Friday saw yet more choppy trading, which saw major averages close mixed by the closing bell.

Earlier in the day the advance fourth quarter GDP was released, which showed that the economy grew at an annual rate of 2.8%. That was lower than many economists expected, however.

Also released was the University of Michigan Consumer Sentiment Survey for January. That gave us a reading of 75.0, which was a bit better than estimates looking for 74.2.

Here's the charts:

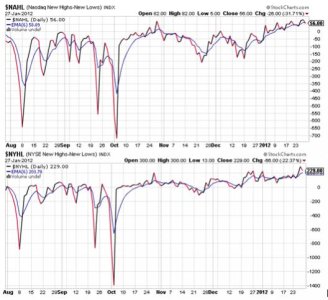

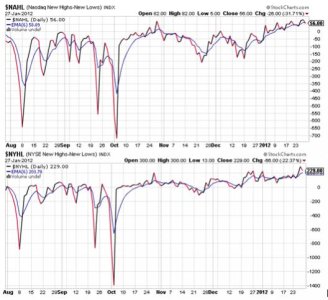

NAMO and NYMO are still sitting very near their trigger points. NAMO is on a buy, while NYMO is barely a sell. Not much help.

NAHL and NYHL both fell. NAHL flipped to sell, while NYHL remained on a buy.

TRIN and TRINQ moved only modestly. Both remain on sells.

BPCOMPQ continues its tracker along the upper bollinger band and remains in a buy condition.

So the signals are mixed again and that keeps the Seven Sentinels in a buy condition.

I don't have much to add tonight. The downside appears limited and fighting the current up trend has been a losing proposition since mid-December. This is the kind of market environment the Seven Sentinels do best in. It's been on a buy since the 22nd of December.

Yesterday I closed my comments with mention of the tracker charts being posted Sunday. At the time it felt like a Friday to me (today was my day off) so I was ahead of the game.

Now that Friday is really here I'll say it again. Stop by Sunday evening when I'll have the tracker charts posted. See you then.

Earlier in the day the advance fourth quarter GDP was released, which showed that the economy grew at an annual rate of 2.8%. That was lower than many economists expected, however.

Also released was the University of Michigan Consumer Sentiment Survey for January. That gave us a reading of 75.0, which was a bit better than estimates looking for 74.2.

Here's the charts:

NAMO and NYMO are still sitting very near their trigger points. NAMO is on a buy, while NYMO is barely a sell. Not much help.

NAHL and NYHL both fell. NAHL flipped to sell, while NYHL remained on a buy.

TRIN and TRINQ moved only modestly. Both remain on sells.

BPCOMPQ continues its tracker along the upper bollinger band and remains in a buy condition.

So the signals are mixed again and that keeps the Seven Sentinels in a buy condition.

I don't have much to add tonight. The downside appears limited and fighting the current up trend has been a losing proposition since mid-December. This is the kind of market environment the Seven Sentinels do best in. It's been on a buy since the 22nd of December.

Yesterday I closed my comments with mention of the tracker charts being posted Sunday. At the time it felt like a Friday to me (today was my day off) so I was ahead of the game.

Now that Friday is really here I'll say it again. Stop by Sunday evening when I'll have the tracker charts posted. See you then.