Bullitt

Market Veteran

- Reaction score

- 75

Take heed before listening to the pros. They are underperforming retail traders - badly. Not saying it's time to pile into UAL, SAVE, ZM, F, CCL, CHK, HTZ, but it's something to think about.

https://www.marketwatch.com/story/a...l-st-pros-heres-what-theyre-buying-2020-06-15

I have to hand it to them - they bought heavily when sentiment was in the tank in late March. This site along with the Bogleheads (buy and hold only in a bull market) was pretty doom and gloom in late March. Even in the long term investing thread a few posters made claims that this time is different and that "it's not 2009 dude".

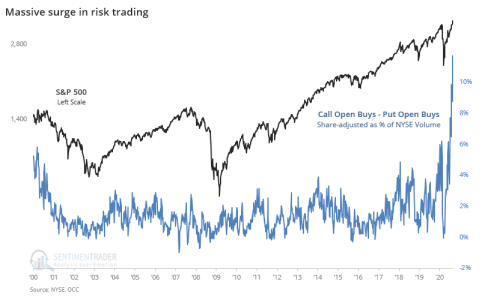

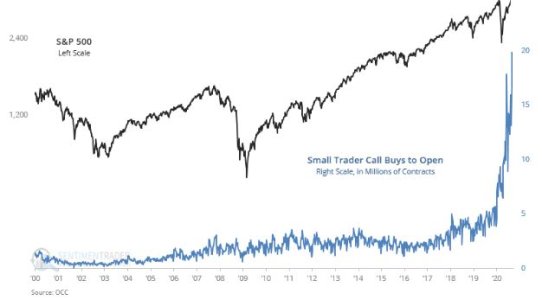

One thing the article doesn't delve into is the use of options by those looking for a big payout. If anything, it's not the market participation that's going to cause pain down the road, but the options craze. Options and leverage are toxic.

The Wall Street pros, who have consistently lagged behind the overall market since the last crisis in 12 years ago, now may find themselves lagging behind mom-and-pop investors by a whopping 16 percentage points, according to the Goldman's research.

https://www.marketwatch.com/story/a...l-st-pros-heres-what-theyre-buying-2020-06-15

I have to hand it to them - they bought heavily when sentiment was in the tank in late March. This site along with the Bogleheads (buy and hold only in a bull market) was pretty doom and gloom in late March. Even in the long term investing thread a few posters made claims that this time is different and that "it's not 2009 dude".

One thing the article doesn't delve into is the use of options by those looking for a big payout. If anything, it's not the market participation that's going to cause pain down the road, but the options craze. Options and leverage are toxic.