Neither the Top 50 nor the Herd (Total Tracker) made any significant allocation changes from last week, or the past several weeks for that matter. Let's take a look at the charts:

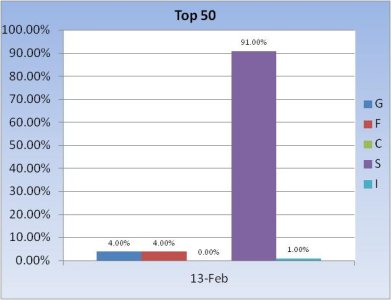

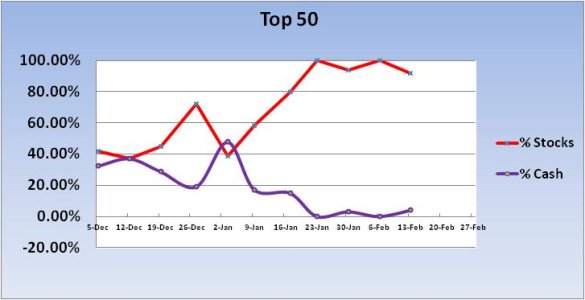

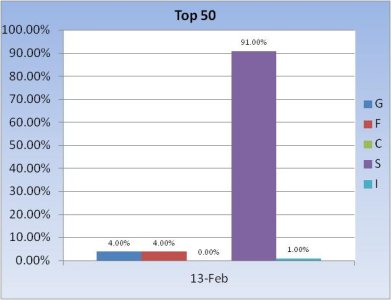

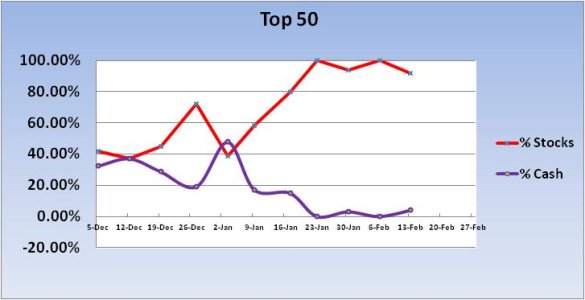

Not much change for the Top 50. A bit of profit taking is about all I can see here as total stock allocations remain quite elevated.

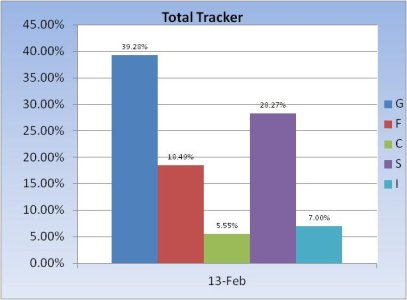

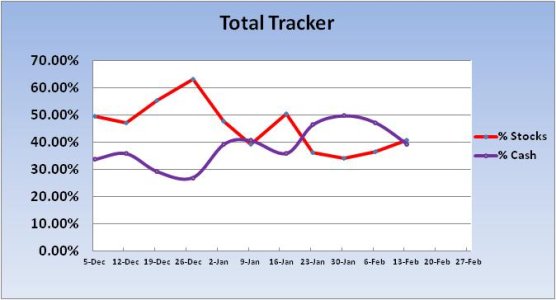

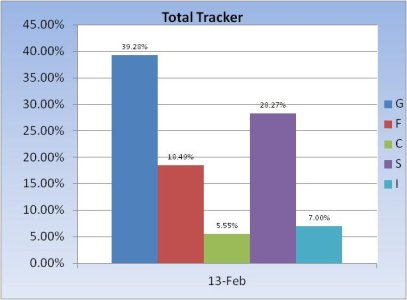

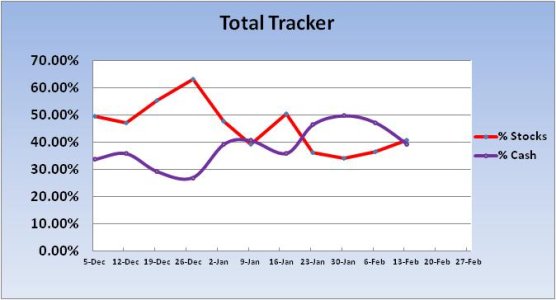

We did see a somewhat modest increase in stock allocations for the Total Tracker this week. It's up 4.49% to a total allocation of 40.81%. It was up a bit last week as well, but only by half that amount. Still, it's a pretty conservative allocation given how far this market has traveled.

Our sentiment survey came in at 49% bulls and 42% bears, which makes for the fourth buy signal in as many weeks. And these charts would appear to agree with that survey.

The Seven Sentinels remain in a buy condition, although they are about as close to a sell as they can be without actually triggering one. If we're down again on Monday, there's a good chance the sell will get triggered. The problem is that even if we're down all morning long, if the market bounces back in the afternoon it could avert that sell signal. That's just one scenario, however.

Even if the system triggers a sell signal next week, I am not convinced the downside will be very deep or that the signal will last very long. It may very well turn out to be a buying opportunity given the strength of the current uptrend. And it's OPEX week, which tells me to expect volatility and somewhat stable prices. I know that sounds a bit contradictory, but OPEX week tends to be supportive of prices overall. That's just a general expectation.

So the market is at a crossroad. Further selling pressure will probably flip many trading systems to sell conditions, not just the Sentinels. That could bring a deeper drop. If that happens, how quickly will dip buyers move in? Many have been stranded on the sidelines for some time now. And how will sentiment react?

This week is going to be interesting. My guess is we do go lower, but it doesn't have to be on Monday. And I'd not be surprised if we make another move higher either. We'll see how it plays out soon enough.

Not much change for the Top 50. A bit of profit taking is about all I can see here as total stock allocations remain quite elevated.

We did see a somewhat modest increase in stock allocations for the Total Tracker this week. It's up 4.49% to a total allocation of 40.81%. It was up a bit last week as well, but only by half that amount. Still, it's a pretty conservative allocation given how far this market has traveled.

Our sentiment survey came in at 49% bulls and 42% bears, which makes for the fourth buy signal in as many weeks. And these charts would appear to agree with that survey.

The Seven Sentinels remain in a buy condition, although they are about as close to a sell as they can be without actually triggering one. If we're down again on Monday, there's a good chance the sell will get triggered. The problem is that even if we're down all morning long, if the market bounces back in the afternoon it could avert that sell signal. That's just one scenario, however.

Even if the system triggers a sell signal next week, I am not convinced the downside will be very deep or that the signal will last very long. It may very well turn out to be a buying opportunity given the strength of the current uptrend. And it's OPEX week, which tells me to expect volatility and somewhat stable prices. I know that sounds a bit contradictory, but OPEX week tends to be supportive of prices overall. That's just a general expectation.

So the market is at a crossroad. Further selling pressure will probably flip many trading systems to sell conditions, not just the Sentinels. That could bring a deeper drop. If that happens, how quickly will dip buyers move in? Many have been stranded on the sidelines for some time now. And how will sentiment react?

This week is going to be interesting. My guess is we do go lower, but it doesn't have to be on Monday. And I'd not be surprised if we make another move higher either. We'll see how it plays out soon enough.