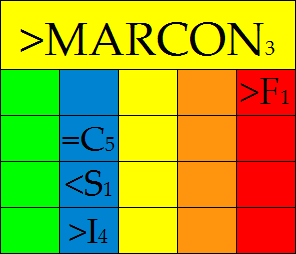

In this blog entry I'm going to discuss the MARket CONdition of the F-Fund, better known as AGG. Of the 5 tools MARCON uses, I'll tunnel into Reference (the 26-week time-perspective) and Interpretation (identifying price direction using trendlines.)

This week, MARCON dropped the F-Fund from ORANGE to RED with a 16% reading. A RED condition is seen as extremely oversold. In a bull market this could be considered an excellent buying opportunity, but MARCON's 26-week timeframe doesn't define AGG as being in a Bull market. Therefore, MARCON sees this as approaching an embedded oversold condition, meaning the risk for downside potential is greater than the potential of a bounce.

So you might ask "how does MARCON define a bull & bear market?" What I do is take the 26-week (6 month) timeframe and add percentage lines across the chart based on the 26-week high/low. When price gives us 3 closes below 50% we are in a bear market until price gives us 3 closes above 50%. The 26-week chart is ever evolving giving us new data and leaving behind the old data. So on December 3rd 2010 AGG went onto a bear market as defined by a 3-day close below 50% on the 26-week chart.

Horizontal Lines:

Green = 100% Highest price on the chart.

Blue = 75%

Yellow = 50% Highest price subtracted from the lowest price.

Orange = 25%

Red = 0% Lowest price on the chart

But bear markets shouldn't be defined by a singular all encompassing rule should they? Well that's a question you have to answer for yourself, but for the purpose of MARCON it is. By the time a bear market is triggered, we usually have other forms of confirmation and one of them is the trend.

1st Warning: The yellow box shows prices went trendless, unable to make higher highs above the green box or lower lows below the red box.

2nd Warning: The green trendline is the dominant trend on this chart and the yellow circle shows you the area where prices are faltering with the trend.

3rd Warning: The trend is offically broken. Prices closed below the previous lower low red box. This establishes a lower low, what follows is a lower high, then 3 closes below 50% giving us the official bear signal.

Dec 3rd 26-week chart.

So there you have it, by the time price triggered a bear market condition we already had 3 warnings telling us MARCON was changing.

Alright, let's go to the most current action, looking at AGG as it stands now. We've closed with a 26-week low last Friday, so I'm required to re-draw the trend. With the new trendline in place, as long as prices remain below the upper red trendline, the trend remains down. Additionally, the Momentum/Trend/Volume indicators are providing confirmation with the recent downslide of prices. Lastly, with prices trading below 50% of the 26-week high/low we are in Bear Market conditions. There you have it, MARCON RED for AGG.