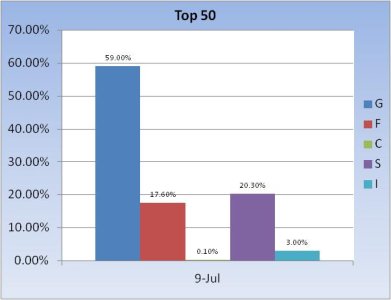

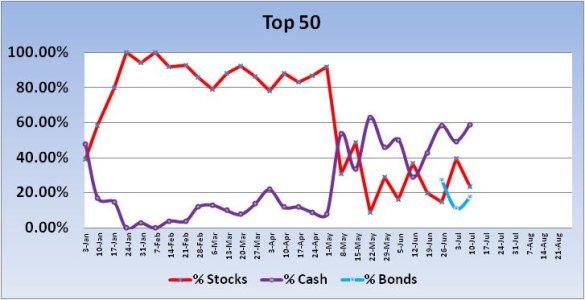

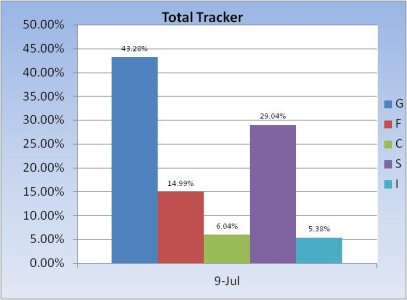

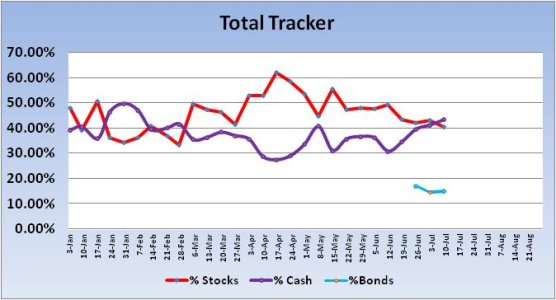

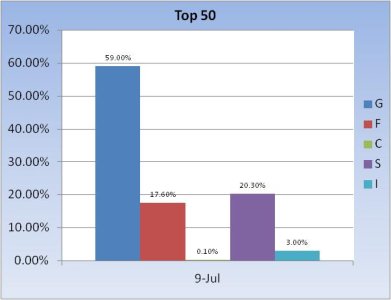

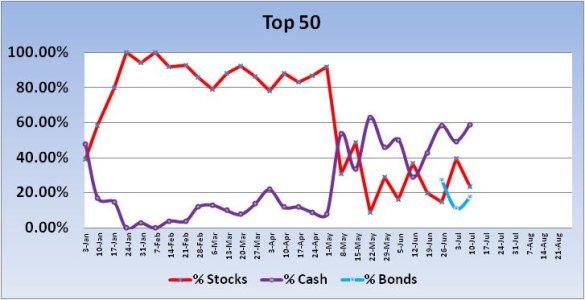

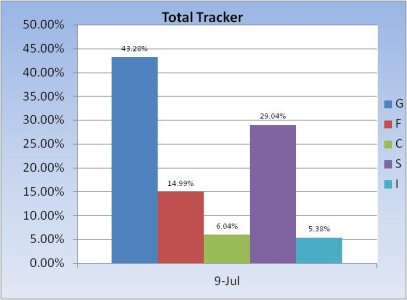

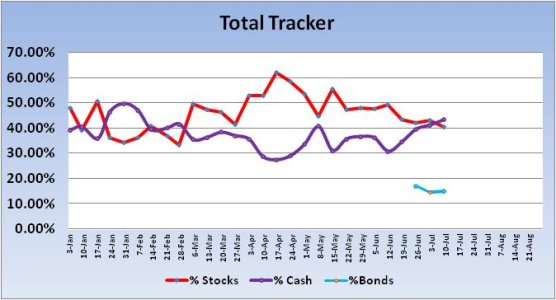

Last Friday was the last trading day of June, and it was a big up day to end the quarter. The Total Tracker charts last week showed that our collective stock allocation was only a bit more than 43%. I wondered if the rally last Friday would entice more bulls to move into stocks, but according to this week's charts that was not the case. We've only gotten more bearish, and that goes for both the Total Tracker and the Top 50.

Total stock allocations for the Top 50 fell 16.4% going into the new trading week. Bond and cash levels both rose.

The Total Tracker shows the same movement, although much less dramatic. Bond and cash levels rose, while stocks dipped.

It's been tough trading TSP accounts for awhile now as volatility has been on the high side. It's great if one can get on the right side of it, but with only 2 IFTs a month, we're pretty limited in our ability to take advantage of this type of market.

Our sentiment survey remained on a buy for the 12th week in row. Interestingly, the survey was almost dead even between bulls and bears, which indicates we got a bit more bullish on the sentiment front, but our allocations reveal a more bearish stance. This could be due to Friday's decline after the poor jobs report data.

I'm seeing more bearish charts and postings the past couple of trading days, but the short term also saw rising bullish levels in some pockets. Another shot lower should shake some of those bulls loose. Overall, I think it's a prescription for continued volatility.

Total stock allocations for the Top 50 fell 16.4% going into the new trading week. Bond and cash levels both rose.

The Total Tracker shows the same movement, although much less dramatic. Bond and cash levels rose, while stocks dipped.

It's been tough trading TSP accounts for awhile now as volatility has been on the high side. It's great if one can get on the right side of it, but with only 2 IFTs a month, we're pretty limited in our ability to take advantage of this type of market.

Our sentiment survey remained on a buy for the 12th week in row. Interestingly, the survey was almost dead even between bulls and bears, which indicates we got a bit more bullish on the sentiment front, but our allocations reveal a more bearish stance. This could be due to Friday's decline after the poor jobs report data.

I'm seeing more bearish charts and postings the past couple of trading days, but the short term also saw rising bullish levels in some pockets. Another shot lower should shake some of those bulls loose. Overall, I think it's a prescription for continued volatility.