Value is in the eye of the beholder. Of course, the general consensus is the that the stock market is overvalued as measured by P/E ratio. It certainiy is heavily weighted by the success or failures of the high tech giants headquartered here in Silicon Valley. And for the most part, the FAANG companies do not pay dividends as they put their earnings back into their business. And the FAANG companies as a rule do their manufacturing overseas.

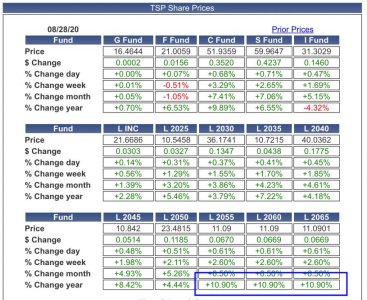

My question regarding the possible overvaluing of the Core Funds is best represented by how government employees still continue to choose to invest in G Fund when now more than ever it cannot keep up with inflation given the declining interest rates as the Fed continues to make borrowing easy. Simple Supply and Demand means that even at $16-17 per share, it is expensive relative to say I fund which has a negative return year to date. It is cheaper to manufacture overseas.

Regarding the L Funds merely being baskets of the Core Funds, we now have L2035 trading in the neighborhood of $10 per share. But only two months ago, if an investor felt he should be in that place before his retirement in 2035, he would have been forced to buy 50% of L2030 and 50% of L2040 both trading in the neighborhood of $30 per share. Of course L2050 is the neighborhood of $20 per share.

When you buy a ten or five pound bag of potatoes, you get a per unit cost break over picking individual vegetables. But should you pay extra for the pre-packaging? You do with L Income over maintaining an allocation of the Core Funds yourself.

The L Funds are not perfect. But they were put in place in an attempt to help people not comfortable making their own allocation choices beyond the preservation safety of the G Fund.