Last week I said I was looking higher given seasonality and sentiment, but thought the indexes would have a tougher time climbing higher. Well, the market did indeed go higher, but it hardly noticed any of the resistance levels it plowed through. Of course, underlying support was a huge factor.

This week, I suspect price will find a way to finish the new week on the plus side again, although I'm not as confident of that outcome as I was the previous two weeks. Seasonality is now negative and sentiment is getting bulled up, plus I'd think some profit taking might be in order soon for those fortunate enough to catch this last run.

Here's this week's charts:

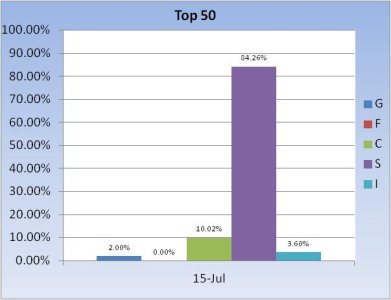

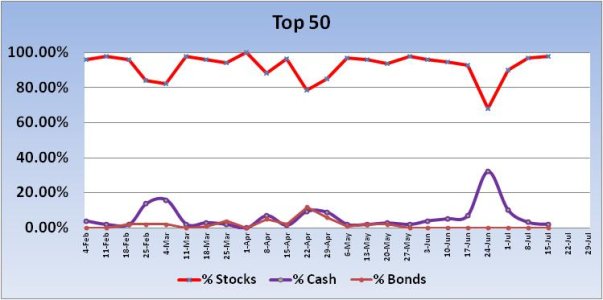

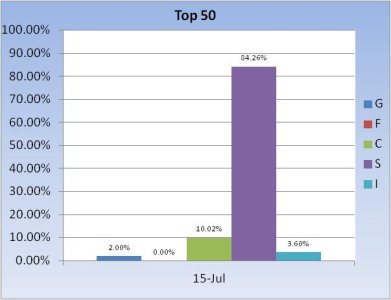

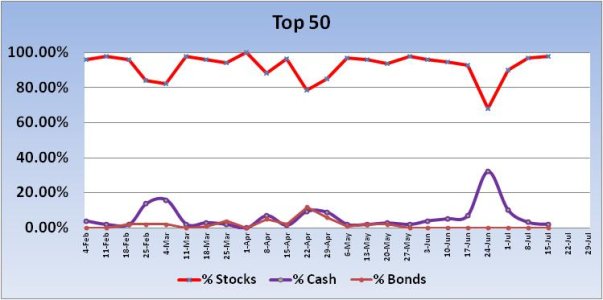

No signal from the Top 50 this week. Stock allocations rose a tad from 96.8% to 97.88%, which I view as overall bullish for the market.

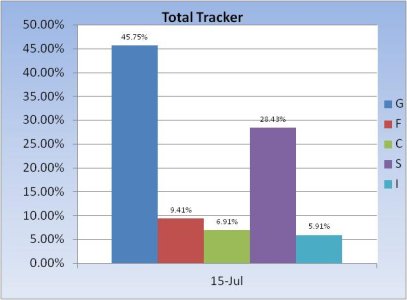

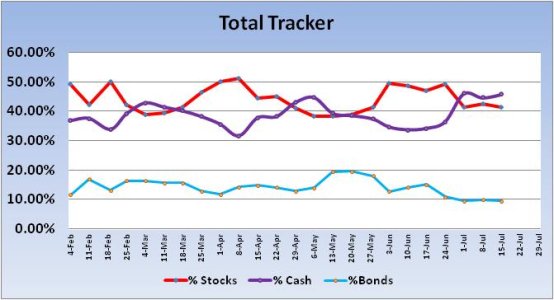

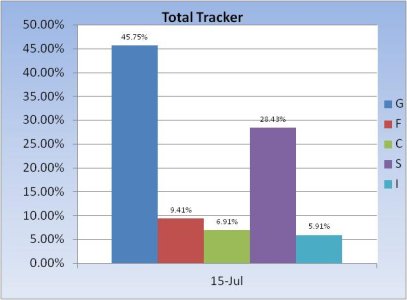

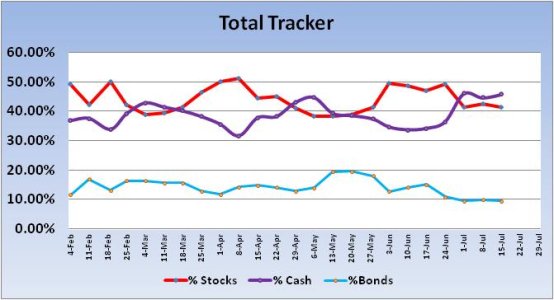

The Total Tracker didn't have a major shifts in allocation either as stock allocations across the entire auto-tracker dipped 1.24% to a total allocation of just 41.25%. I view that as overall bullish for the market too.

The major averages broke out this week and flipped the intermediate term positive once again. Looking at the Wilshire 4500 we can see how powerful this rally was. There was very little downside action since the bottom on June 24th. Price is forcing the bollinger bands to open up, which suggests we should be seeing some selling soon, but I'm not looking for a lot of it given the Fed's commitment to support low rates. Besides the bollinger bands, RSI is just shy of overbought, while MACD continues to point up.

Our sentiment survey remained on a buy with a neutral reading of 58% bulls to 32% bears. I think it's a bit bearish myself given the recent rally. AAII is seeing a lot of bulls too. That doesn't mean we can't continue to rally on, and we probably will, but the reasons to expect some selling are stacking up. If we get some, it's probably a buying opportunity. But I'm not ready to throw all caution to the wind on some selling pressure. I'd prefer to ease back into the market vice jump in with both feet. We are, after all, in the weaker 6 month part of the trading year.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/.

This week, I suspect price will find a way to finish the new week on the plus side again, although I'm not as confident of that outcome as I was the previous two weeks. Seasonality is now negative and sentiment is getting bulled up, plus I'd think some profit taking might be in order soon for those fortunate enough to catch this last run.

Here's this week's charts:

No signal from the Top 50 this week. Stock allocations rose a tad from 96.8% to 97.88%, which I view as overall bullish for the market.

The Total Tracker didn't have a major shifts in allocation either as stock allocations across the entire auto-tracker dipped 1.24% to a total allocation of just 41.25%. I view that as overall bullish for the market too.

The major averages broke out this week and flipped the intermediate term positive once again. Looking at the Wilshire 4500 we can see how powerful this rally was. There was very little downside action since the bottom on June 24th. Price is forcing the bollinger bands to open up, which suggests we should be seeing some selling soon, but I'm not looking for a lot of it given the Fed's commitment to support low rates. Besides the bollinger bands, RSI is just shy of overbought, while MACD continues to point up.

Our sentiment survey remained on a buy with a neutral reading of 58% bulls to 32% bears. I think it's a bit bearish myself given the recent rally. AAII is seeing a lot of bulls too. That doesn't mean we can't continue to rally on, and we probably will, but the reasons to expect some selling are stacking up. If we get some, it's probably a buying opportunity. But I'm not ready to throw all caution to the wind on some selling pressure. I'd prefer to ease back into the market vice jump in with both feet. We are, after all, in the weaker 6 month part of the trading year.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/.