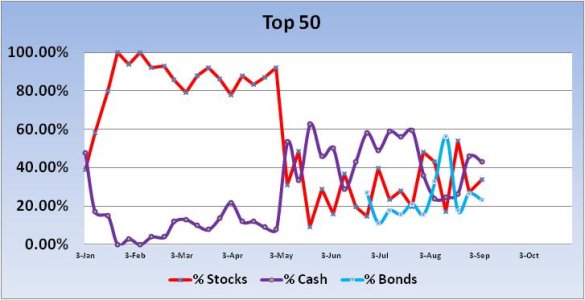

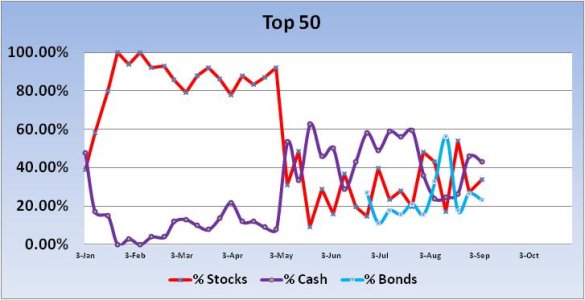

Last week, I pointed out that on a week over week basis the market moved in the opposite direction of the Top 50's stock allocation change about 75% of the time. This has been true for the entire 2012 trading year thus far. Last week, the Top 50 dropped their overall stock exposure by 26.88%. In response, the S fund managed to gain 0.25% for the week. True, it wasn't much, and overall the market was largely flat as the C fund fell 0.28%.

This week, both groups increased their stock exposure to begin Tuesday's trading, but only modestly.

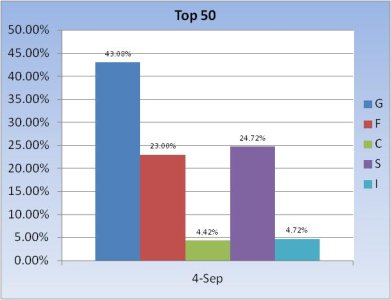

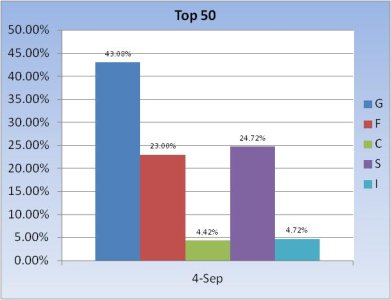

The Top 50 had a total stock allocation of just 27.06% last week. This week that total rose by 6.8% to a total stock allocation of 33.86%.

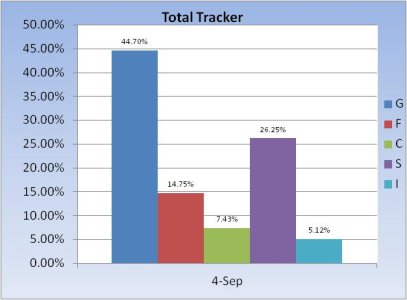

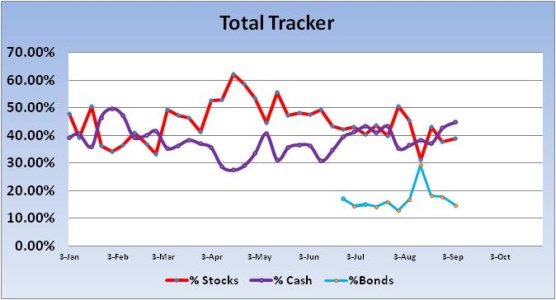

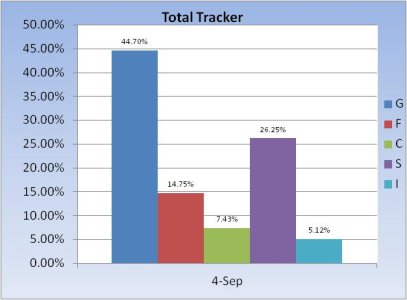

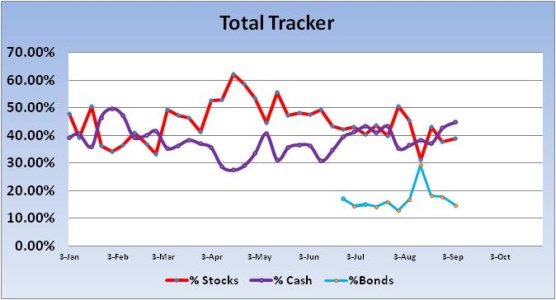

The Total Tracker showed a total stock allocation of 37.75% last week. This week, that allocation rose by just 1.05% to a total of 38.8%.

So there's not much change, but the Top 50 did add to their stock exposure, so a down week may be on tap.

However, our sentiment survey was on a repeat buy and the ECB meets Thursday. Plus, volume could pick up now that Summer vacation is in the rear view mirror for many money managers.

This week, both groups increased their stock exposure to begin Tuesday's trading, but only modestly.

The Top 50 had a total stock allocation of just 27.06% last week. This week that total rose by 6.8% to a total stock allocation of 33.86%.

The Total Tracker showed a total stock allocation of 37.75% last week. This week, that allocation rose by just 1.05% to a total of 38.8%.

So there's not much change, but the Top 50 did add to their stock exposure, so a down week may be on tap.

However, our sentiment survey was on a repeat buy and the ECB meets Thursday. Plus, volume could pick up now that Summer vacation is in the rear view mirror for many money managers.