This is the kind of action that suggests a bottom may be getting closer. The major averages closed mixed on the day with the DOW up fractionally at 0.01%, the S&P 500 0.07%, and the Nasdaq down 0.15%.

All in all it was a relatively uneventful day, so let's take a look at the charts:

NAMO and NYMO continue to move in a tight range, albeit in fairly negative territory. Both remain on sells.

Not much movement in NAHL and NYHL either, which also remain on sells.

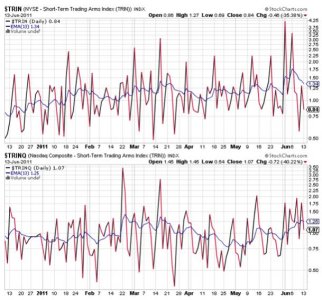

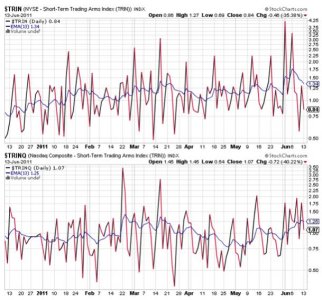

TRIN and TRINQ are both flashing buys.

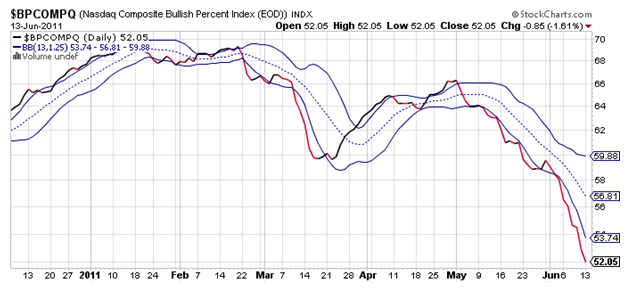

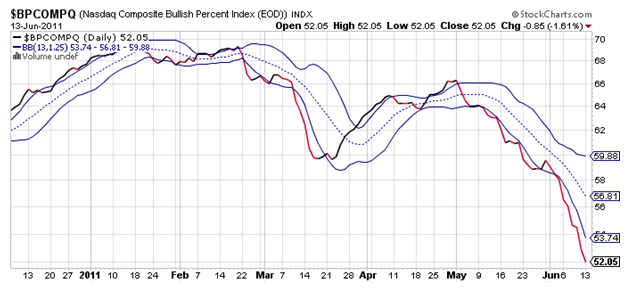

BPCOMPQ continues its descent, although modestly so. Still, this signal is not giving any indication that we're turning. Of course it remains on a sell.

So all but two signals are flashing sells, which keeps the system in a sell condition. I have little to add other than we needed to see some measure of support in this market and we got some today. That doesn't mean another drop lower can't happen because we're not out of the woods yet, but at least the bulls put up a battle today instead of letting the bears rout the market again.

All in all it was a relatively uneventful day, so let's take a look at the charts:

NAMO and NYMO continue to move in a tight range, albeit in fairly negative territory. Both remain on sells.

Not much movement in NAHL and NYHL either, which also remain on sells.

TRIN and TRINQ are both flashing buys.

BPCOMPQ continues its descent, although modestly so. Still, this signal is not giving any indication that we're turning. Of course it remains on a sell.

So all but two signals are flashing sells, which keeps the system in a sell condition. I have little to add other than we needed to see some measure of support in this market and we got some today. That doesn't mean another drop lower can't happen because we're not out of the woods yet, but at least the bulls put up a battle today instead of letting the bears rout the market again.