Yet another strong advance puts an exclamation point at the close of the second quarter, although the quarter still ended with a modest loss overall.

The volume had been thin so far this week, but today's advance saw a bit more interest as the NYSE almost hit 1B shares traded. That happens when technical systems start flipping to buy conditions. And I noticed that our sentiment survey, which hasn't closed for this week yet, is already showing a jump in bullish sentiment.

On the economic data front, initial jobless claims totaled 428,000, which was more than the 420,000 claims that were expected. But to counter that negative headline, the Chicago PMI report came in at 61.1, which was much better than the 54.0 economists were expecting.

Here's the charts:

It's been a huge move for both NAMO and NYMO and an impressive one at that. It can certainly move higher still as the pre-holiday trading environment isn't done yet, but that's no guarantee of a fifth up-day in a row either. Both signals are on solid buys.

NAHL and NYHL continue to look bullish and also remain in buy conditions.

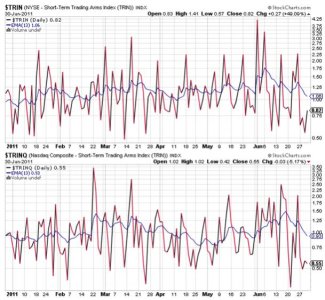

TRIN has worked off its overbought condition for the most part and looks bullish, while TRINQ dipped a bit more back into overbought territory.

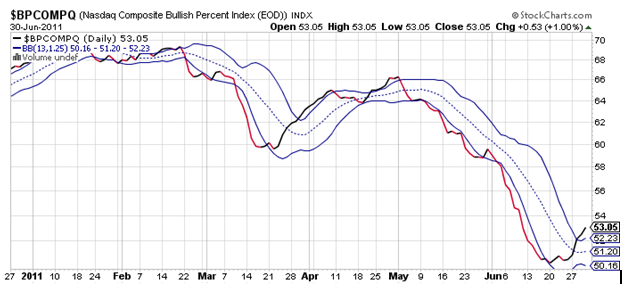

Higher still for BPCOMPQ. It continues to look quite bullish, but extended in the short term now that's it above that upper bollinger band.

So all signals remain in buy conditions, which keep the system in a buy condition. I've sold all but 20% of my allocation in the S fund to begin July with a 80% G and 20% S position. I'll be holding that allocation now for the time being. I am not convinced that this end-of-quarter spike higher is the real deal, but it could be. For now I'll claim to be from Missouri and ask the market to show me.