After yesterday's sell off, I was fairly certain the market would probably see more selling pressure in short order, and we got it. But it didn't last the entire trading day. The lows came early on and by the close the broader market managed moderate gains.

The dollar fell modestly, while oil prices hit an intra-day low of $95.25 per barrel, but rallied to close up 0.8% at $98.97 per barrel.

The April Producer Price Index (PPI) was released this morning and showed an increase of 0.8%, which was higher than the 0.5% increase economists were looking for. Core PPI was up 0.3%, which was also a tad higher than expected.

Retail sales for April rose by 0.5%, which was just shy of the target 0.6% increase that was expected.

Initial weekly jobless claims were higher than forecast as they came in at 434,000, vice an expected 423,000.

Let's go to the charts:

Both NAMO and NYMO moved back up again, with both crossing back through their respective 6 day EMAs, which flips them back to a buy. These signals are now relatively neutral for the moment.

NAHL and NYHL both ebbed a bit higher and are pretty much sitting on their trigger points.

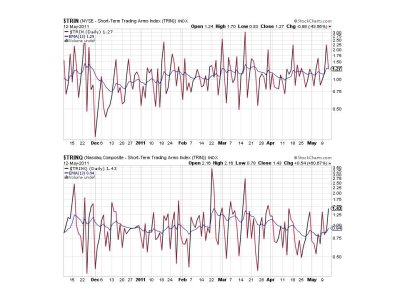

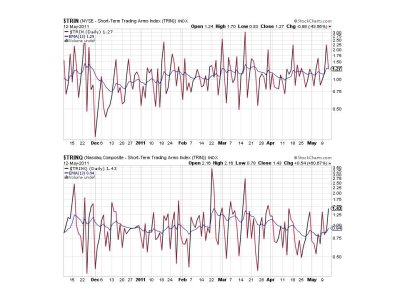

TRIN is also sitting on its trigger point, which TRINQ spiked higher and remains on a sell.

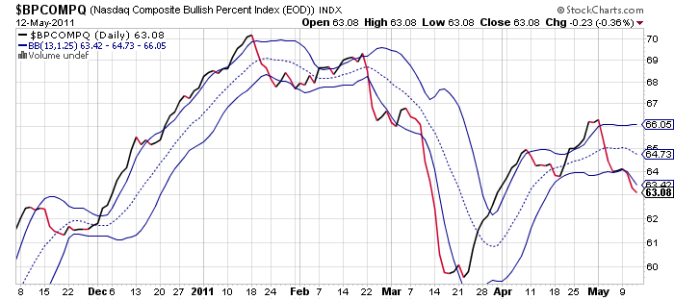

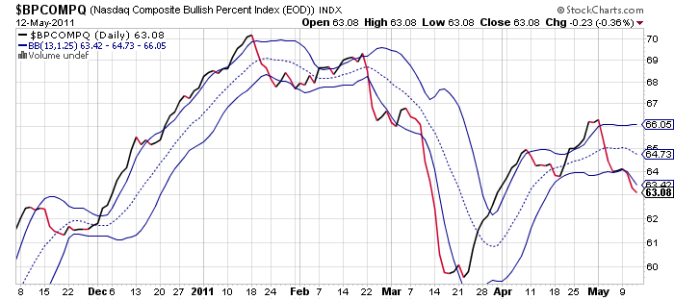

BPCOMPQ ebbed a bit lower today and remains in a sell condition.

So not a whole lot can be gleaned after today's action, but BPCOMPQ continues to point lower. The system remains on a buy in any event and I can only surmise that liquidity continues to support this market. No revelation there, it is what it is.

I'm seeing subtle signs in the market that suggest a fed rate hike may not be too far off. That's not a prediction as these signs are only just starting to show up the past week or so and it could just be a temporary condition, but I'm watching just the same. I think most of us can agree that inflation is alive and well and sooner or later the Fed will have to deal with it. And that means rate hikes.

The dollar fell modestly, while oil prices hit an intra-day low of $95.25 per barrel, but rallied to close up 0.8% at $98.97 per barrel.

The April Producer Price Index (PPI) was released this morning and showed an increase of 0.8%, which was higher than the 0.5% increase economists were looking for. Core PPI was up 0.3%, which was also a tad higher than expected.

Retail sales for April rose by 0.5%, which was just shy of the target 0.6% increase that was expected.

Initial weekly jobless claims were higher than forecast as they came in at 434,000, vice an expected 423,000.

Let's go to the charts:

Both NAMO and NYMO moved back up again, with both crossing back through their respective 6 day EMAs, which flips them back to a buy. These signals are now relatively neutral for the moment.

NAHL and NYHL both ebbed a bit higher and are pretty much sitting on their trigger points.

TRIN is also sitting on its trigger point, which TRINQ spiked higher and remains on a sell.

BPCOMPQ ebbed a bit lower today and remains in a sell condition.

So not a whole lot can be gleaned after today's action, but BPCOMPQ continues to point lower. The system remains on a buy in any event and I can only surmise that liquidity continues to support this market. No revelation there, it is what it is.

I'm seeing subtle signs in the market that suggest a fed rate hike may not be too far off. That's not a prediction as these signs are only just starting to show up the past week or so and it could just be a temporary condition, but I'm watching just the same. I think most of us can agree that inflation is alive and well and sooner or later the Fed will have to deal with it. And that means rate hikes.