It was a boring day in the markets today, but the major averages did manage to close up overall with relatively modest gains.

There was no domestic economic data to speak of today, and overseas reports weren't particularly noteworthy either.

So the market seems content to mark time for now as resistance at the 1340 level of the S&P index continues to be a barrier, but support is holding too. It's just a matter of time now before the market makes its next move one way or the other.

Here's today's charts:

NAMO and NYMO remain in a buy condition, but remain at elevated levels, which as I mentioned in last night's blog, is not by itself indicative of an impending decline. Not with liquidity continuing to support market operations anyway. But that's not a guarantee that a decline can't happen either. The odds simply favor limited downside action and probable continuation of rising prices.

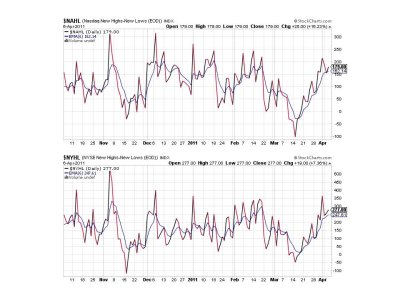

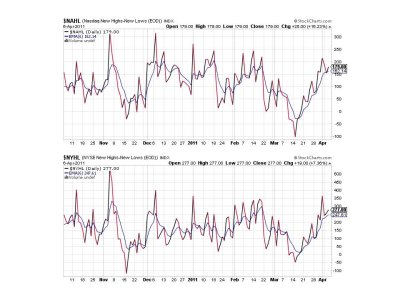

NAHL and NYHL are also in a buy condition.

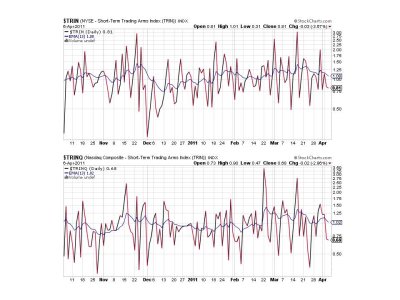

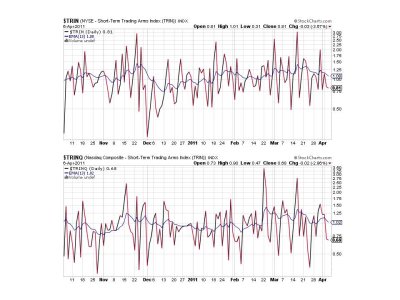

Same with TRIN and TRINQ

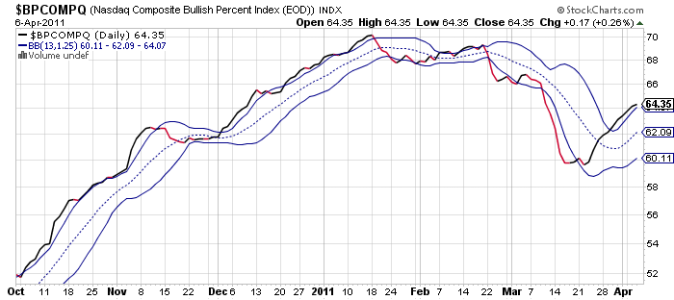

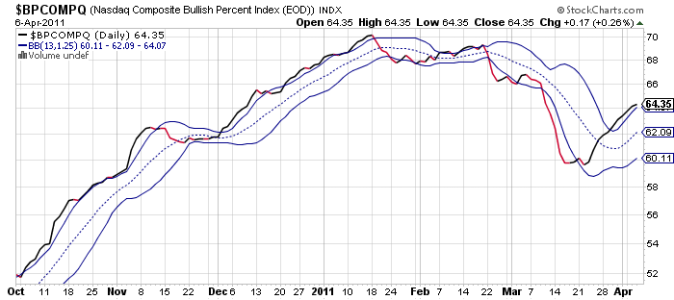

BPCOMPQ also remains in a buy condition.

So all Seven Sentinels are flashing buys, which keeps the system in a buy condition.

I really have nothing else to add with such lackluster action in the market coupled with little news to drive it. It's a wait and see game for now. My bet is we resolve higher, but the market will have the final say on that.

There was no domestic economic data to speak of today, and overseas reports weren't particularly noteworthy either.

So the market seems content to mark time for now as resistance at the 1340 level of the S&P index continues to be a barrier, but support is holding too. It's just a matter of time now before the market makes its next move one way or the other.

Here's today's charts:

NAMO and NYMO remain in a buy condition, but remain at elevated levels, which as I mentioned in last night's blog, is not by itself indicative of an impending decline. Not with liquidity continuing to support market operations anyway. But that's not a guarantee that a decline can't happen either. The odds simply favor limited downside action and probable continuation of rising prices.

NAHL and NYHL are also in a buy condition.

Same with TRIN and TRINQ

BPCOMPQ also remains in a buy condition.

So all Seven Sentinels are flashing buys, which keeps the system in a buy condition.

I really have nothing else to add with such lackluster action in the market coupled with little news to drive it. It's a wait and see game for now. My bet is we resolve higher, but the market will have the final say on that.