Front running a sell-the-news event? Perhaps. And once again the catalyst is the European Union debt crisis. Although more specifically tomorrow's Summit.

Right at the open, the market gapped lower and never really looked back as news of a EU finance minister meeting scheduled for tomorrow was canceled. This is not the same meeting as the EU Summit, also scheduled for tomorrow, but the market drew a parallel between the two. And while the market may be hopeful of a successful plan emerging from that meeting, there's the realization that factions and opposing agendas exist and that could easily spell trouble for agreement on any plan.

It's been awhile since treasuries found significant favor, but a flight to safety was an easy play after the big run-up stocks have had over the past few days.

Early in the trading day, the August S&P/Case-Shiller 20-City Housing Price Index was released and it showed a decline of 3.8%, which eclipsed the 3.5% decline economists were looking for.

Also released was the October Consumer Confidence Index, which declined to 39.8. This is the lowest reading in over two years.

Here's today's charts:

Back to sells for NAMO and NYMO.

NAHL and NYHL also flipped to sells.

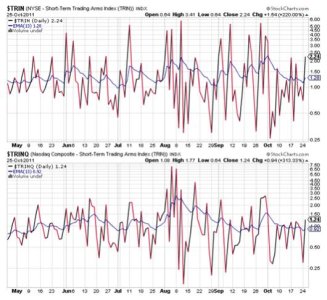

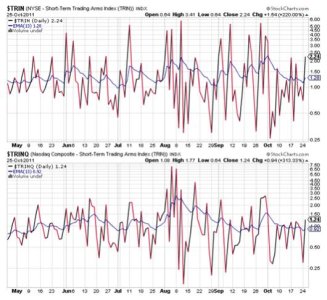

TRIN and TRINQ are also flashing sells, but overall they not showing a particularly oversold market.

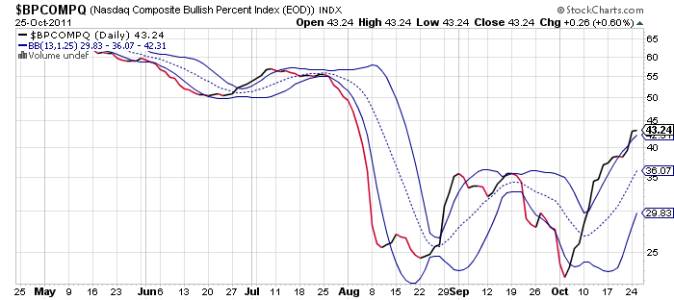

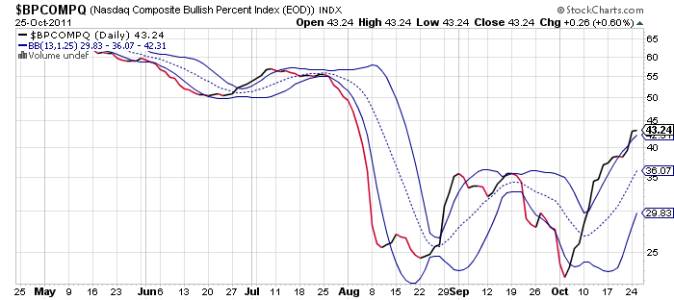

BPCOMPQ takes time to turn and today it edged sideways while maintaining its buy status.

So the signals remain mixed, but hint at further downside in the short term. Given the implications of an unsuccessful EU Summit tomorrow, that could be the catalyst. Especially after the run-up leading to this event. Of course, we could rally on good news after today's weakness too.

Shorting remains robust, which could continue to provide some measure of support for this market. But I'd like to see a few more days of downside action myself. Stocks have climbed a long way and need to consolidate if we're to have continued rallies into the end of the year.

Right at the open, the market gapped lower and never really looked back as news of a EU finance minister meeting scheduled for tomorrow was canceled. This is not the same meeting as the EU Summit, also scheduled for tomorrow, but the market drew a parallel between the two. And while the market may be hopeful of a successful plan emerging from that meeting, there's the realization that factions and opposing agendas exist and that could easily spell trouble for agreement on any plan.

It's been awhile since treasuries found significant favor, but a flight to safety was an easy play after the big run-up stocks have had over the past few days.

Early in the trading day, the August S&P/Case-Shiller 20-City Housing Price Index was released and it showed a decline of 3.8%, which eclipsed the 3.5% decline economists were looking for.

Also released was the October Consumer Confidence Index, which declined to 39.8. This is the lowest reading in over two years.

Here's today's charts:

Back to sells for NAMO and NYMO.

NAHL and NYHL also flipped to sells.

TRIN and TRINQ are also flashing sells, but overall they not showing a particularly oversold market.

BPCOMPQ takes time to turn and today it edged sideways while maintaining its buy status.

So the signals remain mixed, but hint at further downside in the short term. Given the implications of an unsuccessful EU Summit tomorrow, that could be the catalyst. Especially after the run-up leading to this event. Of course, we could rally on good news after today's weakness too.

Shorting remains robust, which could continue to provide some measure of support for this market. But I'd like to see a few more days of downside action myself. Stocks have climbed a long way and need to consolidate if we're to have continued rallies into the end of the year.