Yesterday, the Seven Sentinels were flashing 6 sell signals, although they were all near their respective trigger points. Still, I suspect some thought the recent rally might be over, but just like that the Sentinels are flashing 7 buy signals after seeing some significant buying pressure take the indexes much higher, pretty much retracing the bulk of the recent consolidation losses.

Notable news today included some solid PMI readings throughout the EU, which helped the major bourses tack on between 2% and 3%.

Interestingly, China's gains came amid a weak PMI reading, but was overlooked by the market as their economy appears robust and should help lead a global recovery.

Our own domestic data saw the July ISM Manufacturing Index post a 55.5, exceeding expectations. Also, June construction spending increased 0.1%, much better than an anticipated 0.8% decline.

The I fund was helped by a 0.8% drop in the dollar (a new three-month low) but it remains above its 200-day moving average.

Here's today's charts:

Back on offense here. Two buys.

The A/D line is looking impressive. Two more buys.

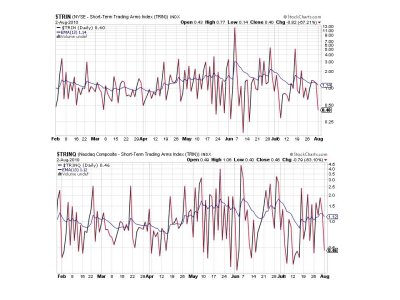

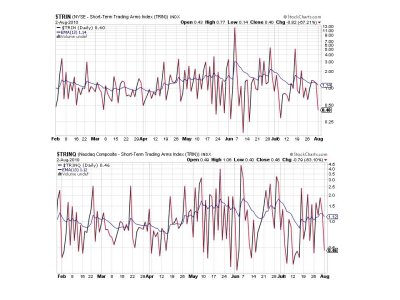

Both TRIN and TRINQ flipped back to buys.

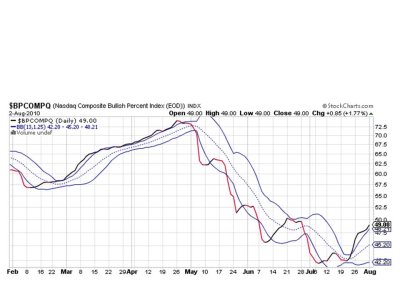

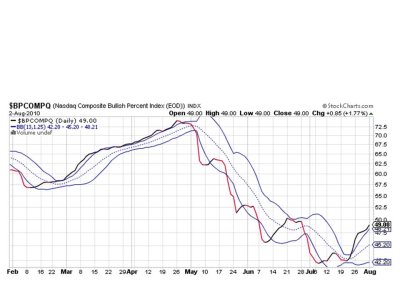

BPCOMPQ is rising again and remains on a buy.

That's 7 of 7 signals flashing buys, which obviously keeps the system on a buy.

The up-leg remains intact and it appears we are moving higher after a brief consolidation period. I remain 100% S fund.

Notable news today included some solid PMI readings throughout the EU, which helped the major bourses tack on between 2% and 3%.

Interestingly, China's gains came amid a weak PMI reading, but was overlooked by the market as their economy appears robust and should help lead a global recovery.

Our own domestic data saw the July ISM Manufacturing Index post a 55.5, exceeding expectations. Also, June construction spending increased 0.1%, much better than an anticipated 0.8% decline.

The I fund was helped by a 0.8% drop in the dollar (a new three-month low) but it remains above its 200-day moving average.

Here's today's charts:

Back on offense here. Two buys.

The A/D line is looking impressive. Two more buys.

Both TRIN and TRINQ flipped back to buys.

BPCOMPQ is rising again and remains on a buy.

That's 7 of 7 signals flashing buys, which obviously keeps the system on a buy.

The up-leg remains intact and it appears we are moving higher after a brief consolidation period. I remain 100% S fund.