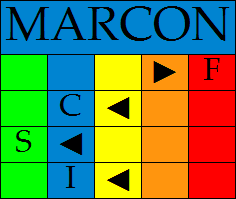

Market Conditions Advisory System.

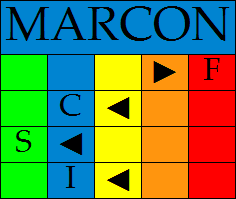

MARCON is a percentage-scaled Market Advisory System with the scale consisting of five color-coded market advisory levels. These levels are intended to reflect the current market conditions across the broad indexes. This system is created as a means to give the reader an additional way to judge the strength of the markets. As previously stated, this is a MARKET ADVISORY SYSTEM. For the time being MARCON is not intended to give buy/sell signals. MARCON's current status can be seen on my avatar or by clicking on my signature block. This system will be updated over the weekend.

MARCON colors: Red-Extremely oversold, Orange-Prices declining, Yellow-Prices in transition, Blue-Prices rising, &

Green-Extremely overbought.

Represented by a single alphabetic letter: F-The F-Fund, C-The C-Fund, S-The S-Fund, I-The I-Fund.

See Chart above<table style="width: 14px; height: 52px;" id="scc-symsearch-table" class="scc-typical scc-zebra scc-scans-table scc-symsearch-table"><tbody><tr><td>

</td><td>

</td></tr><tr><td>

</td><td>

</td><td>

</td></tr></tbody></table>5 Tools used to grade performance: Reference, Interpretation, Momentum, Trend, & Volume.

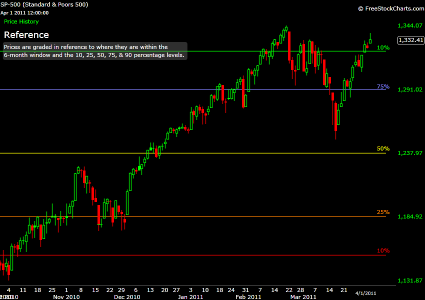

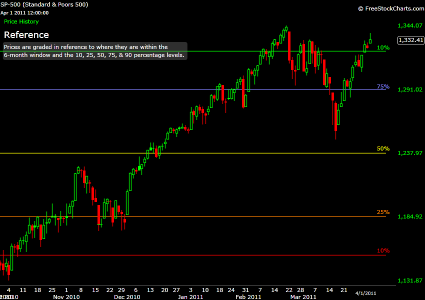

Reference - Uses 10, 25, 50, 75, & 90 percent price levels wrapped within the 26 week high/low price range. All indexes are judged from within this time frame on the Daily charts. See Chart below

Interpretation - Grades change in trend using 5 colored trendlines, using a basic 123 trend identification, complemented with a 3 day closing confirmation for surety.

See Chart below

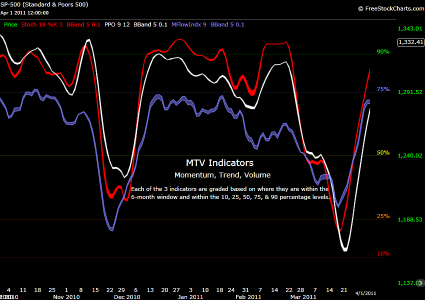

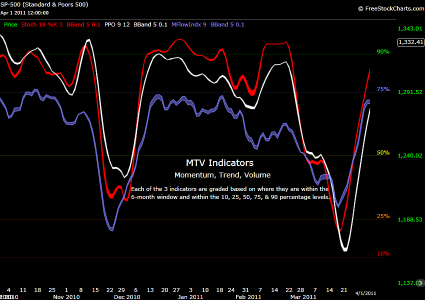

Momentum - Uses a 5 Day Simple Moving Average wrapped within an (18, 3) Stochastic graded off the 90, 75, 50, 25, & 10 percentage levels within the 6-month window.

Trend - Uses a 5 Day Simple Moving Average wrapped within a (9, 12) PPO graded off the 90, 75, 50, 25, & 10 percentage levels within the 6-month window.

Volume - Uses a factor 5 Day Simple Moving Average wrapped within a 9 Money Flow Index graded off the graded off the 90, 75, 50, 25, & 10 percentage levels within the 6-month window.

See Chart below

MARCON is a percentage-scaled Market Advisory System with the scale consisting of five color-coded market advisory levels. These levels are intended to reflect the current market conditions across the broad indexes. This system is created as a means to give the reader an additional way to judge the strength of the markets. As previously stated, this is a MARKET ADVISORY SYSTEM. For the time being MARCON is not intended to give buy/sell signals. MARCON's current status can be seen on my avatar or by clicking on my signature block. This system will be updated over the weekend.

MARCON colors: Red-Extremely oversold, Orange-Prices declining, Yellow-Prices in transition, Blue-Prices rising, &

Green-Extremely overbought.

MARCON represents: The New York Stock Exchange, Dow Jones Transportation Average, Standard & Poors 500, Wilshire 4500 Completion Index, iShares EAFE Index, and PowerShares DB US Dollar Index Bearish Fund.

See Chart below

See Chart below

Represented by a single alphabetic letter: F-The F-Fund, C-The C-Fund, S-The S-Fund, I-The I-Fund.

See Chart above<table style="width: 14px; height: 52px;" id="scc-symsearch-table" class="scc-typical scc-zebra scc-scans-table scc-symsearch-table"><tbody><tr><td>

</td><td>

</td></tr><tr><td>

</td><td>

</td><td>

</td></tr></tbody></table>5 Tools used to grade performance: Reference, Interpretation, Momentum, Trend, & Volume.

Reference - Uses 10, 25, 50, 75, & 90 percent price levels wrapped within the 26 week high/low price range. All indexes are judged from within this time frame on the Daily charts. See Chart below

Interpretation - Grades change in trend using 5 colored trendlines, using a basic 123 trend identification, complemented with a 3 day closing confirmation for surety.

See Chart below

Momentum - Uses a 5 Day Simple Moving Average wrapped within an (18, 3) Stochastic graded off the 90, 75, 50, 25, & 10 percentage levels within the 6-month window.

Trend - Uses a 5 Day Simple Moving Average wrapped within a (9, 12) PPO graded off the 90, 75, 50, 25, & 10 percentage levels within the 6-month window.

Volume - Uses a factor 5 Day Simple Moving Average wrapped within a 9 Money Flow Index graded off the graded off the 90, 75, 50, 25, & 10 percentage levels within the 6-month window.

See Chart below