After a modestly negative open, a better-than-expected ISM report sent the market higher in the early going, but that rally quickly dissipated when the S&P 500 failed to punch through resistance around the 1230 level. From the there the market chopped back down to trade around the neutral line before more serious selling pressure kicked in later in afternoon trade. At the close the market found itself near or at its lows of the day.

Among other data released today was the latest initial jobless claims tally, which came in at 409,000. That total was just a bit higher than expected, but there was also an upward revision to the previous week's tally, which moved the four week average upward.

There was also a revised unit labor cost for the second quarter, which showed a 3.3% increase. That was above the 2.4% expected by economists.

July construction spending saw a 1.3% decline, which was well below estimates of no change.

Another factor affecting trading in the afternoon session was news that Goldman Sachs is the target of a formal enforcement action by the Fed regarding residential mortgage loan servicing and foreclosure processing. That sent the financial sector deeper in the red than it already was previously.

Here's today's charts:

Both NAMO and NYMO were sent decidedly lower today. Both flipped to sells in the process. If this is still a bear market, then I'd expect more downside pressure in the days ahead. But that could depend on sentiment too, and I'm not sure where we stand just yet.

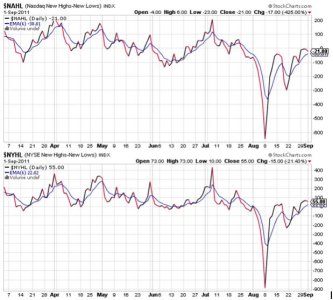

Interestingly, both NAHL and NYHL were only modestly lower today. Both remain on buys.

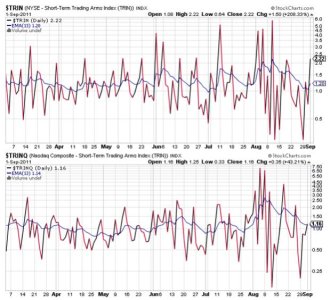

TRIN spiked back above its 13 day EMA and flipped to a sell, while TRINQ moved only modestly higher, but also flipping to a sell. TRINQ is suggesting a modestly oversold market, while TRINQ is neutral.

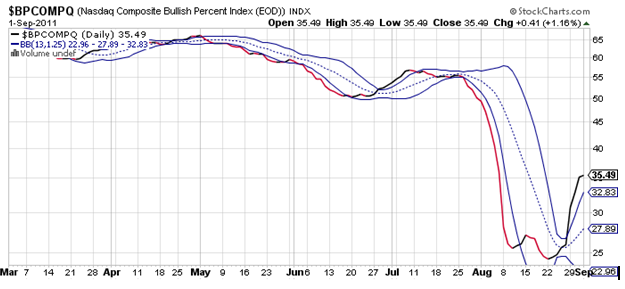

BPCOMPQ ebbed just a tad higher on today's action, but if the turn in momentum leads to further selling pressure I would expect this signal to begin dropping soon. For now though, this signal remains on a buy.

So the seven sentinels remain in an intermediate term buy condition, but I do not have a high confidence level in this signal given the wild volatility we saw in September and the bear market condition that was signaled earlier that month. I could be wrong, but with limited trading opportunities for us in TSP, you can bet I'll err on the side of caution for now.