Thus far the Transports have retraced 88.27% from the previous swing low-high. It looks to be forming an M-Pattern which could lead to a Bearish MA-pattern But M-Patterns are far outside the scope of my knowledge base so if you want to add something please feel free.

I'm neutral on AGG as it appears to be trading sideways from 104.03 to 104.70 I doubt I'll change my mind until we see a break past either of these 2 levels.

As for $SPX if we stay within the red parallel descending price channel then tomorrow we shouldn't close below 1059. Perhaps we'll fill in a gap along the way? If there is good news in all this doom and gloom it would be the several bounces off the 50% retracement from the previous swing low-high.

Here is a closer look at the parallel channel. For fun, I've added pink Fibonacci lines within the channel to make a Parallel Descending Fibonacci Price Channel (PDFPC.) If i were to get bullish then we could get a close at 1072.72 (for tomorrow only)

I believe this is a key level based on previous candlestick rejections and the 61.8% PDFPC retracement.

Side Note: There is a 2.28 point high-side gap that gets filled at 1084.03

Currently 309 S&P 500 stocks have closed below their 20 SMA and 330 below their 20 EMA. Of those, 122 have their 20 SMA below the 50 SMA and 62 with their 20 EMA below the 50 EMA.

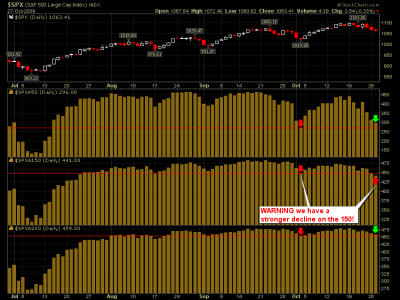

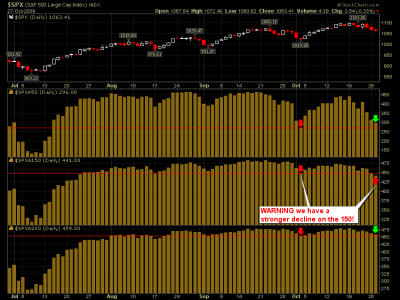

Here's a look at the number of S&P 500 stocks trading above their 50, 150, & 200 day moving average represented by $SPXA50, $SPXA150, & $SPXA200. See the warning attached in the chart.

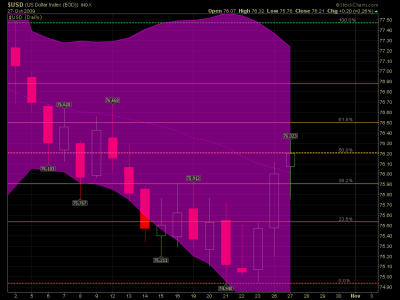

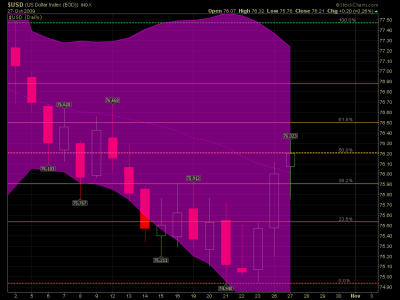

I should point out 50% IS NOT a Fibonacci number, it's just a key level everyone watches so it get's lumped in with Fibonacci tools. based on the previous swing high-low the dollar closed with a 50% retracement. It also closed above both the 20 SMA & EMA. While this gets me more bullish on the dollar, I'd still like to see confirmation with an additional close (or two) above the 20 SMA/EMA. As for the 50 SMA/EMA they are sitting just above & below the 76.40% Fibonacci level.

Best of luck!!!

I'm neutral on AGG as it appears to be trading sideways from 104.03 to 104.70 I doubt I'll change my mind until we see a break past either of these 2 levels.

As for $SPX if we stay within the red parallel descending price channel then tomorrow we shouldn't close below 1059. Perhaps we'll fill in a gap along the way? If there is good news in all this doom and gloom it would be the several bounces off the 50% retracement from the previous swing low-high.

Here is a closer look at the parallel channel. For fun, I've added pink Fibonacci lines within the channel to make a Parallel Descending Fibonacci Price Channel (PDFPC.) If i were to get bullish then we could get a close at 1072.72 (for tomorrow only)

I believe this is a key level based on previous candlestick rejections and the 61.8% PDFPC retracement.

Side Note: There is a 2.28 point high-side gap that gets filled at 1084.03

Currently 309 S&P 500 stocks have closed below their 20 SMA and 330 below their 20 EMA. Of those, 122 have their 20 SMA below the 50 SMA and 62 with their 20 EMA below the 50 EMA.

Here's a look at the number of S&P 500 stocks trading above their 50, 150, & 200 day moving average represented by $SPXA50, $SPXA150, & $SPXA200. See the warning attached in the chart.

I should point out 50% IS NOT a Fibonacci number, it's just a key level everyone watches so it get's lumped in with Fibonacci tools. based on the previous swing high-low the dollar closed with a 50% retracement. It also closed above both the 20 SMA & EMA. While this gets me more bullish on the dollar, I'd still like to see confirmation with an additional close (or two) above the 20 SMA/EMA. As for the 50 SMA/EMA they are sitting just above & below the 76.40% Fibonacci level.

Best of luck!!!