12/24/25

Despite a lot of green in the big three indices, stocks were mixed yesterday after a much better than expected 3rd quarter GDP report sent yields higher initially, and the probability of another interest rate cut lower. Large cap tech led pushing the indices higher, but small caps took a hit because of the more hawkish outlook on interest rates.

The third quarter GDP came in at +4.3%, after forecasts were closer to 3%. It's old rear-view mirror data since it was for July through September, but not many had a 4 handle on that BINGO card. It probably should not be taken too seriously because we're more interested in the 4th quarter and next year's 1st quarter, rather than the summer data, but it did have an impact on stocks and bonds.

If you look up at those index charts above, it looks like a strong day for stocks. Then we look below and internally it was another story. There were many more stocks down than up, and the Nasdaq, which was up 133-points, saw more 52-week lows than new highs.

For a second day in a row, the intraday chart shows small caps of the Russell 2000 (IWM) peaking early while the S&P 500 closed at the highs of the day. One is a good sign, and one a potential concern.

Before we get too bearish, we can see in the DWCPF Index (S-Fund) that the chart did what we thought it might have to do before making a run for the all time highs. That is, fill in Monday's open gap. Technically the gap was filled, but it's possible that it has to reach down to Friday's closing price, rather than just Friday's high. So, I think this chart is fine - unless it starts trading below 2520 again.

If we compare that to the S&P 500 (C-fund), we see a different story where it made a new closing high yesterday, although it did trade higher intraday back in October. This is a good looking, bullish inverted head and shoulders formation.

The PMO Indicator is back above its moving average, which is a good thing, but be leery of this chart if this PMO comes back down for a second negative cross-under in the coming days or week. The first one was on the 16. A second cross-under is usually the bad one. As long as this stays above the moving average from here, the index should be fine.

The dollar was down despite the rear-view mirror GDP strength, and once again it does the opposite of what the fundamentals tell us, but at least there is some rhyme or reason to the chart which is trending lower after a failed breakout last Friday. A falling dollar generally helps the I-fund and...

... that was the case yesterday as the ACWX (I-fund) gapped up to another new high, and held near the highs into the close, leading the TSP funds on the day.

The strong GDP data, old as it was, did pushed the 10-year Treasury Yield up initially, but it rolled over again after hitting the 200-day average. That still looks like a bull flag so I wouldn't be surprised if yields do eventually breakout to the upside. There is an open gap down below 4.05% that may be a draw on the downside.

Based on the December seasonality chart, I consider the start of the Santa Clause rally on or about December 21st, and so far that has been working, but technically it is the last five trading days of the year and the first two of the new year. Using that definition, here what has happen during the last 20 Santa Claus rally periods.

The fact that it was down the last two years is interesting, and perhaps decreases the chances of a 3rd year in a row, but you never know. The market loves to get us leaning the wrong way.

The stock market and TSP offices will be closed for Christmas on Thursday, December 25. Also, the stock market will close early at 1:00 p.m. ET on Wednesday the 24th. The TSP transaction deadline is unchanged for Wednesday.

Since I write up my commentary the night before the posted date up top, it means I will have to create Friday's report on Christmas evening. Because of that, it may be a quickie.

Merry Christmas and Happy Holidays to all!

I covered the three TSP stocks funds above.

BND (bonds / F-fund) had a drop, then a pop after that stronger than expected GDP data, but clearly this chart is respecting its support and resistance as the 50-day EMA held on the downside, and the old broken support line acted as resistance on the upside.

Thanks so much for reading! Merry Christmas and Happy Holidays to all! We'll see you back here on Friday for a quick update.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Despite a lot of green in the big three indices, stocks were mixed yesterday after a much better than expected 3rd quarter GDP report sent yields higher initially, and the probability of another interest rate cut lower. Large cap tech led pushing the indices higher, but small caps took a hit because of the more hawkish outlook on interest rates.

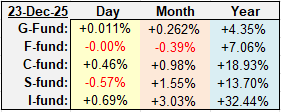

| Daily TSP Funds Return More returns |

The third quarter GDP came in at +4.3%, after forecasts were closer to 3%. It's old rear-view mirror data since it was for July through September, but not many had a 4 handle on that BINGO card. It probably should not be taken too seriously because we're more interested in the 4th quarter and next year's 1st quarter, rather than the summer data, but it did have an impact on stocks and bonds.

If you look up at those index charts above, it looks like a strong day for stocks. Then we look below and internally it was another story. There were many more stocks down than up, and the Nasdaq, which was up 133-points, saw more 52-week lows than new highs.

For a second day in a row, the intraday chart shows small caps of the Russell 2000 (IWM) peaking early while the S&P 500 closed at the highs of the day. One is a good sign, and one a potential concern.

Before we get too bearish, we can see in the DWCPF Index (S-Fund) that the chart did what we thought it might have to do before making a run for the all time highs. That is, fill in Monday's open gap. Technically the gap was filled, but it's possible that it has to reach down to Friday's closing price, rather than just Friday's high. So, I think this chart is fine - unless it starts trading below 2520 again.

If we compare that to the S&P 500 (C-fund), we see a different story where it made a new closing high yesterday, although it did trade higher intraday back in October. This is a good looking, bullish inverted head and shoulders formation.

The PMO Indicator is back above its moving average, which is a good thing, but be leery of this chart if this PMO comes back down for a second negative cross-under in the coming days or week. The first one was on the 16. A second cross-under is usually the bad one. As long as this stays above the moving average from here, the index should be fine.

The dollar was down despite the rear-view mirror GDP strength, and once again it does the opposite of what the fundamentals tell us, but at least there is some rhyme or reason to the chart which is trending lower after a failed breakout last Friday. A falling dollar generally helps the I-fund and...

... that was the case yesterday as the ACWX (I-fund) gapped up to another new high, and held near the highs into the close, leading the TSP funds on the day.

The strong GDP data, old as it was, did pushed the 10-year Treasury Yield up initially, but it rolled over again after hitting the 200-day average. That still looks like a bull flag so I wouldn't be surprised if yields do eventually breakout to the upside. There is an open gap down below 4.05% that may be a draw on the downside.

Based on the December seasonality chart, I consider the start of the Santa Clause rally on or about December 21st, and so far that has been working, but technically it is the last five trading days of the year and the first two of the new year. Using that definition, here what has happen during the last 20 Santa Claus rally periods.

The fact that it was down the last two years is interesting, and perhaps decreases the chances of a 3rd year in a row, but you never know. The market loves to get us leaning the wrong way.

The stock market and TSP offices will be closed for Christmas on Thursday, December 25. Also, the stock market will close early at 1:00 p.m. ET on Wednesday the 24th. The TSP transaction deadline is unchanged for Wednesday.

Since I write up my commentary the night before the posted date up top, it means I will have to create Friday's report on Christmas evening. Because of that, it may be a quickie.

Merry Christmas and Happy Holidays to all!

I covered the three TSP stocks funds above.

BND (bonds / F-fund) had a drop, then a pop after that stronger than expected GDP data, but clearly this chart is respecting its support and resistance as the 50-day EMA held on the downside, and the old broken support line acted as resistance on the upside.

Thanks so much for reading! Merry Christmas and Happy Holidays to all! We'll see you back here on Friday for a quick update.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.