Well, the S&P 500 managed to briefly eclipse yesterday's intraday high, but it closed well below 1125, which means we are either pausing before springboarding higher or we have run out of steam.

The nonfarm payrolls data being released on Friday seems to be drawing attention away from other market data. The ISM Services Index for February came in at 53.0, which was above expectations, and the Fed's Beige Book revealed no surprises.

The dollar was lower and VIX dropped below 19 to settle at 18.83.

The fears over the Greece default seem to have diminished over the last few trading days, but that doesn't mean the situation is resolved. In fact, after Greece there's several more countries waiting their turn in the default spotlight. So there's plenty of volatile news waiting to happen as we more forward, which will more than likely be used to push the markets up and down.

Today's charts:

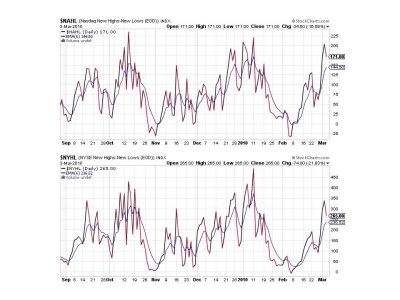

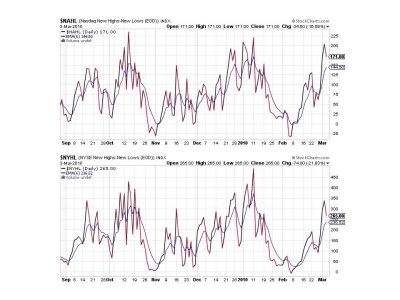

First sign of a reversal? It's a modest dip right now for both signals, but a reversal has to start somewhere. We have to see how the other signals look in relation to these two to get a better interpretation.

NAHL and NYHL both dipped today, but remain on a buy for now.

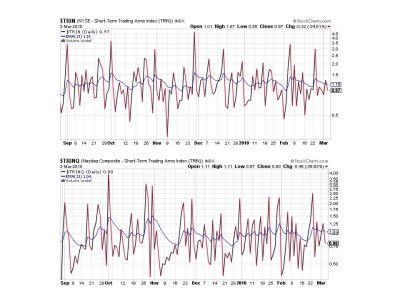

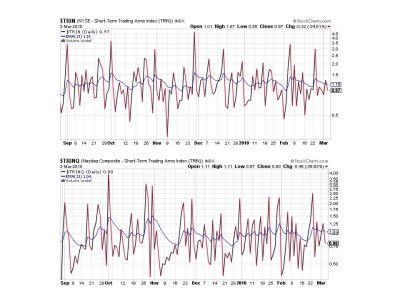

TRIN and TRINQ both flipped back to buys today, but they've hugging their moving average of late. No real help here.

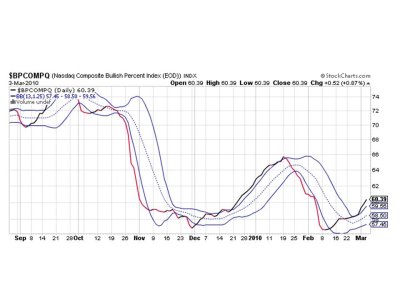

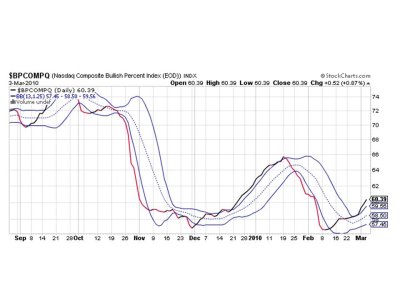

BPCOMPQ continues to look modestly bullish as it ebbed a bit higher today.

If you didn't notice, all seven signals are on a buy, but since the system was already on a buy it does not carry much weight.

Overall my interpretation of these signals tells me if weakness comes, it may not trigger a sell right away, unless the selling pressure is intense and on volume. The buy signal could linger for a bit yet while the market chops around, much like today's action. But a market event like Friday's non-farm payroll report can serve as a catalyst to roll the market over too. Given the inabilty of the market to hold much of its gains the past couple trading days, I'd say there's not a lot of conviction in this market moving much higher than it already has. But the SS needs to deteriorate some more before I can attempt to front-run a sell signal. I'd really like to see BPCOMPQ begin to turn too. We aren't there yet, so there's still some hope for the bulls of higher prices yet to come.

Not much change in the Top 15 or 50. See you tomorrow.

The nonfarm payrolls data being released on Friday seems to be drawing attention away from other market data. The ISM Services Index for February came in at 53.0, which was above expectations, and the Fed's Beige Book revealed no surprises.

The dollar was lower and VIX dropped below 19 to settle at 18.83.

The fears over the Greece default seem to have diminished over the last few trading days, but that doesn't mean the situation is resolved. In fact, after Greece there's several more countries waiting their turn in the default spotlight. So there's plenty of volatile news waiting to happen as we more forward, which will more than likely be used to push the markets up and down.

Today's charts:

First sign of a reversal? It's a modest dip right now for both signals, but a reversal has to start somewhere. We have to see how the other signals look in relation to these two to get a better interpretation.

NAHL and NYHL both dipped today, but remain on a buy for now.

TRIN and TRINQ both flipped back to buys today, but they've hugging their moving average of late. No real help here.

BPCOMPQ continues to look modestly bullish as it ebbed a bit higher today.

If you didn't notice, all seven signals are on a buy, but since the system was already on a buy it does not carry much weight.

Overall my interpretation of these signals tells me if weakness comes, it may not trigger a sell right away, unless the selling pressure is intense and on volume. The buy signal could linger for a bit yet while the market chops around, much like today's action. But a market event like Friday's non-farm payroll report can serve as a catalyst to roll the market over too. Given the inabilty of the market to hold much of its gains the past couple trading days, I'd say there's not a lot of conviction in this market moving much higher than it already has. But the SS needs to deteriorate some more before I can attempt to front-run a sell signal. I'd really like to see BPCOMPQ begin to turn too. We aren't there yet, so there's still some hope for the bulls of higher prices yet to come.

Not much change in the Top 15 or 50. See you tomorrow.