Today's action looked like a market needing a break. Of two notable data points released today pending home sales for November decreased 16.0%, which was a steeper drop than was forecast. The datapoint overshadowed factory orders for November, which was up 1.1% (vice a concensus 0.5% increase). The dollar initially traded lower to start the day, but gained 0.2% by the close, which helped pare any gains in the I fund.

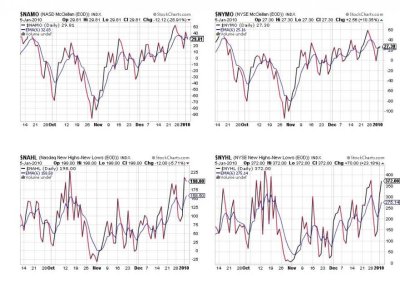

The SS did not change too much with today's action. Here's the charts:

Still on a buy for three of four of these charts.

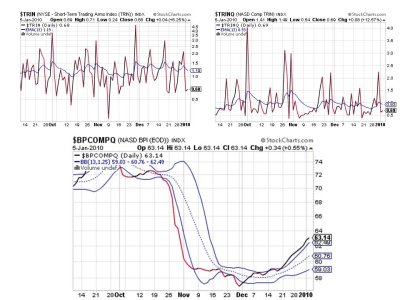

These three charts also remain on a buy.

So the system remains on a buy moving forward, but I don't get the impression looking at the charts that this market can go much higher without some profit taking soon.

The tracker is not functional today, so I can't update top 15 or top 50 data. Hopefully we'll have it back tomorrow. See you then.

The SS did not change too much with today's action. Here's the charts:

Still on a buy for three of four of these charts.

These three charts also remain on a buy.

So the system remains on a buy moving forward, but I don't get the impression looking at the charts that this market can go much higher without some profit taking soon.

The tracker is not functional today, so I can't update top 15 or top 50 data. Hopefully we'll have it back tomorrow. See you then.