What started out looking like another strong advance early in the trading day eventually turned into a volatile slide into the red before some final, end-of-day dip buying helped the market end up overall. Larger caps fared better than small and mids, as the S&P managed a modest gain, but the S fund ended down, albeit well off its lows of the session.

The I fund fared the worst among our TSP funds as the dollar gained 0.4% today. Dollar strength has not been good for stocks and today was no exception.

It wasn't an ugly day, but it sure is looking like a topping process is in progress.

Jobless claims fell 23,000 week-over-week to 452,000, which wasn't too far off expectation. It seemed the market might have been taking its cue early on from this data, but as we saw it didn't hold very well. Leading Indicators for September were up 0.3%, which was in-line with what was expected.

Here's today's charts:

Hmmmm...two sells and the 6 day EMA has a downward trajectory. Both charts show NAMO and NYMO peaked in mid-September, dropped down a bit and flat-lined for about a month, and now it's dropping again as we head towards the elections.

Interestingly internals looked better today as both NAHL and NYHL picked back up. I'll call it two buys here.

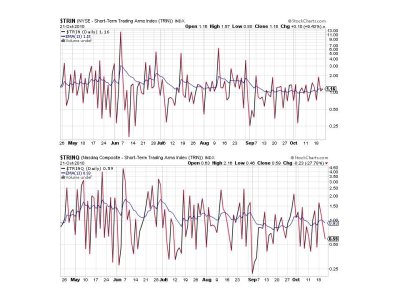

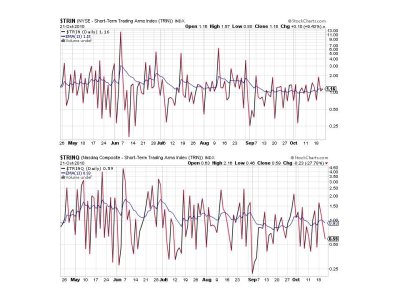

TRIN and TRINQ remain on buys. No tell here.

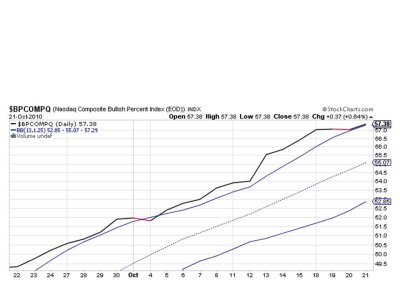

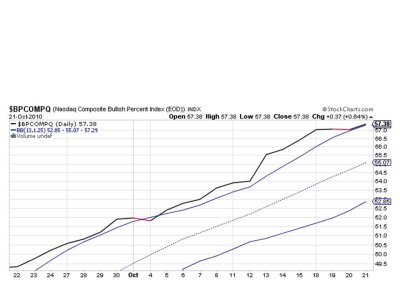

BPCOMPQ did manage to move higher today as it skirted right along that upper bollinger band. It remains on a buy, but could flip to a sell very easily give enough selling pressure.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy.

The probably I have with today's action is it seems to be sending mixed signals, which could be a warning of a coming trend change. The question is how long before we might see one? I don't know as I have to follow the charts on a daily basis, but I did move another 5% out of stocks today and into the G fund, which gives me a 60% exposure to stocks at the moment. I intend to continue to draw down my exposure on strength, but it's certainly not a given the market will give me what I want.

Our sentiment survey is showing about the same number of bulls to bears we had last week, and while that may be a buy signal for the system, it's not nearly as bearish as it was a few weeks ago, and that keeps my caution flag raised.

The I fund fared the worst among our TSP funds as the dollar gained 0.4% today. Dollar strength has not been good for stocks and today was no exception.

It wasn't an ugly day, but it sure is looking like a topping process is in progress.

Jobless claims fell 23,000 week-over-week to 452,000, which wasn't too far off expectation. It seemed the market might have been taking its cue early on from this data, but as we saw it didn't hold very well. Leading Indicators for September were up 0.3%, which was in-line with what was expected.

Here's today's charts:

Hmmmm...two sells and the 6 day EMA has a downward trajectory. Both charts show NAMO and NYMO peaked in mid-September, dropped down a bit and flat-lined for about a month, and now it's dropping again as we head towards the elections.

Interestingly internals looked better today as both NAHL and NYHL picked back up. I'll call it two buys here.

TRIN and TRINQ remain on buys. No tell here.

BPCOMPQ did manage to move higher today as it skirted right along that upper bollinger band. It remains on a buy, but could flip to a sell very easily give enough selling pressure.

So we have 5 of 7 signals flashing buys, which keeps the system on a buy.

The probably I have with today's action is it seems to be sending mixed signals, which could be a warning of a coming trend change. The question is how long before we might see one? I don't know as I have to follow the charts on a daily basis, but I did move another 5% out of stocks today and into the G fund, which gives me a 60% exposure to stocks at the moment. I intend to continue to draw down my exposure on strength, but it's certainly not a given the market will give me what I want.

Our sentiment survey is showing about the same number of bulls to bears we had last week, and while that may be a buy signal for the system, it's not nearly as bearish as it was a few weeks ago, and that keeps my caution flag raised.