.

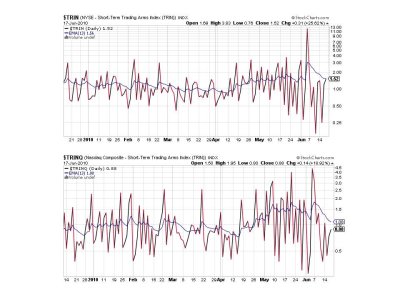

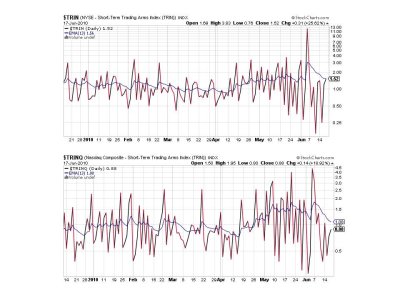

Let's look at the charts:

Closing in on the trigger point 6 day EMA on both signals here, but they still look decidedly bullish.

Still on a buy here.

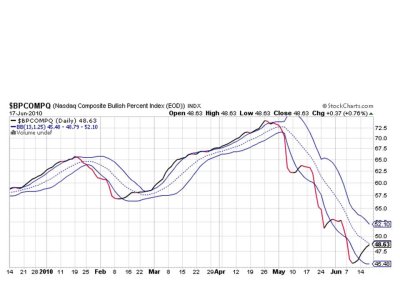

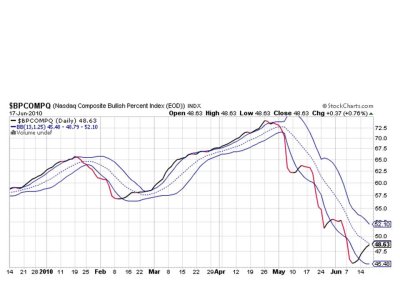

Buys here too.

We can see BPCOMPQ continues its rise, which keeps it on a buy as well.

So all signals remain on a buy, even though some are close to their EMAs. This should not be a problem, and although some short term weakness may materialize, the longer term outlook continues to look positive.

That's it for this evening. See you tomorrow.

The euro continued its advance against the dollar, ending the day with a 0.6% gain.

But it was today's market data that kept the trading mood on the negative side.

Initial jobless claims climbed 12,000 to 472,000, higher than expected. Continuing jobless claims were up 88,000 to 4.57 million, again higher than expected.

The June Philadelphia Fed Index fell to 8.0 from 21.4. This was much lower than the 21.0 that had been forecast.

The May Consumer Price Index (CPI) dropped 0.2% while Core CPI was up 0.1%. Both numbers were pretty much in-line with expectations.

Finally, May leading economic indicators were up 0.4%, just a bit under the anticipated 0.5%.

Let's look at the charts:

Closing in on the trigger point 6 day EMA on both signals here, but they still look decidedly bullish.

Still on a buy here.

Buys here too.

We can see BPCOMPQ continues its rise, which keeps it on a buy as well.

So all signals remain on a buy, even though some are close to their EMAs. This should not be a problem, and although some short term weakness may materialize, the longer term outlook continues to look positive.

That's it for this evening. See you tomorrow.