After all, Monday was up big so some consolidation should be expected, and that more than anything was the reason for the weakness.

Economic data released this morning included a pending home sales report for June that saw a decline of 2.6%, less than expected, but a decline nonetheless.

Also in the mix, June factory orders dropped 1.2%, while May's report was revised lower to a 1.8% decline.

Personal income, spending, and core personal consumption were flat.

But the bullish bias remains in spite of the negative tone in the data. Here's the charts:

NAMO and NYMO flipped back to sells today, but are still bullishly positioned.

NAHL and NYHL also remain bullish.

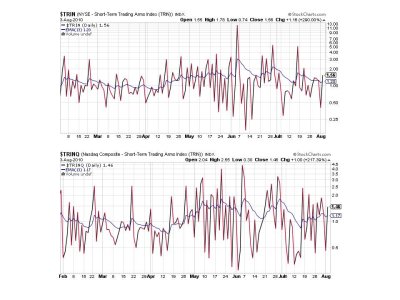

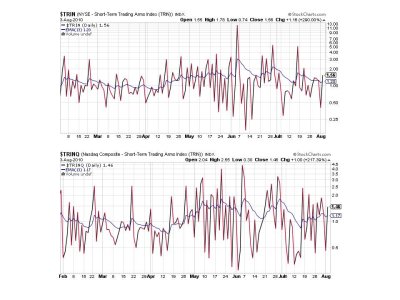

TRIN and TRINQ both flipped to sells, but that gets us poised for another move higher.

Still on a buy for BPCOMPQ.

So the system remains on a buy and I continue to see no reason for this upward move to end. I remain 100% S fund.

Economic data released this morning included a pending home sales report for June that saw a decline of 2.6%, less than expected, but a decline nonetheless.

Also in the mix, June factory orders dropped 1.2%, while May's report was revised lower to a 1.8% decline.

Personal income, spending, and core personal consumption were flat.

But the bullish bias remains in spite of the negative tone in the data. Here's the charts:

NAMO and NYMO flipped back to sells today, but are still bullishly positioned.

NAHL and NYHL also remain bullish.

TRIN and TRINQ both flipped to sells, but that gets us poised for another move higher.

Still on a buy for BPCOMPQ.

So the system remains on a buy and I continue to see no reason for this upward move to end. I remain 100% S fund.